Answered step by step

Verified Expert Solution

Question

1 Approved Answer

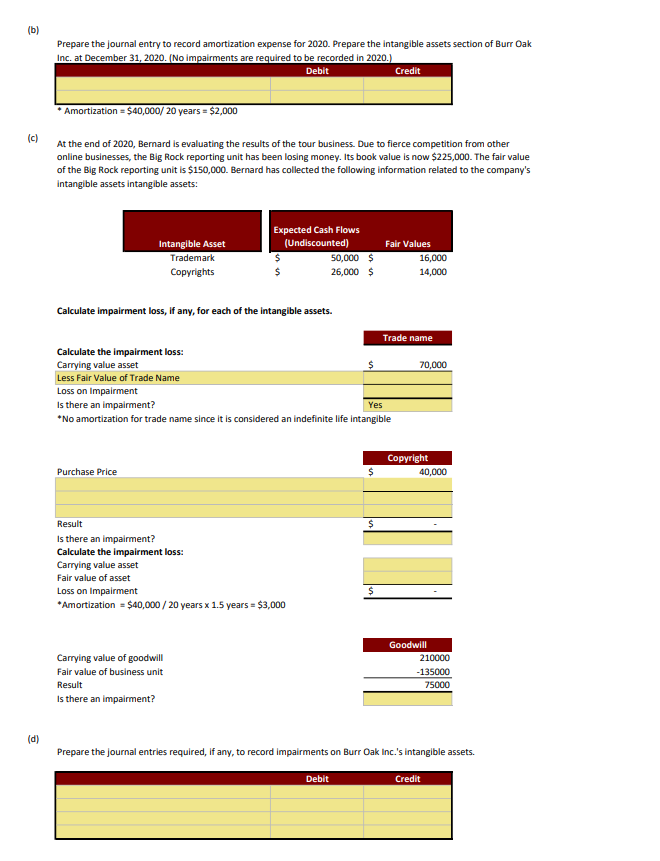

Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Burr Oak Inc. at December 31. 2020. (No imoairments

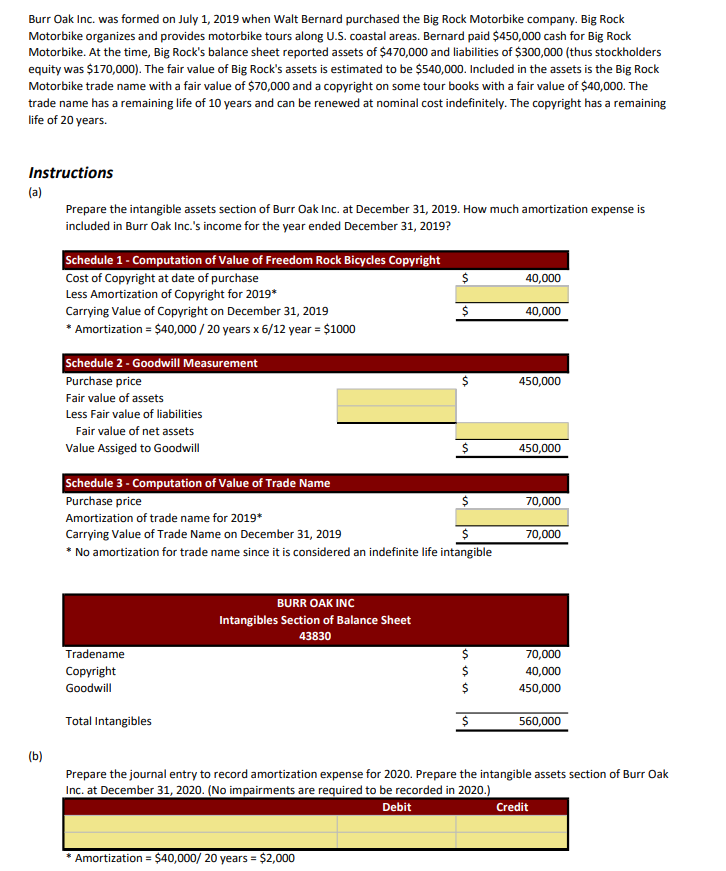

Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Burr Oak Inc. at December 31. 2020. (No imoairments are reauired to be recorded in 2020.1 - Amortization =$40,000/20 years =$2,000 At the end of 2020, Bernard is evaluating the results of the tour business. Due to fierce competition from other online businesses, the Big Rock reporting unit has been losing money. Its book value is now $225,000. The fair value of the Big Rock reporting unit is $150,000. Bernard has collected the following information related to the company's intangible assets intangible assets: Calculate impairment loss, if any, for each of the intangible assets. Prepare the journal entries required, if any, to record impairments on Burr Oak Inc.'s intangible assets. Burr Oak Inc. was formed on July 1, 2019 when Walt Bernard purchased the Big Rock Motorbike company. Big Rock Motorbike organizes and provides motorbike tours along U.S. coastal areas. Bernard paid $450,000 cash for Big Rock Motorbike. At the time, Big Rock's balance sheet reported assets of $470,000 and liabilities of $300,000 (thus stockholders equity was $170,000). The fair value of Big Rock's assets is estimated to be $540,000. Included in the assets is the Big Rock Motorbike trade name with a fair value of $70,000 and a copyright on some tour books with a fair value of $40,000. The trade name has a remaining life of 10 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 20 years. Instructions (a) Prepare the intangible assets section of Burr Oak Inc. at December 31, 2019. How much amortization expense is included in Burr Oak Inc.'s income for the year ended December 31, 2019? Schedule 1 - Computation of Value of Freedom Rock Bicycles Copyright * No amortization for trade name since it is considered an indefinite life intangible (b) Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Burr Oak Inc. at December 31, 2020. (No impairments are required to be recorded in 2020 .)

Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Burr Oak Inc. at December 31. 2020. (No imoairments are reauired to be recorded in 2020.1 - Amortization =$40,000/20 years =$2,000 At the end of 2020, Bernard is evaluating the results of the tour business. Due to fierce competition from other online businesses, the Big Rock reporting unit has been losing money. Its book value is now $225,000. The fair value of the Big Rock reporting unit is $150,000. Bernard has collected the following information related to the company's intangible assets intangible assets: Calculate impairment loss, if any, for each of the intangible assets. Prepare the journal entries required, if any, to record impairments on Burr Oak Inc.'s intangible assets. Burr Oak Inc. was formed on July 1, 2019 when Walt Bernard purchased the Big Rock Motorbike company. Big Rock Motorbike organizes and provides motorbike tours along U.S. coastal areas. Bernard paid $450,000 cash for Big Rock Motorbike. At the time, Big Rock's balance sheet reported assets of $470,000 and liabilities of $300,000 (thus stockholders equity was $170,000). The fair value of Big Rock's assets is estimated to be $540,000. Included in the assets is the Big Rock Motorbike trade name with a fair value of $70,000 and a copyright on some tour books with a fair value of $40,000. The trade name has a remaining life of 10 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 20 years. Instructions (a) Prepare the intangible assets section of Burr Oak Inc. at December 31, 2019. How much amortization expense is included in Burr Oak Inc.'s income for the year ended December 31, 2019? Schedule 1 - Computation of Value of Freedom Rock Bicycles Copyright * No amortization for trade name since it is considered an indefinite life intangible (b) Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Burr Oak Inc. at December 31, 2020. (No impairments are required to be recorded in 2020 .) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started