Prepare the required adjusting journal entries for the month-end based upon the information provided on page 6 of these instructions (Information for AJEs #1 through #10).

Suggested steps are as follows:

- Based on the information provided in a. on page 6 (of these instructions), determine the required adjusting journal entry. Write up this adjusting journal entry on the General Journal sheets provided (WP-11 to WP-14). Make sure to properly date and label your adjusting journal entry (i.e., 1, 2, 3, etc). Start with the account to be debited first, then the account to be credited is written in next. Provide a description for each of your adjusting journal entries. NOTE: These adjusting journal entries are within the group of journal entries that you were required to do throughout the semester.

b. Post this adjusting journal entry from the General Journal to the proper accounts on your worksheet (WP-2). Indicate that you have posted the adjusted journal entry by making a squiggly line in the POST. REF. Column of the General Journal. (Remember, put this squiggly line on the far right side of this column because later we will need to enter the account number in this column when we post this adjusting journal entry to the general ledger. Dont do this yet, we have to complete the worksheet first!)

c. Now go back to page 6 (of these instructions), and perform the same steps from above (3.a. & 3.b.) for the information provided in b. through j.

d. After you have completed all of the required adjusting journal entries, make sure that your worksheet balances. To do this, add up all of the debits and all of the credits that you have made in the ADJUSTMENTS column of the worksheet. Your debits should equal your credits. [Check number = $37,097]

