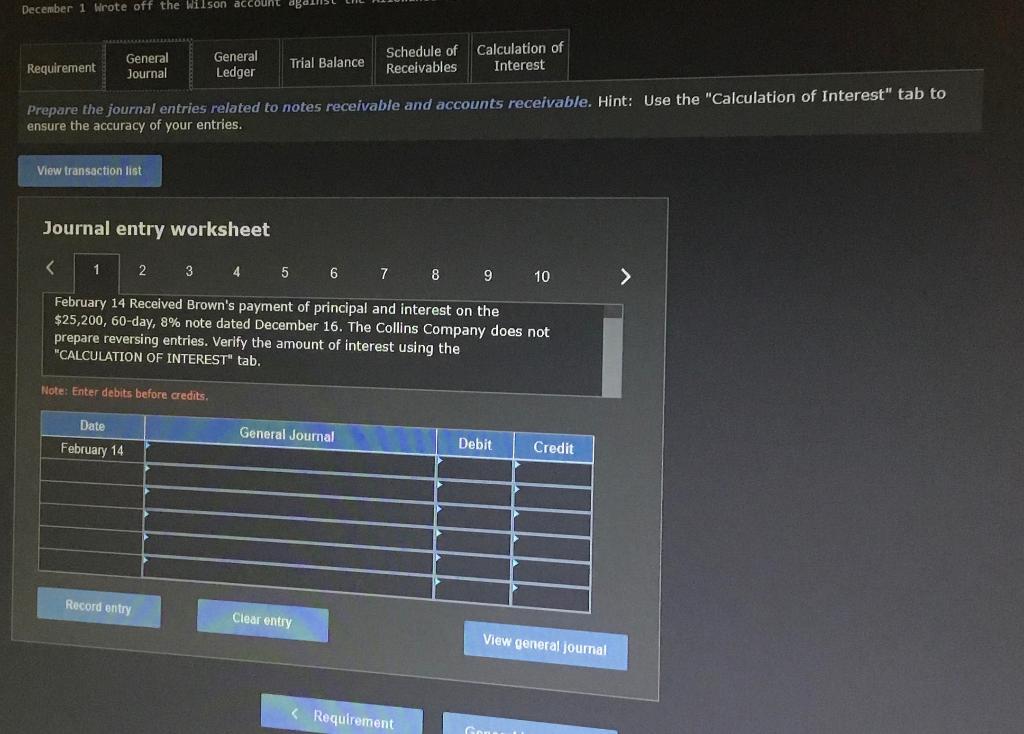

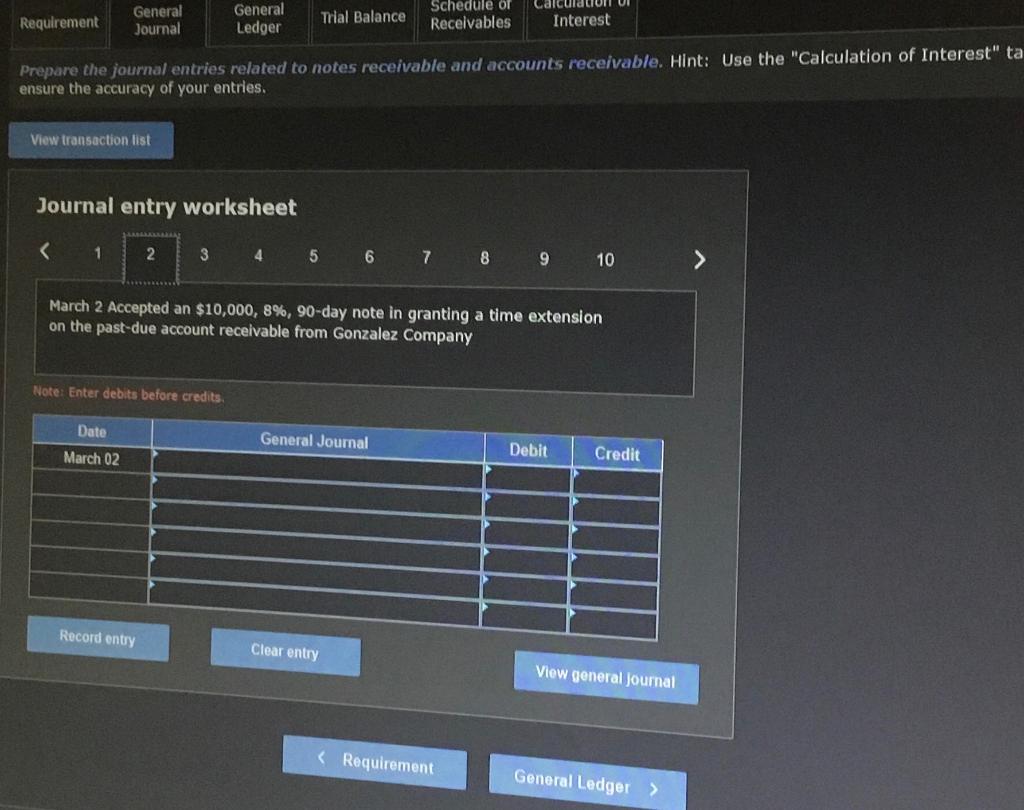

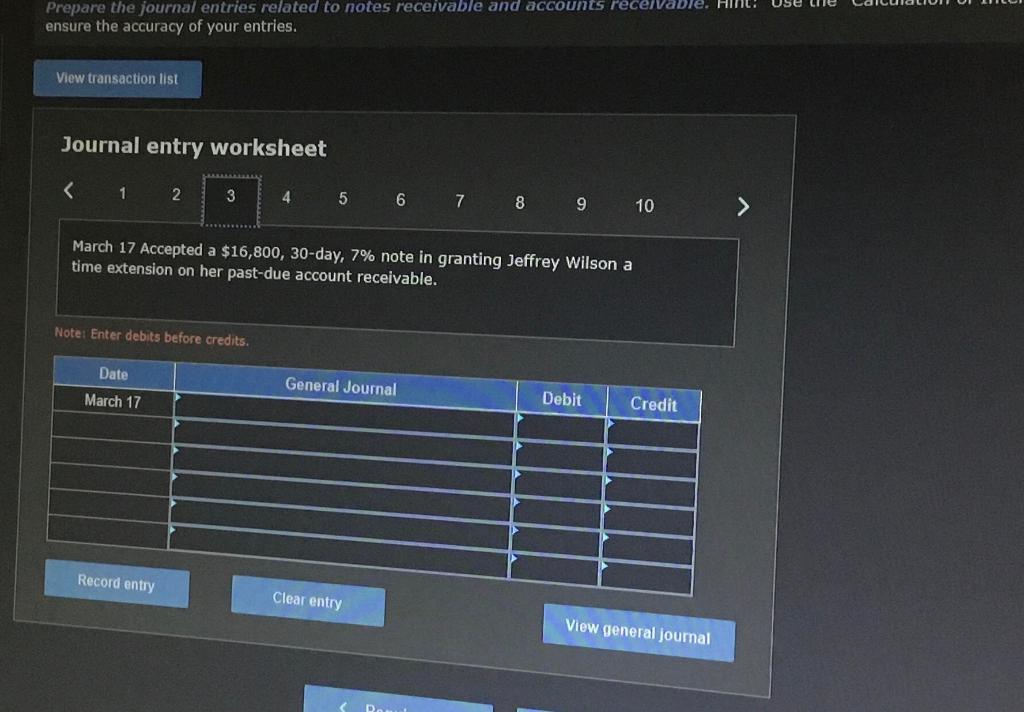

