Question

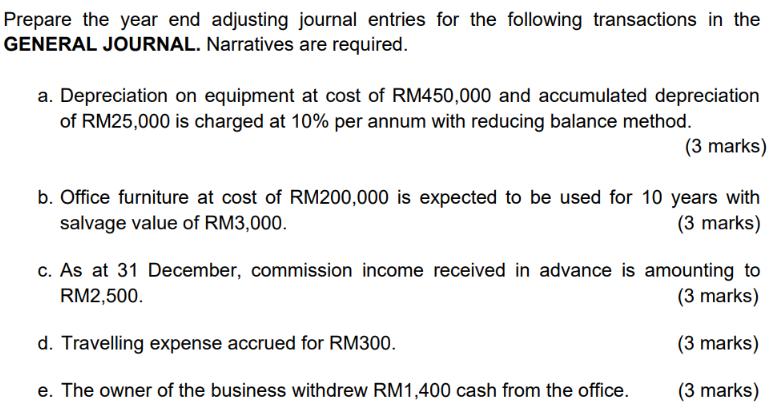

Prepare the year end adjusting journal entries for the following transactions in the GENERAL JOURNAL. Narratives are required. a. Depreciation on equipment at cost

Prepare the year end adjusting journal entries for the following transactions in the GENERAL JOURNAL. Narratives are required. a. Depreciation on equipment at cost of RM450,000 and accumulated depreciation of RM25,000 is charged at 10% per annum with reducing balance method. (3 marks) b. Office furniture at cost of RM200,000 is expected to be used for 10 years with salvage value of RM3,000. (3 marks) c. As at 31 December, commission income received in advance is amounting to (3 marks) RM2,500. d. Travelling expense accrued for RM300. (3 marks) e. The owner of the business withdrew RM1,400 cash from the office. (3 marks)

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Date General Journal Debit Credit a Deprecaitio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

20th Edition

1259157148, 78110874, 9780077616212, 978-1259157141, 77616219, 978-0078110870

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App