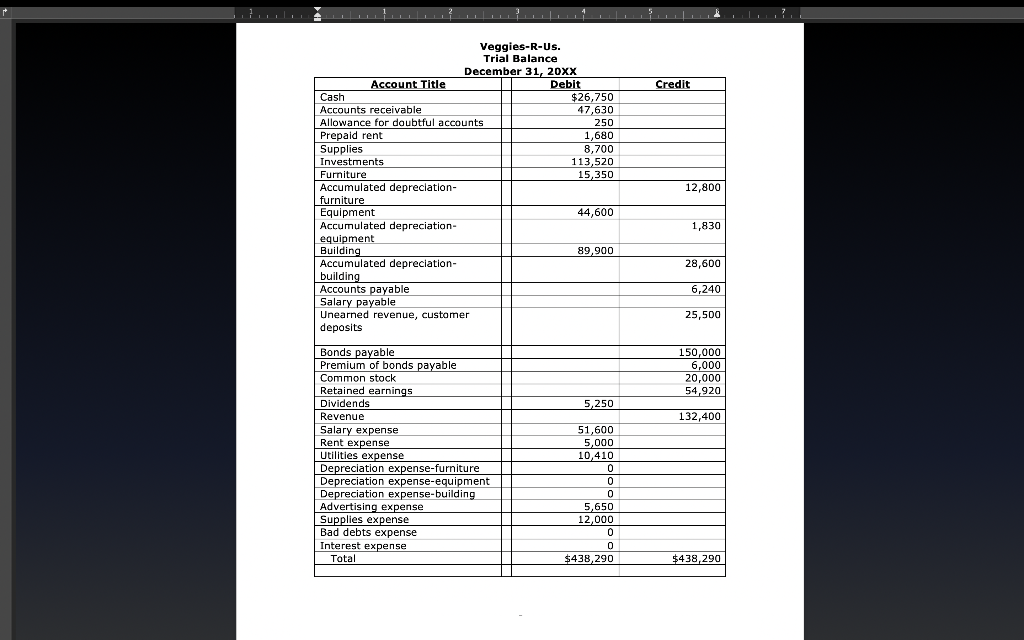

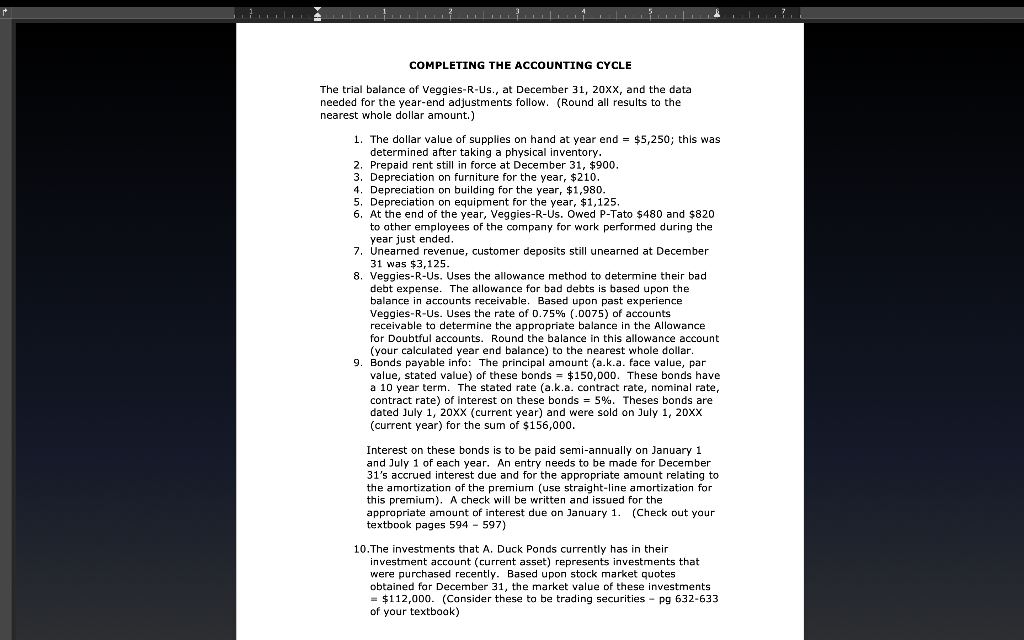

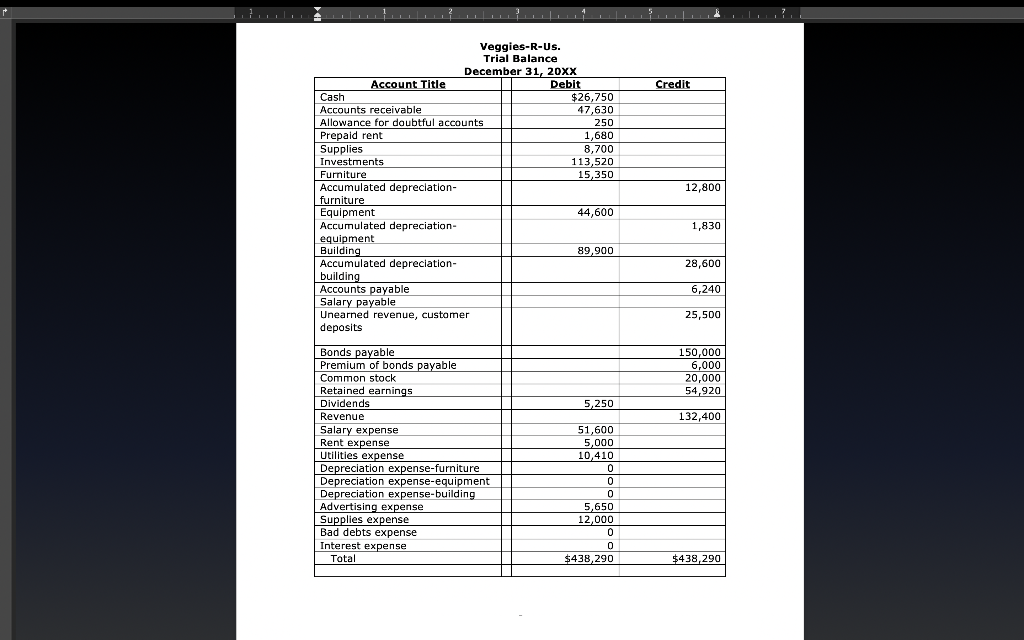

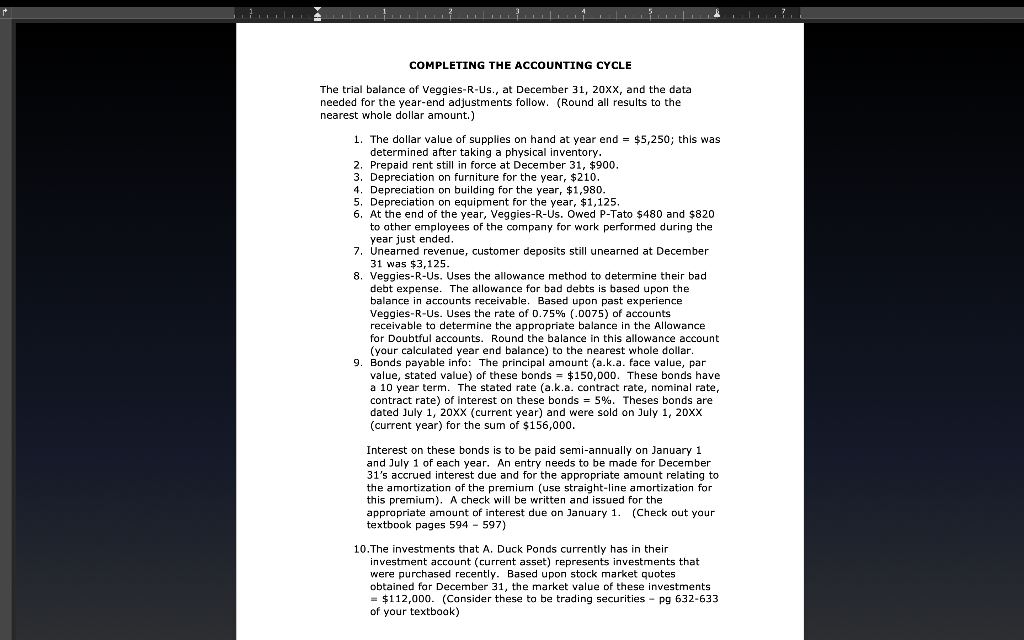

Credit Veggies-R-Us. Trial Balance December 31, 20XX Account Title | Debit Cash $26,750 Accounts receivable 47,630 Allowance for doubtful accounts 250 Prepaid rent 1,680 Supplies 8,700 Investments 113,520 Furniture 15,350 Accumulated depreciation- furniture Equipment 44,600 Accumulated depreciation- equipment Building 89,900 Accumulated depreciation- building Accounts payable Salary payable Unearned revenue, customer deposits 12,800 1,830 28,600 6,240 25,500 150,000 6,000 20,000 54,920 5,250 132,400 Bonds payable Premium of bonds payable Common stock Retained earnings Dividends Revenue Salary expense Rent expense Utilities expense Depreciation expense-furniture Depreciation expense-equipment Depreciation expense-building Advertising expense Supplies expense Bad debts expense Interest expense Total 51,600 5,000 10.410 0 | 0 5.650 12,000 $438,290 $438,290 COMPLETING THE ACCOUNTING CYCLE The trial balance of Veggies-R-Us., at December 31, 20xx, and the data needed for the year-end adjustments follow. (Round all results to the nearest whole dollar amount.) 1. The dollar value of supplies on hand at year end = $5,250; this was determined after taking a physical inventory. 2. Prepaid rent still in force at December 31, $900. 3. Depreciation on furniture for the year, $210. 4. Depreciation on building for the year, $1,980. 5. Depreciation on equipment for the year, $1,125. 6. At the end of the year, Veggies-R-Us. Owed P-Tato $480 and $820 to other employees of the company for work performed during the year just ended. 7. Unearned revenue, customer deposits still unearned at December 31 was $3,125. 8. Veggies-R-Us. Uses the allowance method to determine their bad debt expense. The allowance for bad debts is based upon the balance in accounts receivable. Based upon past experience Veggies-R-Us. Uses the rate of 0.75% (.0075) of accounts receivable to determine the appropriate balance in the Allowance for Doubtful accounts. Round the balance in this allowance account (your calculated year end balance) to the nearest whole dollar. 