Answered step by step

Verified Expert Solution

Question

1 Approved Answer

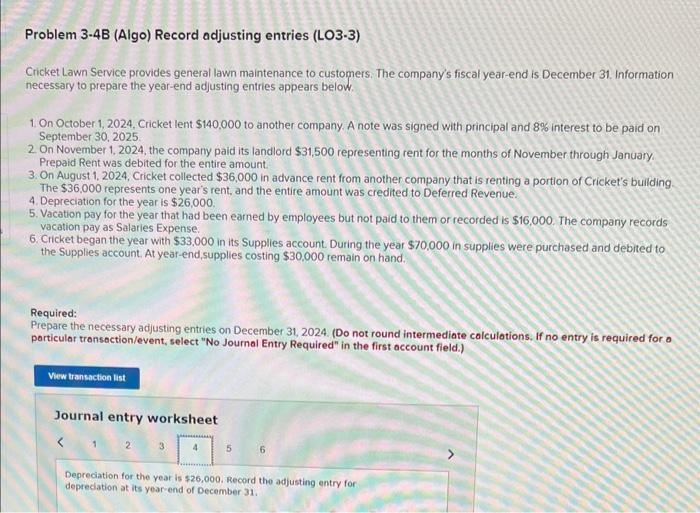

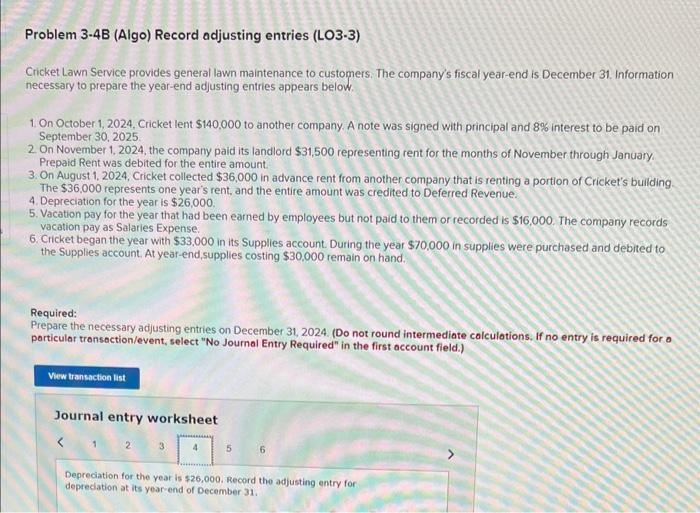

Problem 3-4B (Algo) Record adjusting entries (LO3-3) Problem 3-4B (Algo) Record adjusting entries (LO3-3) Cricket Lawn Service provides general lawn maintenance to customers. The company's

Problem 3-4B (Algo) Record adjusting entries (LO3-3)

Problem 3-4B (Algo) Record adjusting entries (LO3-3) Cricket Lawn Service provides general lawn maintenance to customers. The company's fiscal year-end is December 31 . Information necessary to prepare the year-end adjusting entries appears below. 1. On October 1, 2024, Cricket lent $140,000 to another company. A note was signed with principal and 8% interest to be paid on September 30,2025 2. On November 1, 2024, the company paid its landlord $31,500 representing rent for the months of November through January. Prepaid Rent was debited for the entire amount. 3. On August 1, 2024, Cricket collected $36,000 in advance rent from another company that is renting a portion of Cricket's building. The $36,000 represents one year's rent, and the entife amount was credited to Deferred Revenue. 4. Depreciation for the year is $26,000. 5. Vacation pay for the year that had been eamed by employees but not paid to them or recorded is $16,000. The company records vacation pay as Salaries Expense. 6. Cricket began the year with $33,000 in its Supplies account. During the year $70.000 in supplies were purchased and debited to the Supplies account. At year-end, supplies costing $30,000 remain on hand. Required: Prepare the necessary adjusting entries on December 31, 2024. (Do not round intermediate calculotions, If no entry is required for a porticular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Deprecation for the year is $26,000. Record the adjusting entry for depreciation at its year-end of December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started