Answered step by step

Verified Expert Solution

Question

1 Approved Answer

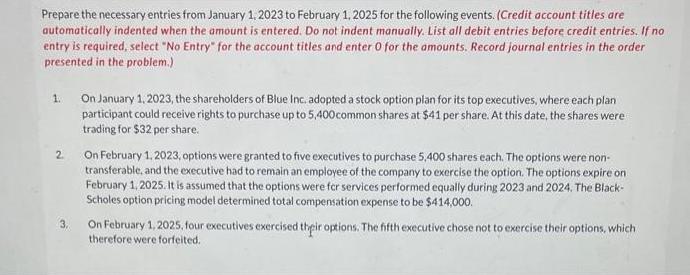

Prepare the necessary entries from January 1, 2023 to February 1, 2025 for the following events. (Credit account titles are automatically indented when the

Prepare the necessary entries from January 1, 2023 to February 1, 2025 for the following events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) 1. 2 3, On January 1, 2023, the shareholders of Blue Inc. adopted a stock option plan for its top executives, where each plan participant could receive rights to purchase up to 5,400 common shares at $41 per share. At this date, the shares were trading for $32 per share. On February 1, 2023, options were granted to five executives to purchase 5,400 shares each. The options were non- transferable, and the executive had to remain an employee of the company to exercise the option. The options expire on February 1, 2025. It is assumed that the options were for services performed equally during 2023 and 2024. The Black- Scholes option pricing model determined total compensation expense to be $414,000. On February 1, 2025, four executives exercised their options. The fifth executive chose not to exercise their options, which therefore were forfeited.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1January 1 2023 No Entry 2February 1 2023 Debit Compensation Expense Stock Options 414000 Credit Add...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started