Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the journal entries required for 2 0 2 3 , using the asset adjustment method. ( Credit account titles are automatically indented decimal places,

Prepare the journal entries required for using the asset adjustment method. Credit account titles are automatically indented

decimal places, eg

No Account Titles and Explanation

Machine#

To record depreciation expense

To eliminate accumulated depreciation

To adjust the Machinery account to fair value

Machine #

To record depreciation expense

To eliminate accumulated depreciation

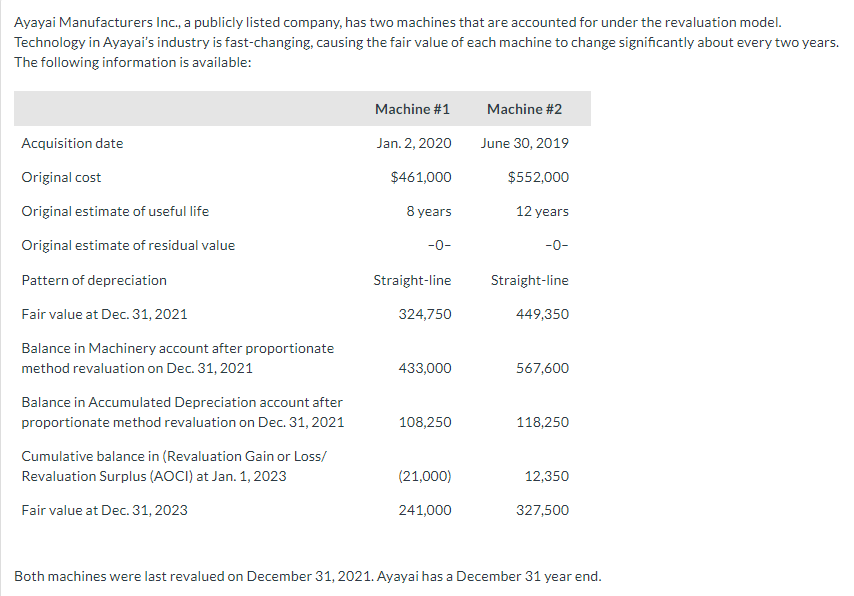

Ayayai Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model.

Technology in Ayayai's industry is fastchanging, causing the fair value of each machine to change significantly about every two years.

The following information is available:

Both machines were last revalued on December Ayayai has a December year end.Prepare the journal entries required for using the proportionate method. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries. Do not round intermediate calculations. Round answers to decimal places, eg No Account Titles and Explanation Debit Credit Machine #To record depreciation expenseTo adjust the Machinery account to fair value Machine #To record depreciation expenseTo adjust the Machinery account to fair valueBramble Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Bramble's industry is fastchanging, causing the fair value of each machine to change significantly about every two years. The following information is available:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started