9. Bonds payable info: The principal amount (a.k.a. face value, par value, stated value) of these bonds = $150,000. These bonds have a 10 year term. The stated rate (a.k.a. contract rate, nominal rate, contract rate) of interest on these bonds = 5%. Theses bonds are dated July 1, 20XX (current year) and were sold on July 1, 20XX (current year) for the sum of $156,000. Interest on these bonds is to be paid semi-annually on January 1 and July 1 of each year. An entry needs to be made for December 31's accrued interest due and for the appropriate amount relating to the amortization of the premium (use straight-line amortization for this premium). A check will be written and issued for the appropriate amount of interest due on January 1. (Check out your textbook pages 594 - 597) 10. The investments that A. Duck Ponds currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market quotes obtained for December 31, the market value of these investments = $112,000. (Consider these to be trading securities - pg 632-633 of your textbook) Credit Veggies-R-Us. Trial Balance December 31, 20XX Account Title | Debit Cash $26,750 Accounts receivable 47,630 Allowance for doubtful accounts 250 Prepaid rent 1,680 Supplies 8,700 Investments 113,520 Furniture 15,350 Accumulated depreciation- furniture Equipment 44,600 Accumulated depreciation- equipment Building 89,900 Accumulated depreciation- building Accounts payable Salary payable Unearned revenue, customer deposits 12,800 1,830 28,600 6,240 25,500 150,000 6,000 20,000 54,920 5,250 132,400 Bonds payable Premium of bonds payable Common stock Retained earnings Dividends Revenue Salary expense Rent expense Utilities expense Depreciation expense-furniture Depreciation expense-equipment Depreciation expense-building Advertising expense Supplies expense Bad debts expense Interest expense Total 51,600 5,000 10.410 0 | 0 5.650 12,000 $438,290 $438,290 COMPLETING THE ACCOUNTING CYCLE The trial balance of Veggies-R-Us., at December 31, 20xx, and the data needed for the year-end adjustments follow. (Round all results to the nearest whole dollar amount.) 