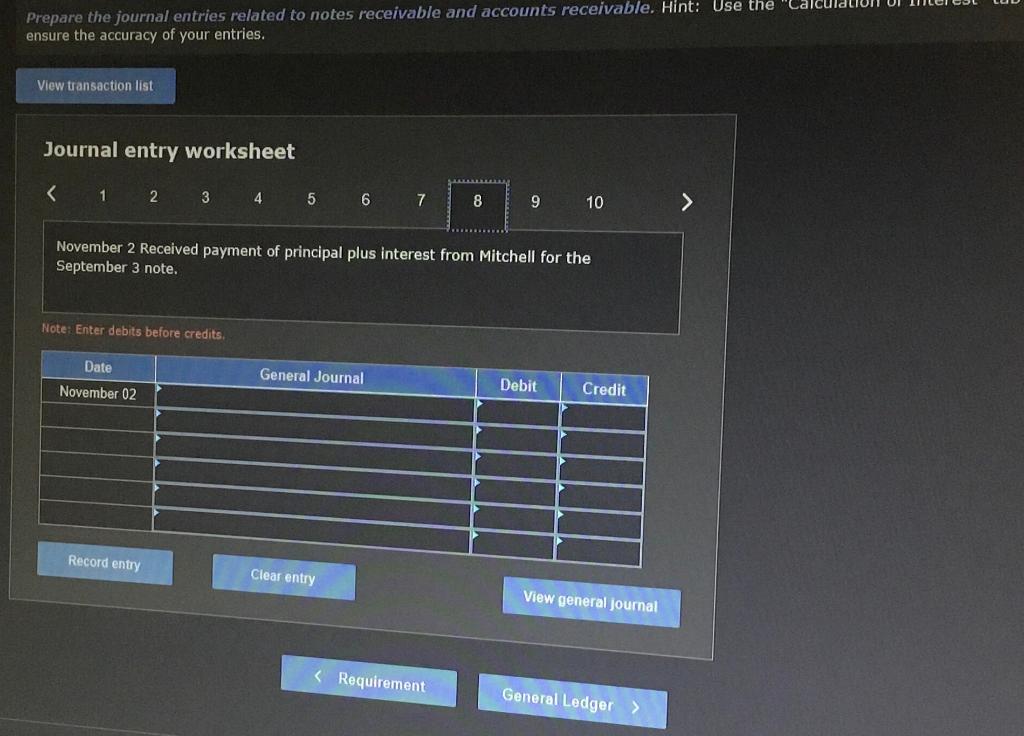

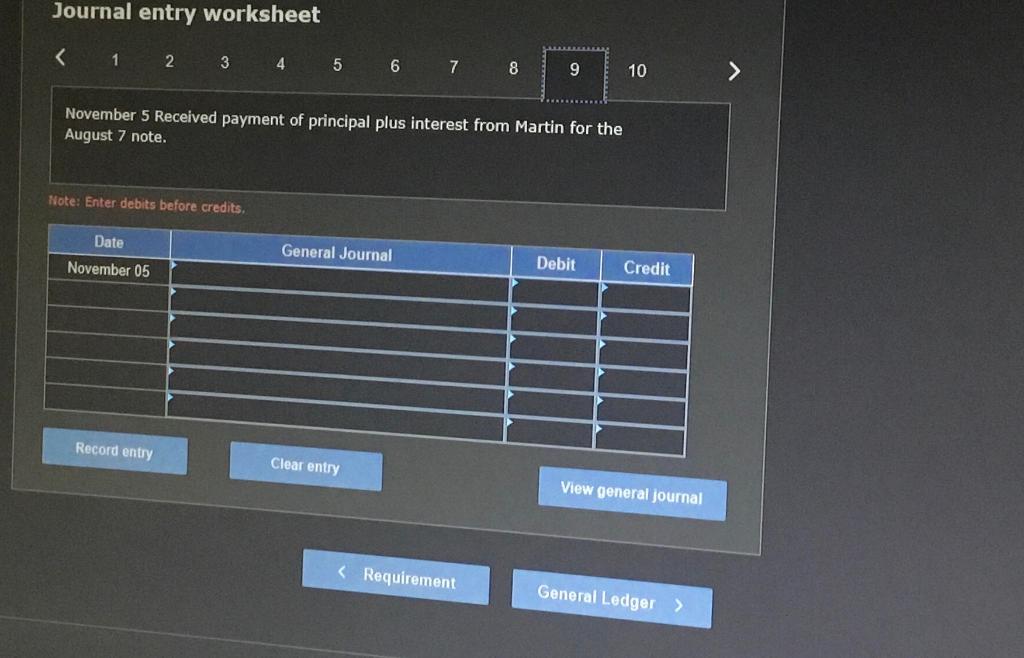

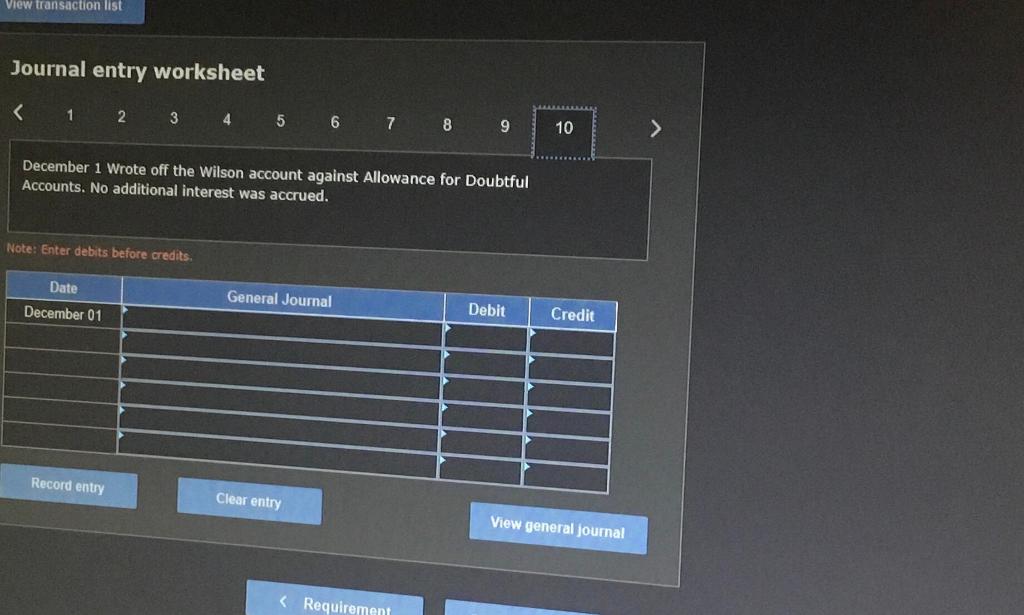

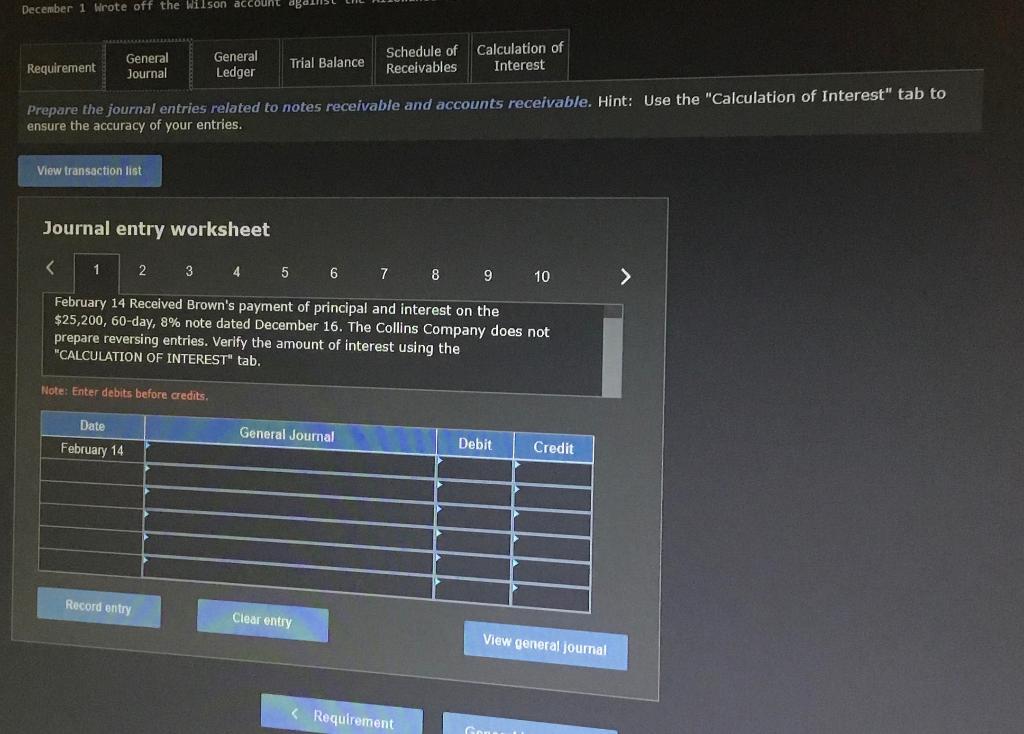

