PREPARE THE STATEMENT OF CASH FLOWS FOR RICHCORP USING THE DIRECT METHOD

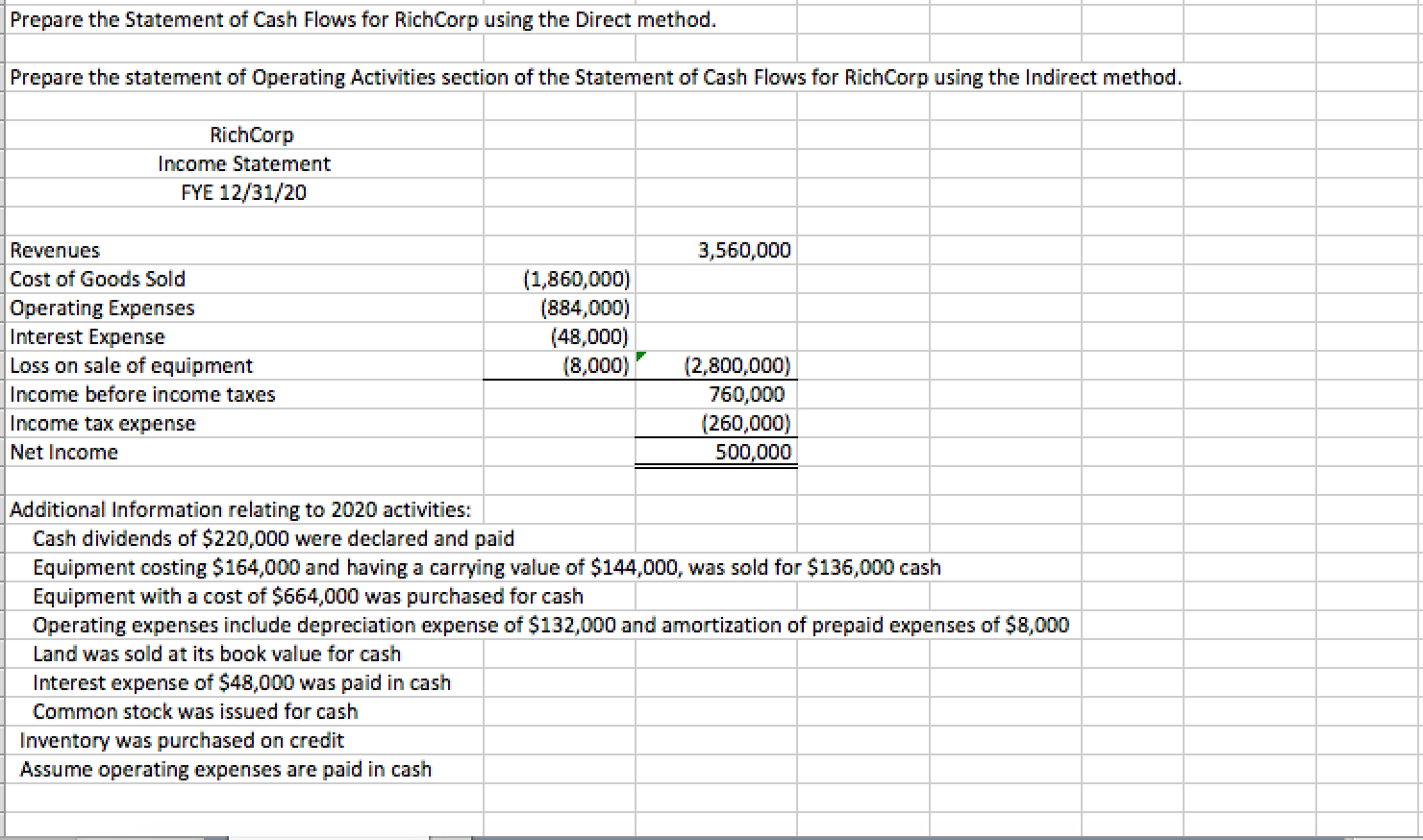

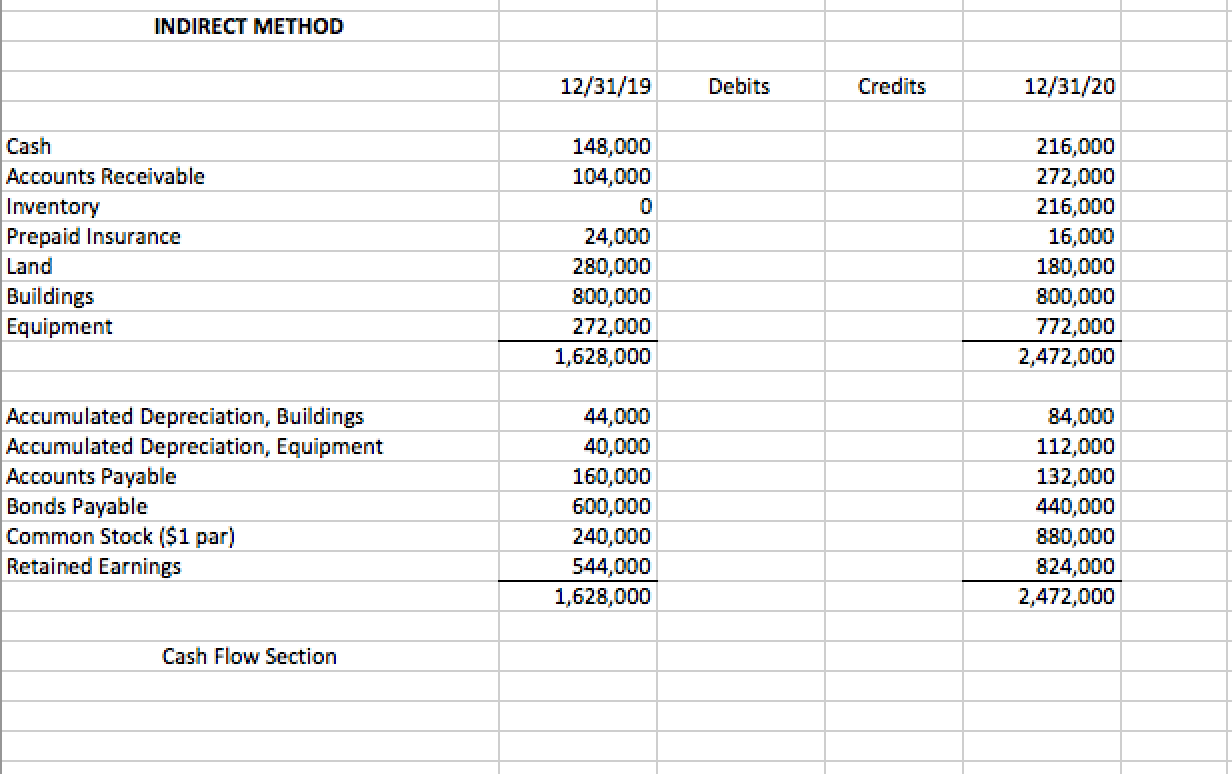

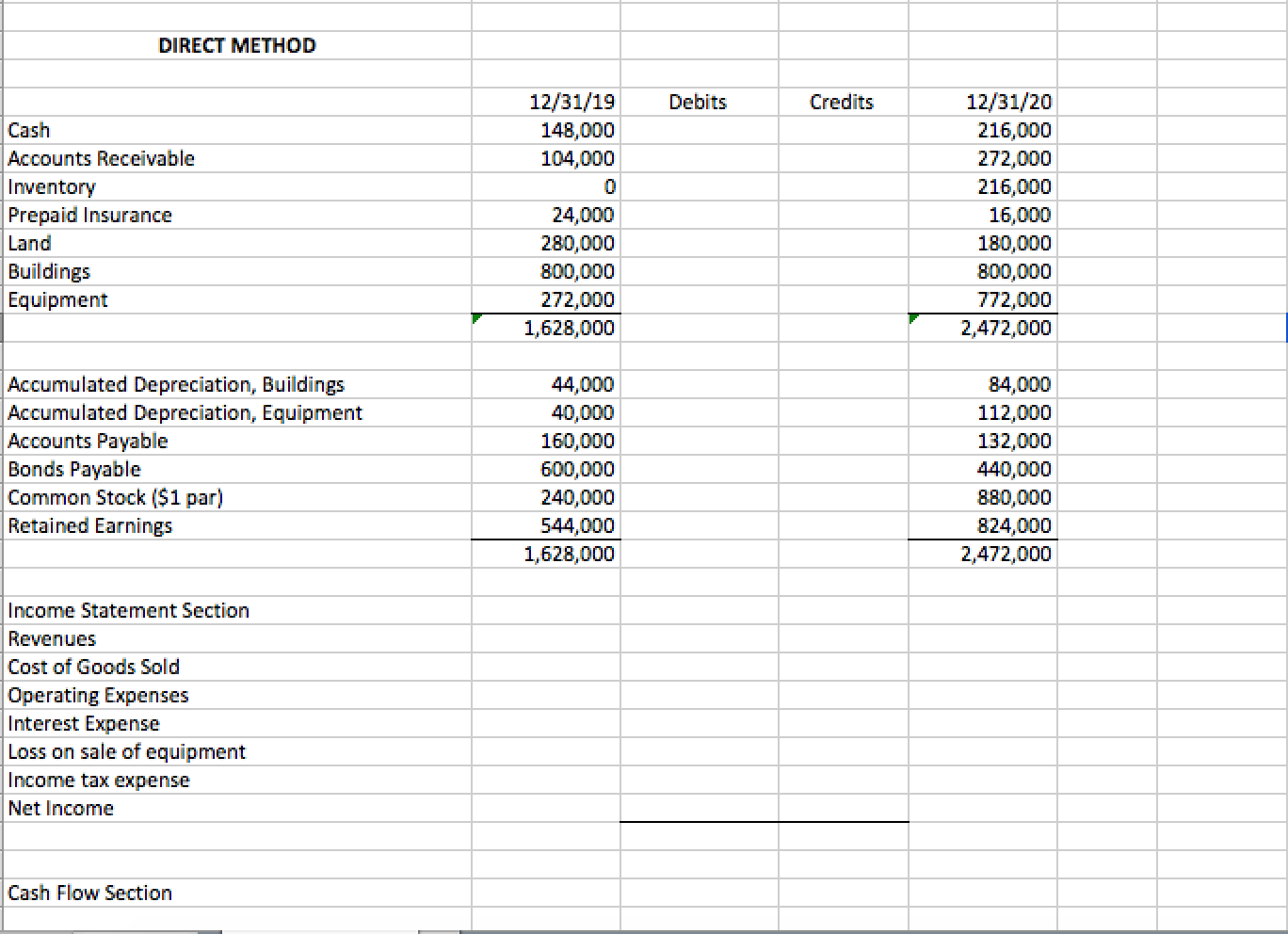

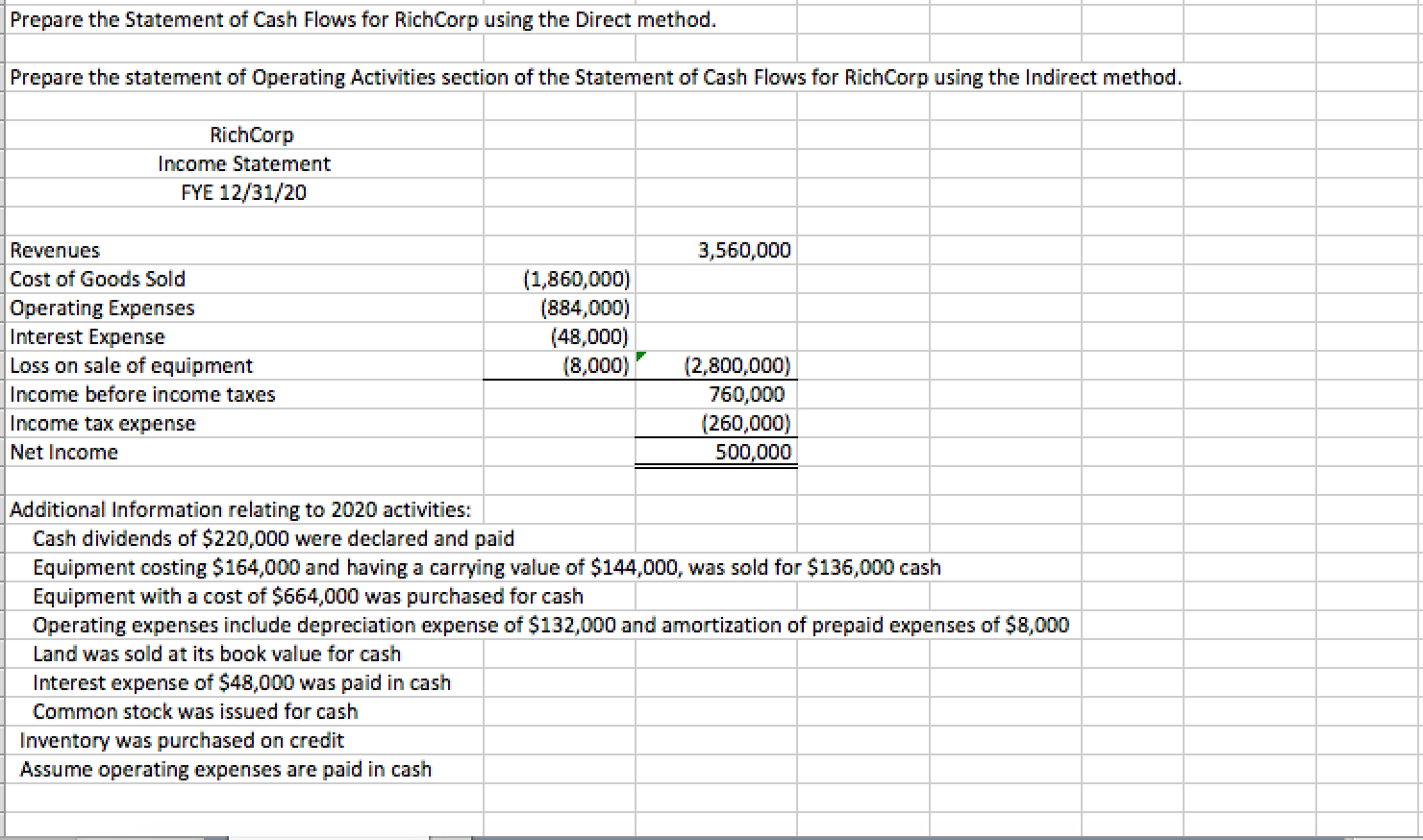

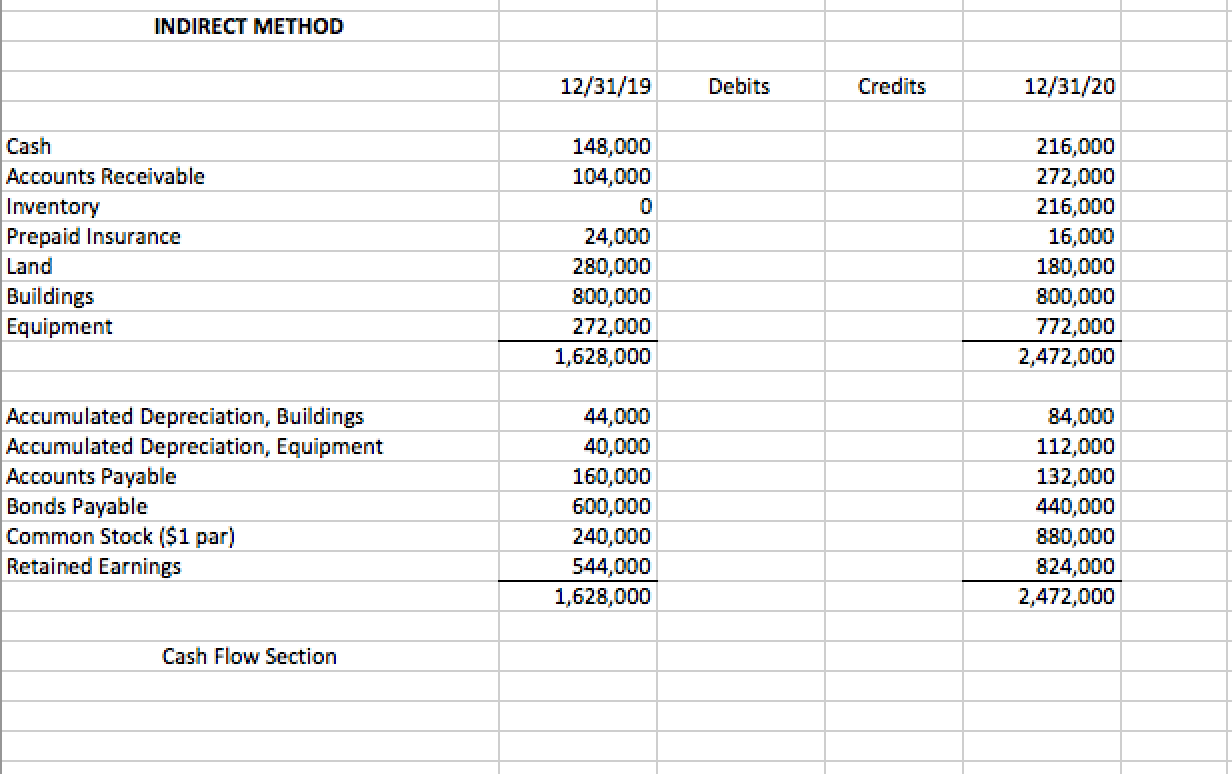

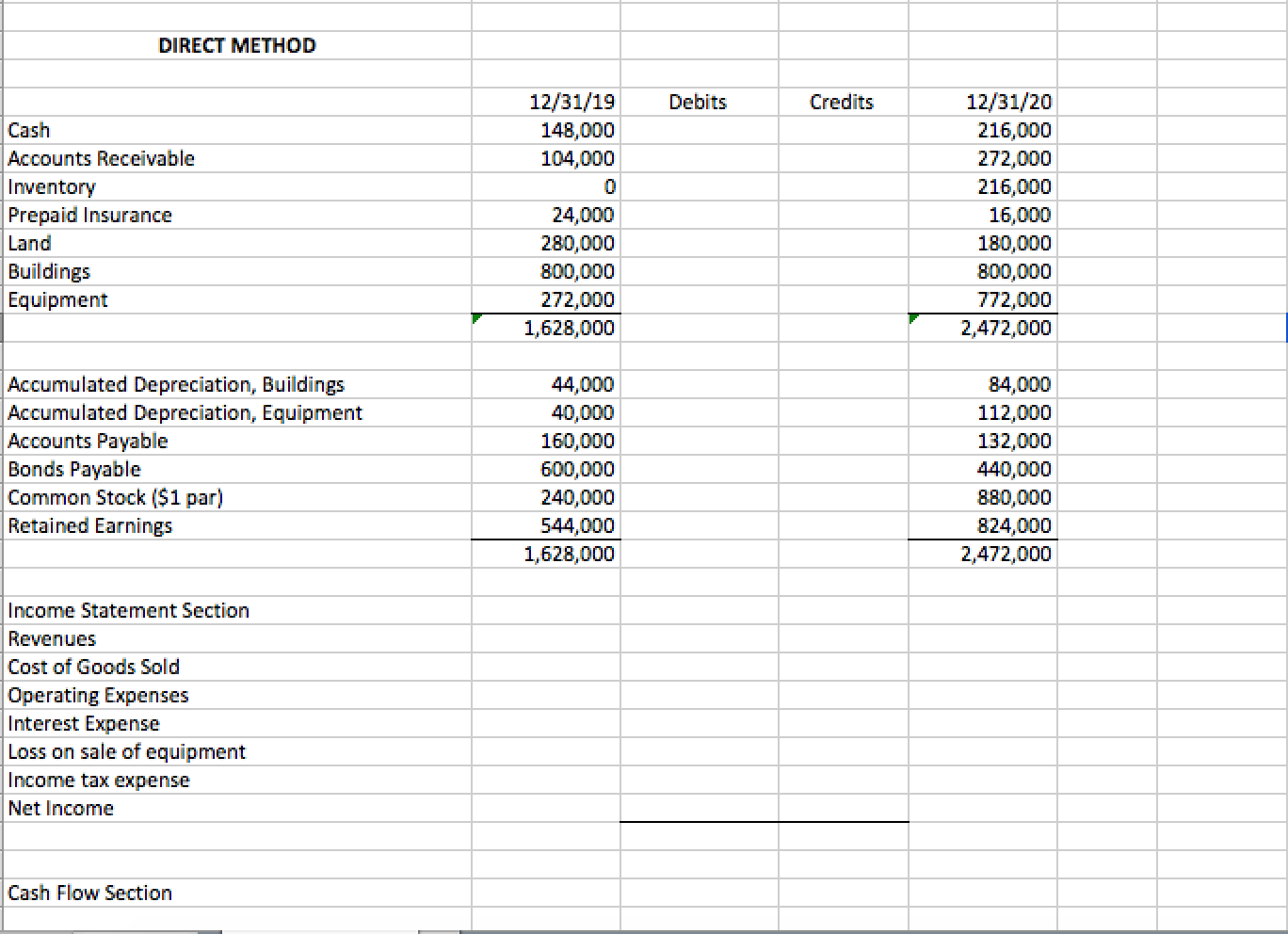

Prepare the Statement of Cash Flows for Rich Corp using the Direct method. Prepare the statement