Answered step by step

Verified Expert Solution

Question

1 Approved Answer

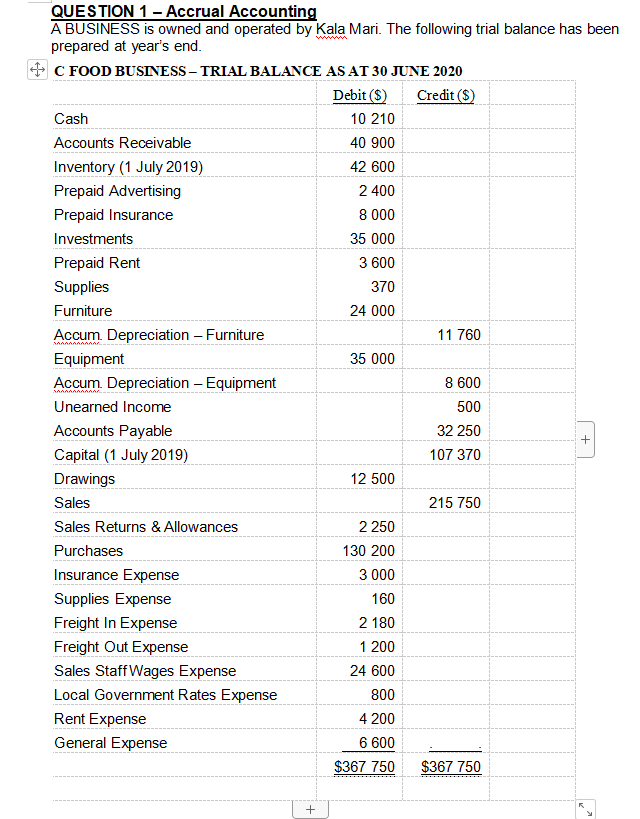

Prepare the journal entries to account for all of the items above. QUESTION 1 - Accrual Accounting A BUSINESS is owned and operated by Kala

Prepare the journal entries to account for all of the items above.

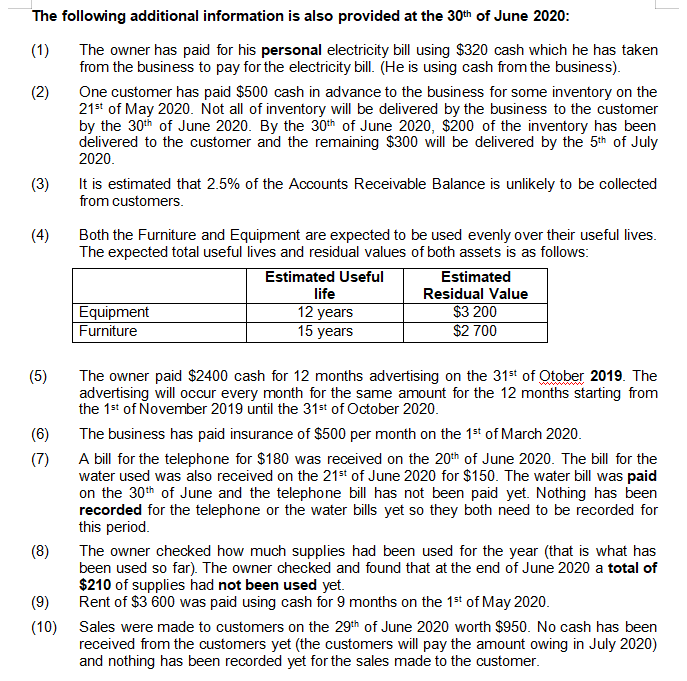

QUESTION 1 - Accrual Accounting A BUSINESS is owned and operated by Kala Mari. The following trial balance has been prepared at year's end. * C FOOD BUSINESS - TRIAL BALANCE AS AT 30 JUNE 2020 Debit ($) Credit ($) Cash 10 210 Accounts Receivable 40 900 Inventory (1 July 2019) 42 600 Prepaid Advertising 2 400 Prepaid Insurance 8 000 Investments 35 000 Prepaid Rent 3 600 Supplies 370 Furniture 24 000 Accum. Depreciation - Furniture 11 760 Equipment 35 000 Accum. Depreciation - Equipment 8 600 Unearned Income 500 Accounts Payable 32 250 Capital (1 July 2019) 107 370 Drawings 12 500 Sales 215 750 Sales Returns & Allowances 2 250 Purchases 130 200 Insurance Expense 3 000 Supplies Expense 160 Freight In Expense 2 180 Freight Out Expense 1 200 Sales Staff Wages Expense 24 600 Local Government Rates Expense 800 Rent Expense 4 200 General Expense 6 600 $367 750 $367 750 + + The following additional information is also provided at the 30th of June 2020: (1) The owner has paid for his personal electricity bill using $320 cash which he has taken from the business to pay for the electricity bill. (He is using cash from the business). (2) One customer has paid $500 cash in advance to the business for some inventory on the 21st of May 2020. Not all of inventory will be delivered by the business to the customer by the 30th of June 2020. By the 30th of June 2020, $200 of the inventory has been delivered to the customer and the remaining $300 will be delivered by the 5th of July 2020 (3) It is estimated that 2.5% of the Accounts Receivable Balance is unlikely to be collected from customers. (4) Both the Furniture and Equipment are expected to be used evenly over their useful lives. The expected total useful lives and residual values of both assets is as follows: Estimated Useful Estimated Residual Value Equipment 12 years $3200 Furniture $2 700 life 15 years (5) The owner paid $2400 cash for 12 months advertising on the 31st of Otober 2019. The advertising will occur every month for the same amount for the 12 months starting from the 1st of November 2019 until the 31st of October 2020. (6) The business has paid insurance of $500 per month on the 1st of March 2020. A bill for the telephone for $180 was received on the 20th of June 2020. The bill for the water used was also received on the 21st of June 2020 for $150. The water bill was paid on the 30th of June and the telephone bill has not been paid yet. Nothing has been recorded for the telephone or the water bills yet so they both need to be recorded for this period. (8) The owner checked how much supplies had been used for the year (that is what has been used so far). The owner checked and found that at the end of June 2020 a total of $210 of supplies had not been used yet. (9) Rent of $3 600 was paid using cash for 9 months on the 1st of May 2020. (10) Sales were made to customers on the 29th of June 2020 worth $950. No cash has been received from the customers yet (the customers will pay the amount owing in July 2020) and nothing has been recorded yet for the sales made to the customerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started