Answered step by step

Verified Expert Solution

Question

1 Approved Answer

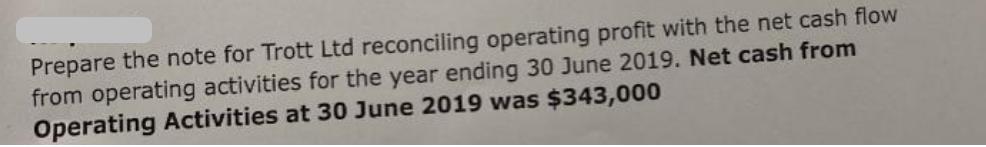

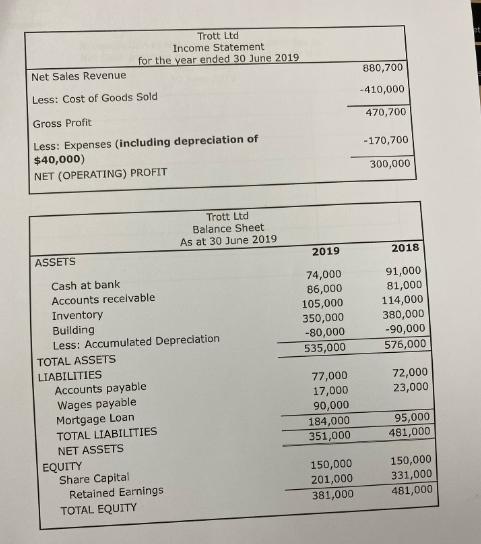

Prepare the note for Trott Ltd reconciling operating profit with the net cash flow from operating activities for the year ending 30 June 2019.

Prepare the note for Trott Ltd reconciling operating profit with the net cash flow from operating activities for the year ending 30 June 2019. Net cash from Operating Activities at 30 June 2019 was $343,000 Net Sales Revenue Less: Cost of Goods Sold Gross Profit Less: Expenses (including depreciation of $40,000) NET (OPERATING) PROFIT ASSETS Trott Ltd Income Statement for the year ended 30 June 2019 TOTAL ASSETS LIABILITIES Cash at bank Accounts receivable. Inventory. Building Less: Accumulated Depreciation Accounts payable Wages payable Mortgage Loan TOTAL LIABILITIES NET ASSETS EQUITY Share Capital Retained Earnings Trott Ltd Balance Sheet As at 30 June 2019 TOTAL EQUITY 2019 74,000 86,000 105,000 350,000 -80,000 535,000 77,000 17,000 90,000 184,000. 351,000 150,000 201,000 381,000 880,700 -410,000 470,700 -170,700 300,000 2018 91,000 81,000 114,000 380,000 -90,000 576,000 72,000 23,000 95,000 481,000 150,000 331,000 481,000

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Trott Ltd Note Reconciliation of Operating Profit with Net Cash Flow For the year ending 30 June 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started