of Operating Activities section of the Statement of Cash Flows for RichCorp using the Indirect method. Rich Corp Income Statement FYE 12/31/20 3,560,000 Revenues Cost of Goods Sold Operating Expenses Interest Expense Loss on sale of equipment Income before income taxes Income tax expense Net Income (1,860,000) (884,000) (48,000) (8,000) (2,800,000) 760,000 (260,000) 500,000 Additional Information relating to 2020 activities: Cash dividends of $220,000 were declared and paid Equipment costing $164,000 and having a carrying value of $144,000, was sold for $136,000 cash Equipment with a cost of $664,000 was purchased for cash Operating expenses include depreciation expense of $132,000 and amortization of prepaid expenses of $8,000 Land was sold at its book value for cash Interest expense of $48,000 was paid in cash Common stock was issued for cash Inventory was purchased on credit Assume operating expenses are paid in cash INDIRECT METHOD 12/31/19 Debits Credits 12/31/20 Cash Accounts Receivable Inventory Prepaid Insurance Land Buildings Equipment 148,000 104,000 0 24,000 280,000 800,000 272,000 1,628,000 216,000 272,000 216,000 16,000 180,000 800,000 772,000 2,472,000 Accumulated Depreciation, Buildings Accumulated Depreciation, Equipment Accounts Payable Bonds Payable Common Stock ($1 par) Retained Earnings 44,000 40,000 160,000 600,000 240,000 544,000 1,628,000 84,000 112,000 132,000 440,000 880,000 824,000 2,472,000 Cash Flow Section DIRECT METHOD Debits Credits Cash Accounts Receivable Inventory Prepaid Insurance Land Buildings Equipment 12/31/19 148,000 104,000 0 24,000 280,000 800,000 272,000 1,628,000 12/31/20 216,000 272,000 216,000 16,000 180,000 800,000 772,000 2,472,000 Accumulated Depreciation, Buildings Accumulated Depreciation, Equipment Accounts Payable Bonds Payable Common Stock ($1 par) Retained Earnings 44,000 40,000 160,000 600,000 240,000 544,000 1,628,000 84,000 112,000 132,000 440,000 880,000 824,000 2,472,000 Income Statement Section Revenues Cost of Goods Sold Operating Expenses Interest Expense Loss on sale of equipment Income tax expense Net Income Cash Flow