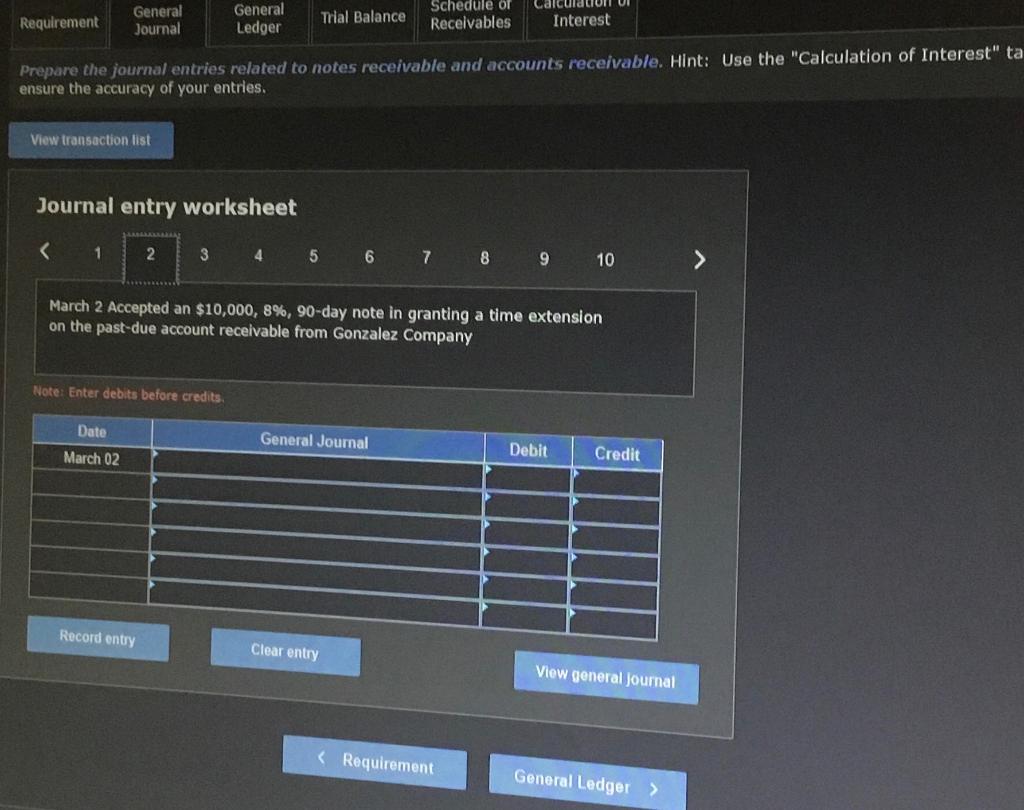

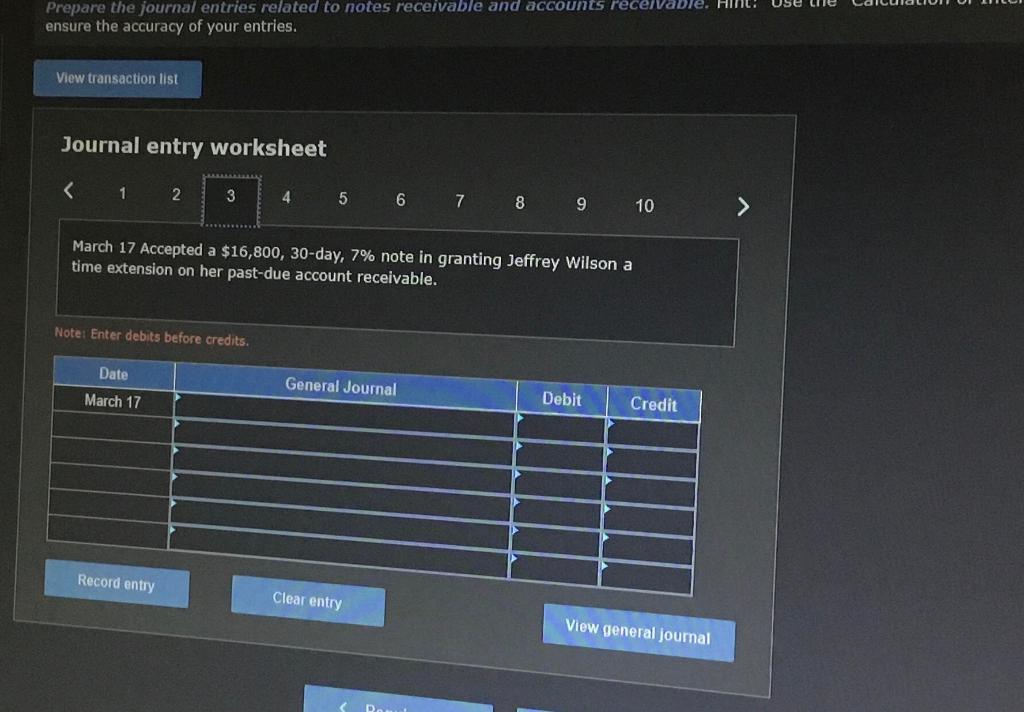

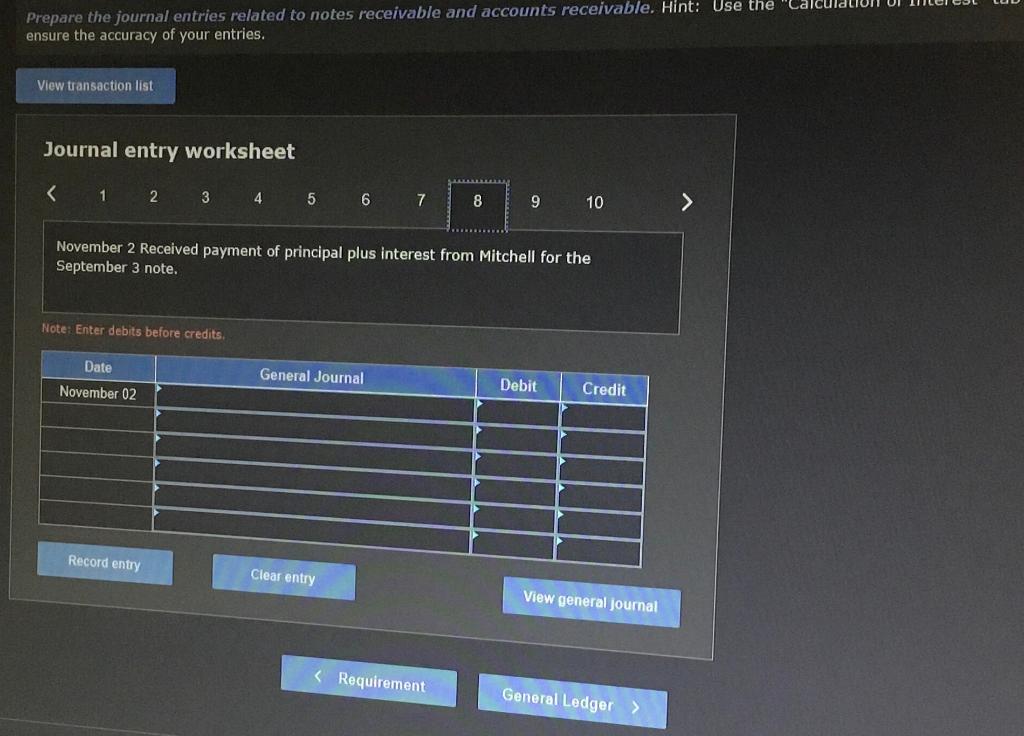

