Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the statement of financial position Harrigan, the only son of the Somers, inherited the famly's hardware business, Somer's Tools. He acquired enough business sense

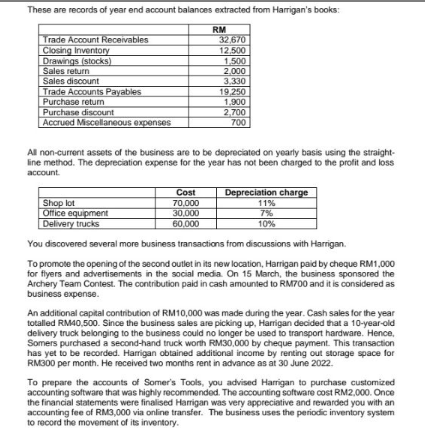

Prepare the statement of financial positionHarrigan, the only son of the Somers, inherited the famly's hardware business, Somer's Tools. He acquired enough business sense after helping his father run the hardware shop for the last 10 years. Harrigan managed the business well and it fourished. He strategized to expand the business and took the first step by planning to open another outlet in the neighbouring district. This effort required addnional funds which he did not yet have. Currently, the total business capital is RM200,000 which is made up of RM30,000 cash in bank, RM10,000 cash in hand, two delivery trucks valued at RM60.000, RM30,000 worth of office equipment and a RM70,000 shop lot. Harrigan plans to apply for a bank loan. To do so, he needs to provide the bank with the financial statements of his business. Harrigan approached you, his accountant friend, for assistance. The financial statements of Somer's Tools have never been prepared. As far as Harrigan can remember, his late tather maintained simple cash basis recoeds of the business. Harrigan provided you information of payment to accounts payable amounting to RM26,500 while collection from accounts recelvable totalled RM37,000. The following are relevant information for the year ended 30 June 2022 to assist you in preparing the financial statements of the business: Cash payments were made for the following items: Information for receipts and payments via the business bank accounts that Harrigan had updated so far are as stated: Note: All trade accounts receivable and trade accounts payable amounts relate to the current year's transactions. These are records of year end account balances extracted from Harrigan's books: Al non-current assets of the business are to be depreciated on yearly basis using the straightline method. The depreciation expense for the year has not been charged to the profit and loss account. You discovered several more business transactions from discussions with Harrigan. To promote the opening of the second outlet in its new location, Harrigan paid by cheque RM1,000 for flyers and advertisements in the social media. On 15 March, the business sponsored the Archery Team Contest. The contribution paid in cash amounted to RM700 and it is considered as business expense. An additional capilal contribution of RM10,000 was made during the year. Cash sales for the year totalled RM40,500. Since the business sales are picking up, Harrigan decided that a 10 -year-old delivery truck belonging to the business could no longer be used to transport hardware. Hence, Somers purchased a second-hand truck worth RM30,000 by cheque payment. This transaction has yet to be recorded. Harrigan obtained additional income by renting out storage space for RM300 per month. He received two months rent in advance as at 30 June 2022. To prepare the accounts of Somer's Tools, you advised Harrigan to purchase customized accounting software that was highly recommended. The accounting software cost RM2,000. Once the financial statements were finalised Harrigan was very appreciative and rewarded you with an accounting fee of RM3,000 via online transfer. The business uses the periodic inventory system to record the movement of its inventory. Harrigan, the only son of the Somers, inherited the famly's hardware business, Somer's Tools. He acquired enough business sense after helping his father run the hardware shop for the last 10 years. Harrigan managed the business well and it fourished. He strategized to expand the business and took the first step by planning to open another outlet in the neighbouring district. This effort required addnional funds which he did not yet have. Currently, the total business capital is RM200,000 which is made up of RM30,000 cash in bank, RM10,000 cash in hand, two delivery trucks valued at RM60.000, RM30,000 worth of office equipment and a RM70,000 shop lot. Harrigan plans to apply for a bank loan. To do so, he needs to provide the bank with the financial statements of his business. Harrigan approached you, his accountant friend, for assistance. The financial statements of Somer's Tools have never been prepared. As far as Harrigan can remember, his late tather maintained simple cash basis recoeds of the business. Harrigan provided you information of payment to accounts payable amounting to RM26,500 while collection from accounts recelvable totalled RM37,000. The following are relevant information for the year ended 30 June 2022 to assist you in preparing the financial statements of the business: Cash payments were made for the following items: Information for receipts and payments via the business bank accounts that Harrigan had updated so far are as stated: Note: All trade accounts receivable and trade accounts payable amounts relate to the current year's transactions. These are records of year end account balances extracted from Harrigan's books: Al non-current assets of the business are to be depreciated on yearly basis using the straightline method. The depreciation expense for the year has not been charged to the profit and loss account. You discovered several more business transactions from discussions with Harrigan. To promote the opening of the second outlet in its new location, Harrigan paid by cheque RM1,000 for flyers and advertisements in the social media. On 15 March, the business sponsored the Archery Team Contest. The contribution paid in cash amounted to RM700 and it is considered as business expense. An additional capilal contribution of RM10,000 was made during the year. Cash sales for the year totalled RM40,500. Since the business sales are picking up, Harrigan decided that a 10 -year-old delivery truck belonging to the business could no longer be used to transport hardware. Hence, Somers purchased a second-hand truck worth RM30,000 by cheque payment. This transaction has yet to be recorded. Harrigan obtained additional income by renting out storage space for RM300 per month. He received two months rent in advance as at 30 June 2022. To prepare the accounts of Somer's Tools, you advised Harrigan to purchase customized accounting software that was highly recommended. The accounting software cost RM2,000. Once the financial statements were finalised Harrigan was very appreciative and rewarded you with an accounting fee of RM3,000 via online transfer. The business uses the periodic inventory system to record the movement of its inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started