Answered step by step

Verified Expert Solution

Question

1 Approved Answer

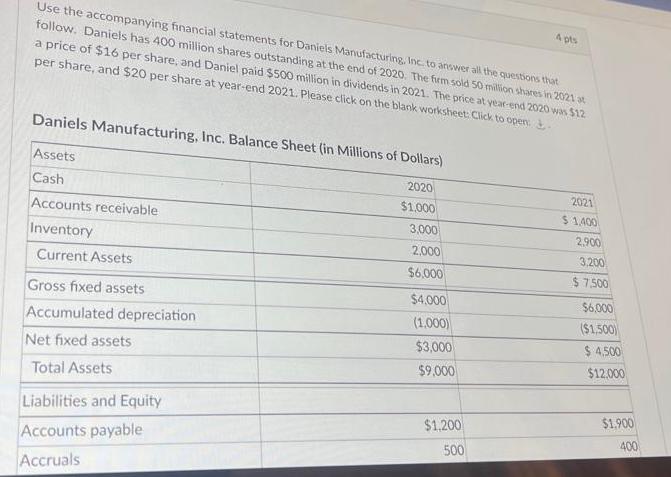

Use the accompanying financial statements for Daniels Manufacturing, Inc. to answer all the questions that follow. Daniels has 400 million shares outstanding at the

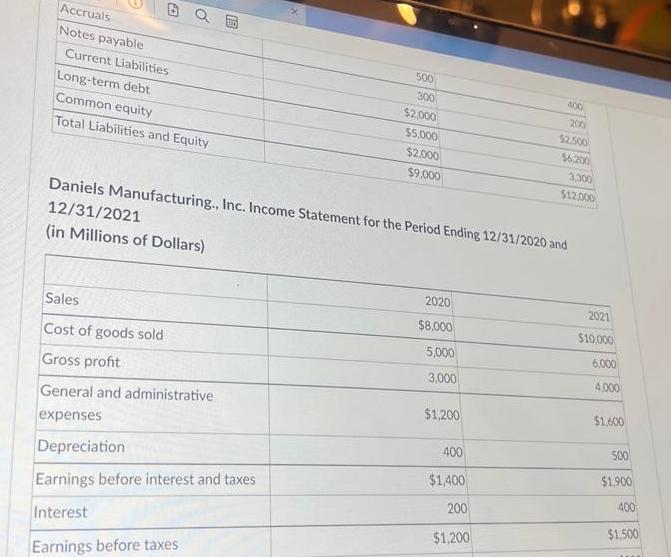

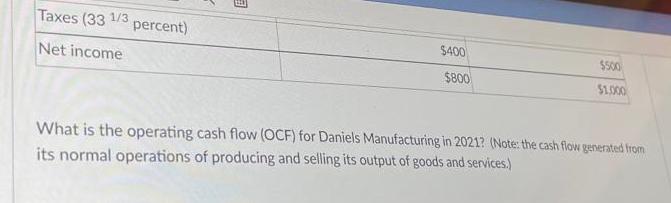

Use the accompanying financial statements for Daniels Manufacturing, Inc. to answer all the questions that follow. Daniels has 400 million shares outstanding at the end of 2020. The firm sold 50 million shares in 2021 at a price of $16 per share, and Daniel paid $500 million in dividends in 2021. The price at year-end 2020 was $12 per share, and $20 per share at year-end 2021. Please click on the blank worksheet: Click to open: Daniels Manufacturing, Inc. Balance Sheet (in Millions of Dollars) 2020 $1.000 Assets Cash Accounts receivable Inventory Current Assets Gross fixed assets Accumulated depreciation Net fixed assets Total Assets Liabilities and Equity Accounts payable Accruals 3,000 2,000 $6,000 $4,000 (1,000) $3,000 $9,000 $1,200 500 4 pts 2021 $1,400 2.900 3,200 $7.500 $6,000 ($1,500) $ 4.500 $12,000 $1.900 400 Accruals Notes payable Current Liabilities Long-term debt Common equity Total Liabilities and Equity Sales Cost of goods sold Gross profit General and administrative expenses Depreciation 500 Earnings before interest and taxes Interest Earnings before taxes 300 $2,000 $5.000 $2.000 $9,000 2020 $8,000 5,000 3,000 Daniels Manufacturing., Inc. Income Statement for the Period Ending 12/31/2020 and 12/31/2021 (in Millions of Dollars) $1,200 400 400 $1,400 200 $1,200 200 $2.500 $6,200 3.300 $12,000 2021 $10,000 6.000 4,000 $1,600 500 $1,900 400 $1.500 Taxes (33 1/3 Net income percent) $400 $800 $500 $1.000 What is the operating cash flow (OCF) for Daniels Manufacturing in 2021? (Note: the cash flow generated from its normal operations of producing and selling its output of goods and services.)

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER OCF EBIT Depreciation Taxes From the income statement for 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started