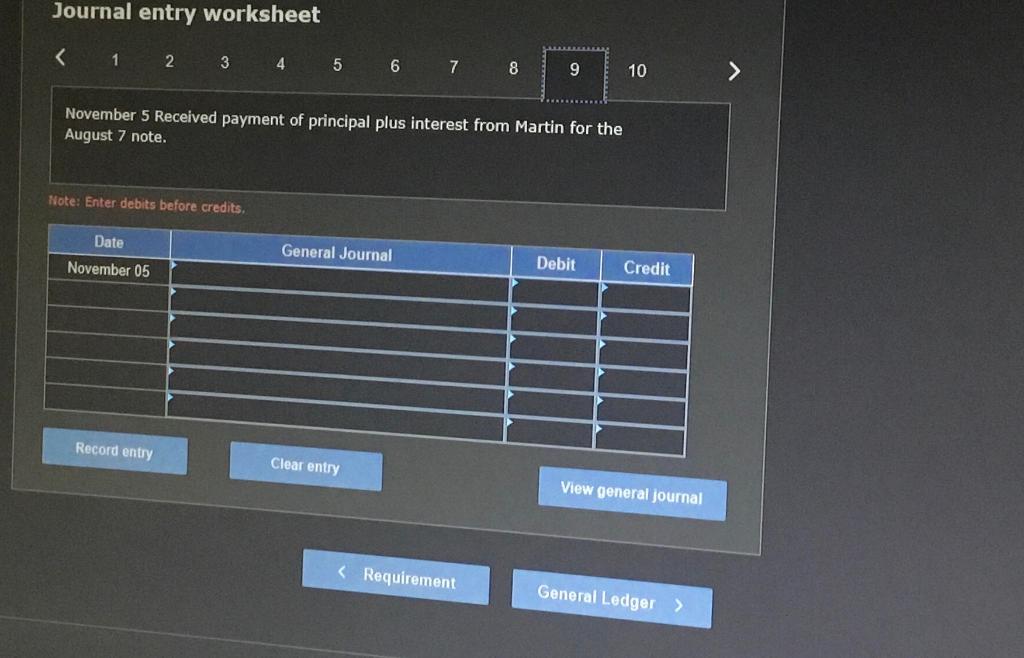

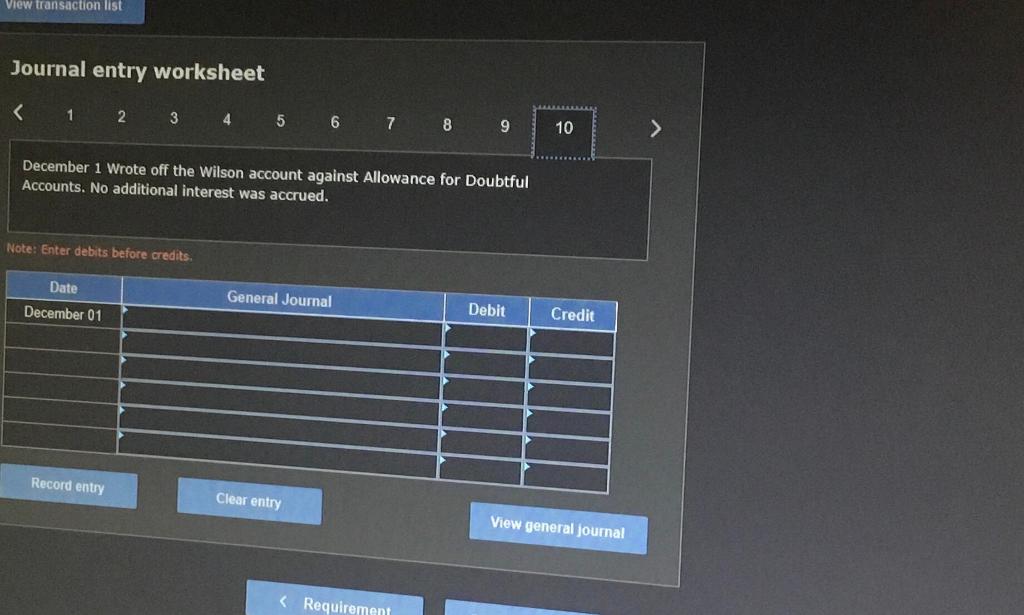

Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries.