1. The dollar value of supplies on hand at year end = $5,250; this was determined after taking a physical inventory. 2. Prepaid rent still in force at December 31, $900. 3. Depreciation on furniture for the year, $210. 4. Depreciation on building for the year, $1,980. 5. Depreciation on equipment for the year, $1,125. 6. At the end of the year, Veggies-R-Us. Owed P-Tato $480 and $820 to other employees of the company for work performed during the year just ended. 7. Unearned revenue, customer deposits still unearned at December 31 was $3,125. 8. Veggies-R-Us. Uses the allowance method to determine their bad debt expense. The allowance for bad debts is based upon the balance in accounts receivable. Based upon past experience Veggies-R-Us. Uses the rate of 0.75% (.0075) of accounts receivable to determine the appropriate balance in the Allowance for Doubtful accounts. Round the balance in this allowance account (your calculated year end balance) to the nearest whole dollar. 9. Bonds payable info: The principal amount (a.k.a. face value, par value, stated value) of these bonds = $150,000. These bonds have a 10 year term. The stated rate (a.k.a. contract rate, nominal rate, contract rate) of interest on these bonds = 5%. Theses bonds are dated July 1, 20XX (current year) and were sold on July 1, 20XX (current year) for the sum of $156,000. Interest on these bonds is to be paid semi-annually on January 1 and July 1 of each year. An entry needs to be made for December 31's accrued interest due and for the appropriate amount relating to the amortization of the premium (use straight-line amortization for this premium). A check will be written and issued for the appropriate amount of interest due on January 1. (Check out your textbook pages 594 - 597) 10. The investments that A. Duck Ponds currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market quotes obtained for December 31, the market value of these investments = $112,000. (Consider these to be trading securities - pg 632-633 of your textbook)