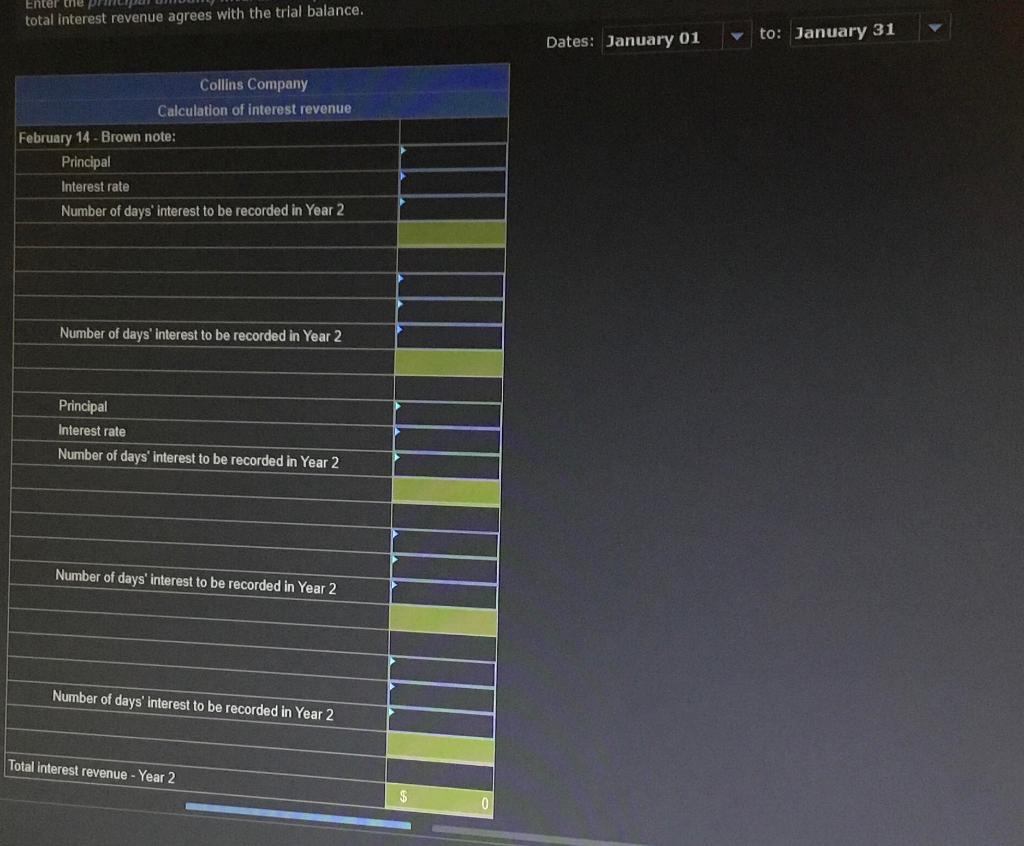

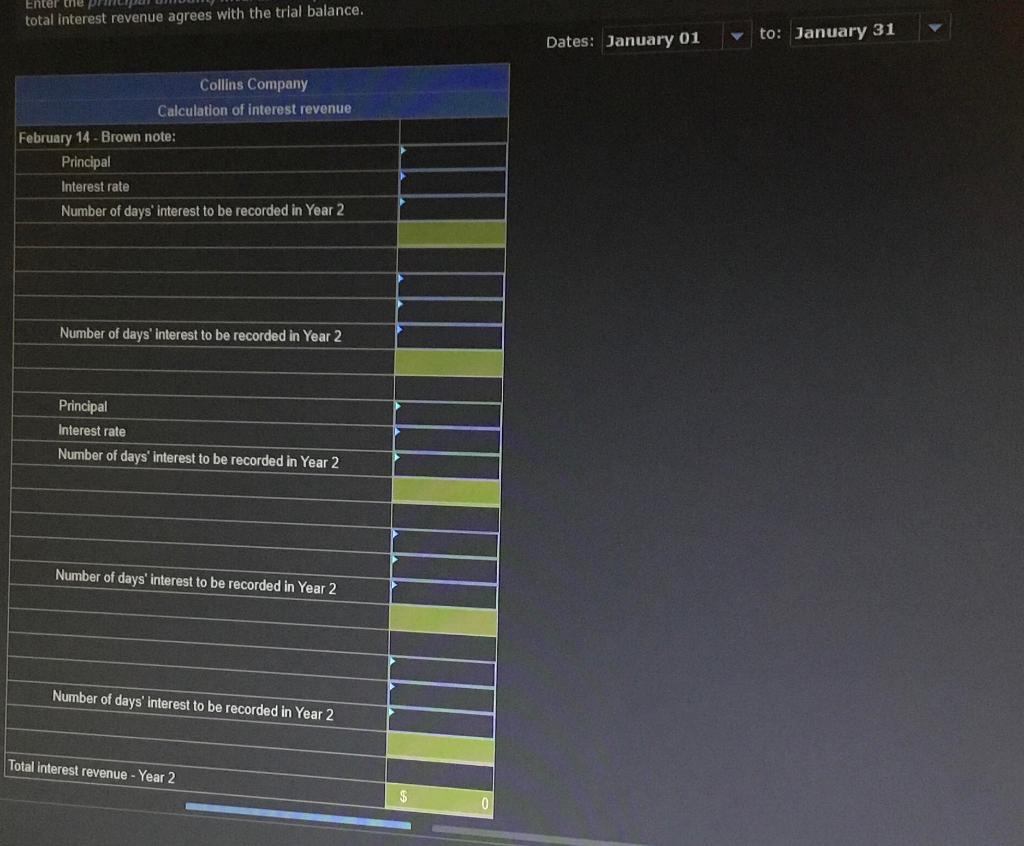

2. Enter the principal amount, interest rate, and number of days of interest to be recorded for each note. Verify that total interest revenue agrees with the trial balance.

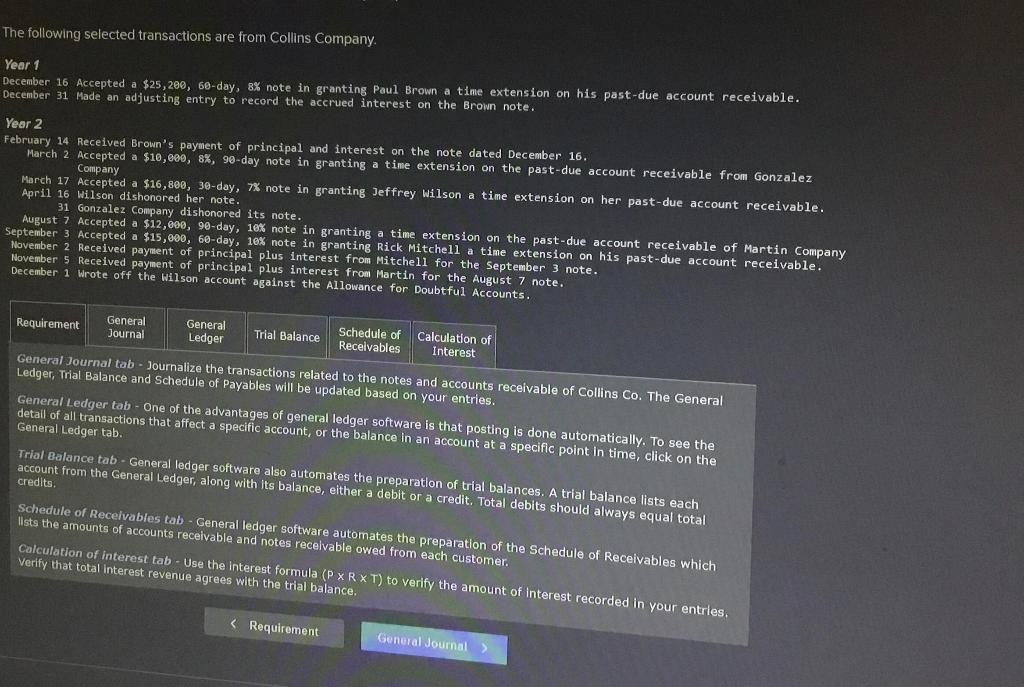

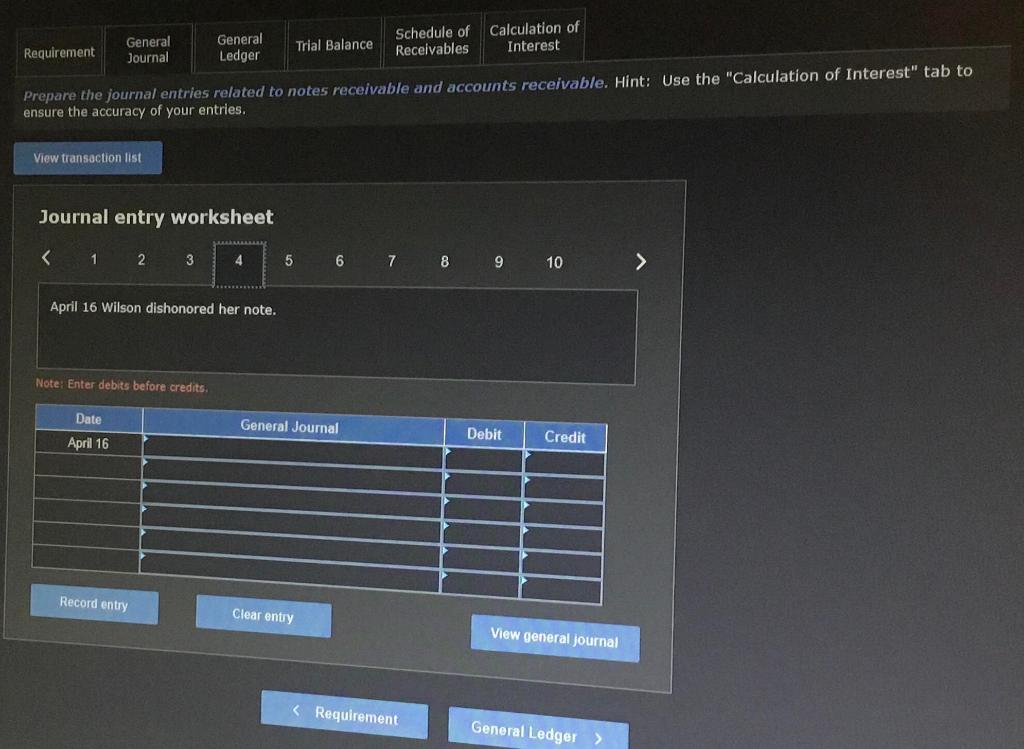

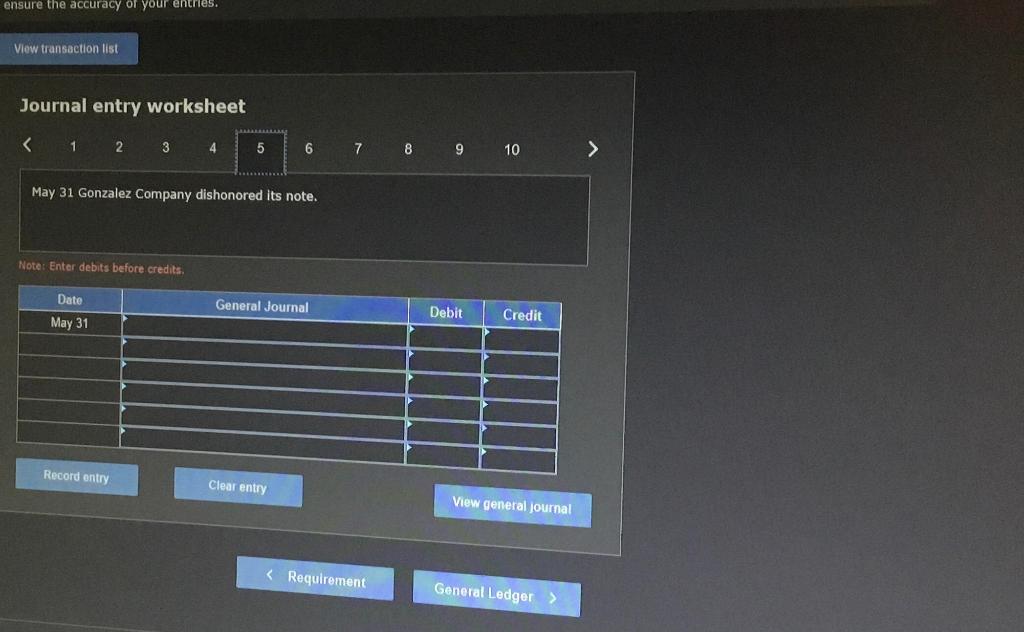

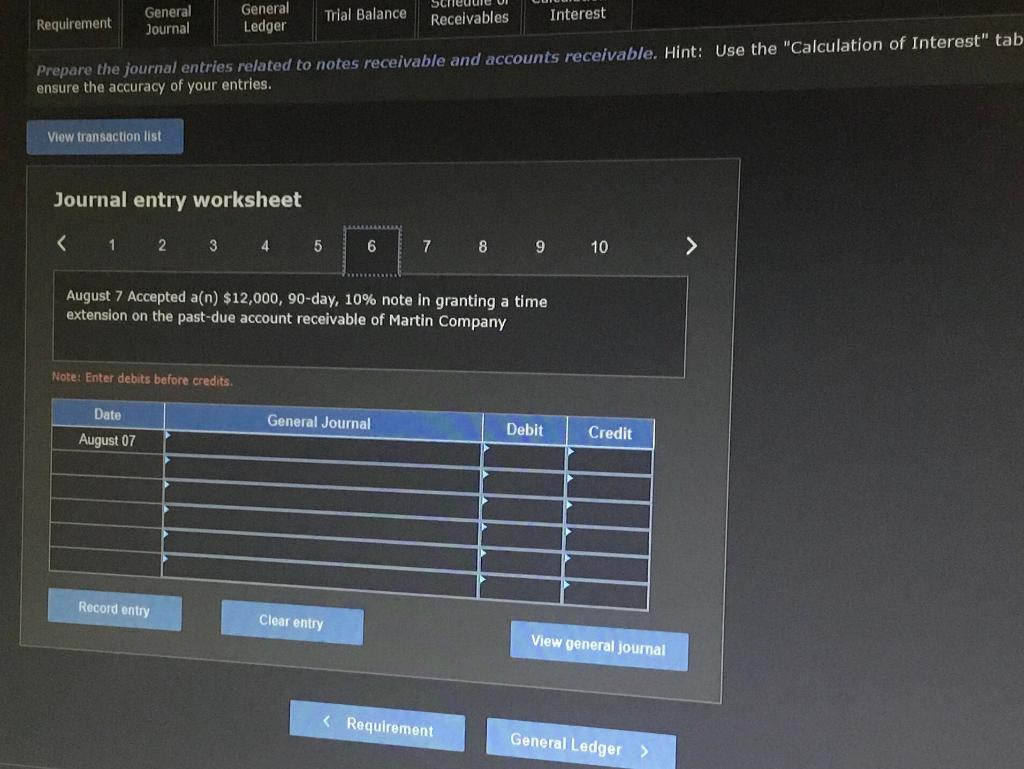

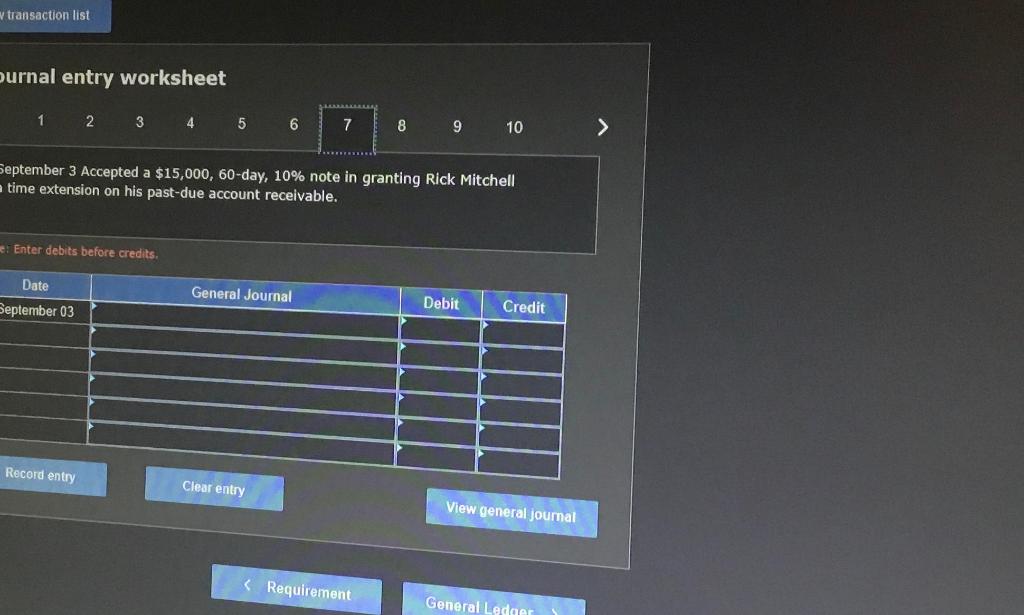

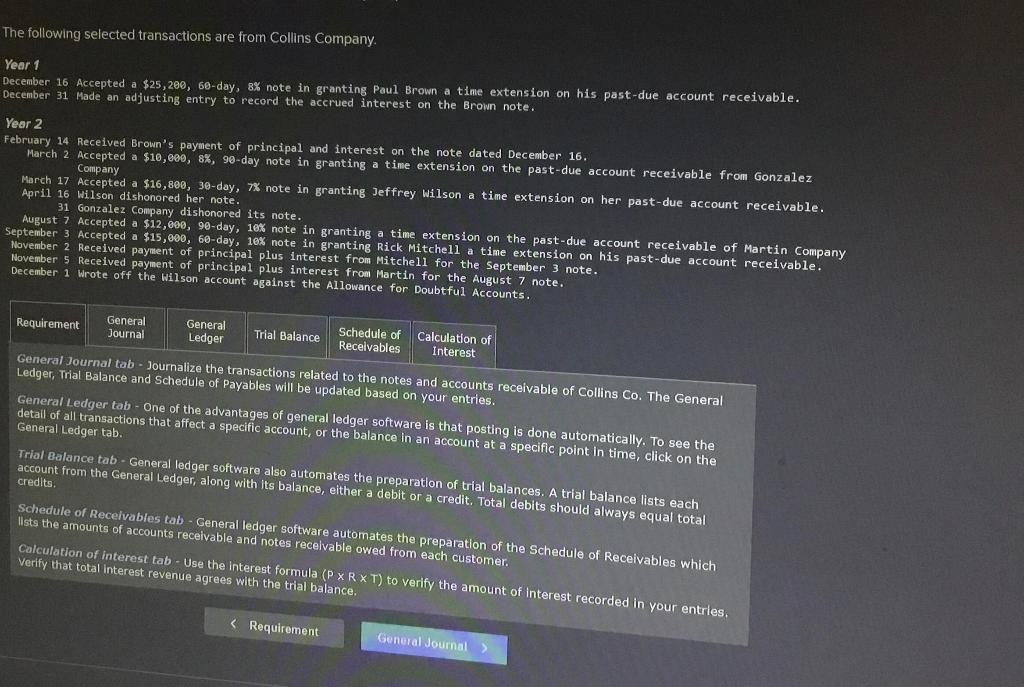

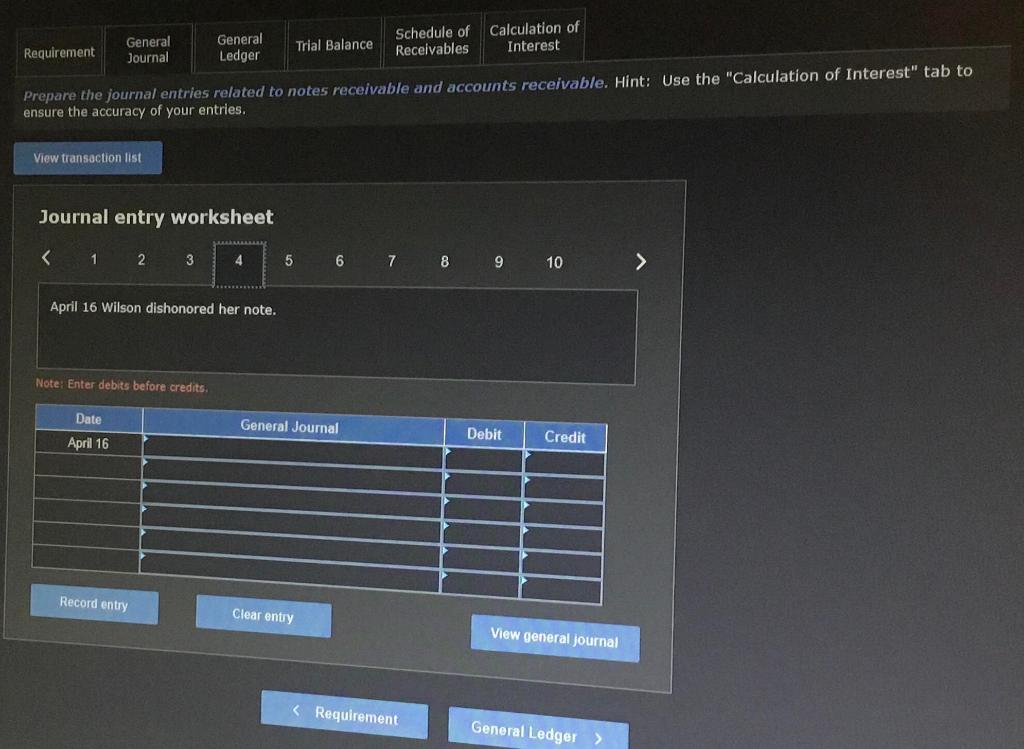

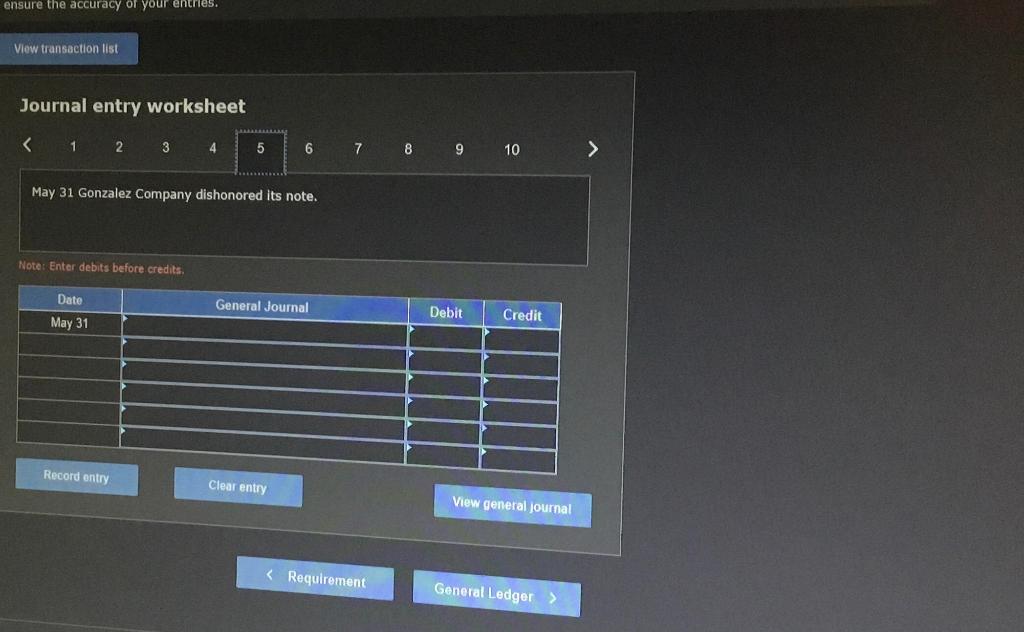

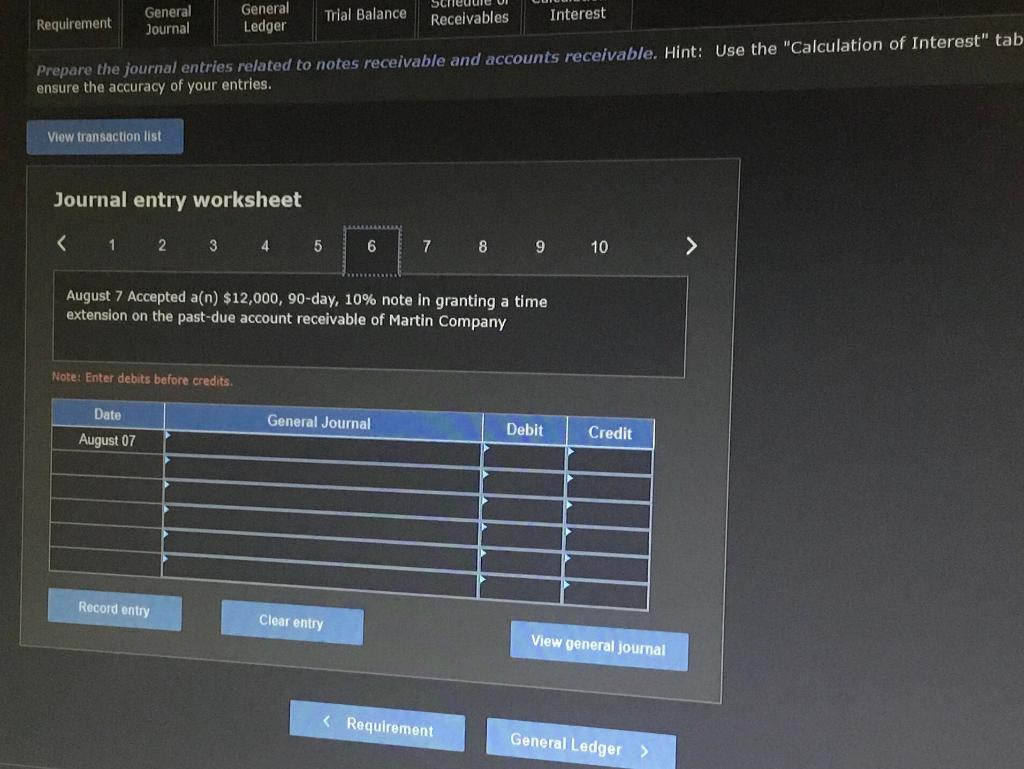

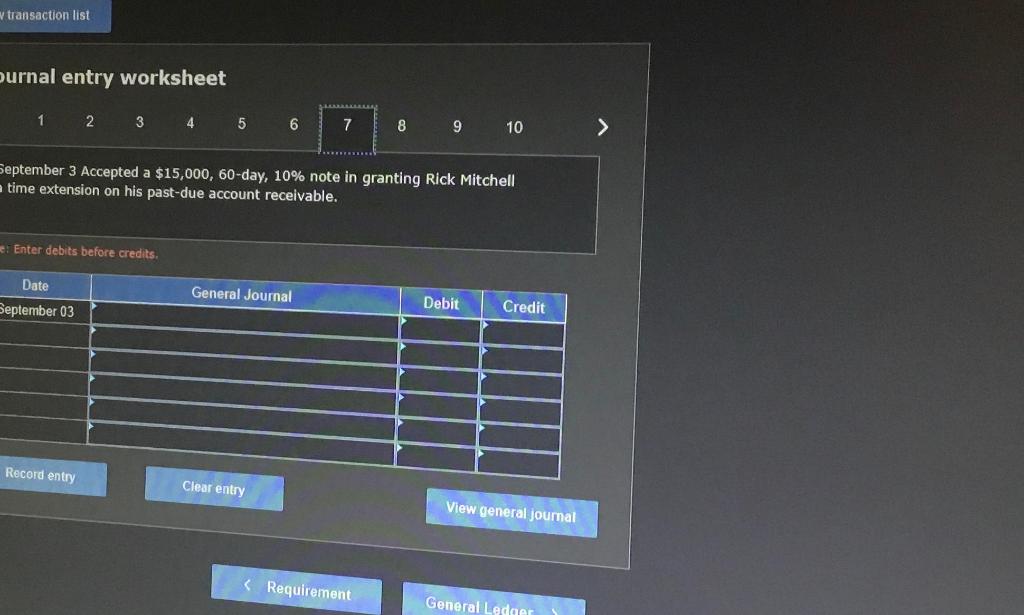

The following selected transactions are from Collins Company. Year 1 December 16 Accepted a $25,200,60-day, 8% note in granting Paul Brown a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Brown note. Year 2 February 14 Received Brown's payment of principal and interest on the note dated December 16. March 2 Accepted a $10,000,8%, 90-day note in granting a time extension on the past-due account receivable from Company March 17 Accepted a $16,800,30-day, 7% note in granting Jeffrey Wilson a time extension on her past-due account receivable. April 16 Wilson dishonored her note. 31 Gonzalez Company dishonored its note. August 7 Accepted a $12,600,90-day, 10% note in granting a time extension on the past-due account receivable of Martin September 3 Accepted a $15,000,60-day, 108 note in granting Rick Mitchell a time extension on his past-due account receivable. November 5 Received payment of principal plus interest from Mitchell for the September 3 note. December 1 Wrote off the Wilson account against the Allowance Hartin for the August 7 note. Ledger, Trial Balance and Schedule of Payables will be updated based on your entries. General Ledger tab - One of the advantages of general ledger software is that posting is done automatically. To see the detall of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit, Total debits should always equal total credits. lists the amounts of accounts Calculation of interest tab - Use the interest formula (PRT) to verify the amount of interest recorded in your entries, Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries. Journal entry worksheet 2345678910 February 14 Recelved Brown's payment of principal and interest on the $25,200,60-day, 8% note dated December 16 . The Collins Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Wote: Enter debits before credits. Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" ensure the accuracy of your entries. Journal entry worksheet