Question

Present and discuss the profile of the firm (including Main Shareholders, Market Capitalization, Stock Price, Stockholders Equity (Common Stock and Preferred Stock), Retained Earnings, Total

Present and discuss the profile of the firm (including Main Shareholders, Market Capitalization, Stock Price, Stockholders Equity (Common Stock and Preferred Stock), Retained Earnings, Total Debt, Gearing Ratio, Credit Risk, Dividends, Payout Ratio, social and environmental metrics. Discuss also some recent financial and sustainability news related to the firm that could be interesting to the shareholders) and its evolution in the last five years. You may find information about the profile of the firm, its capital structure and main competitors from Yahoo! Finance within the Key Statistics (also view Financials Balance Sheet - Annual Data) and Competitors sections. You may find information about the profile of the firm, its capital structure and main competitors from the FAME database.

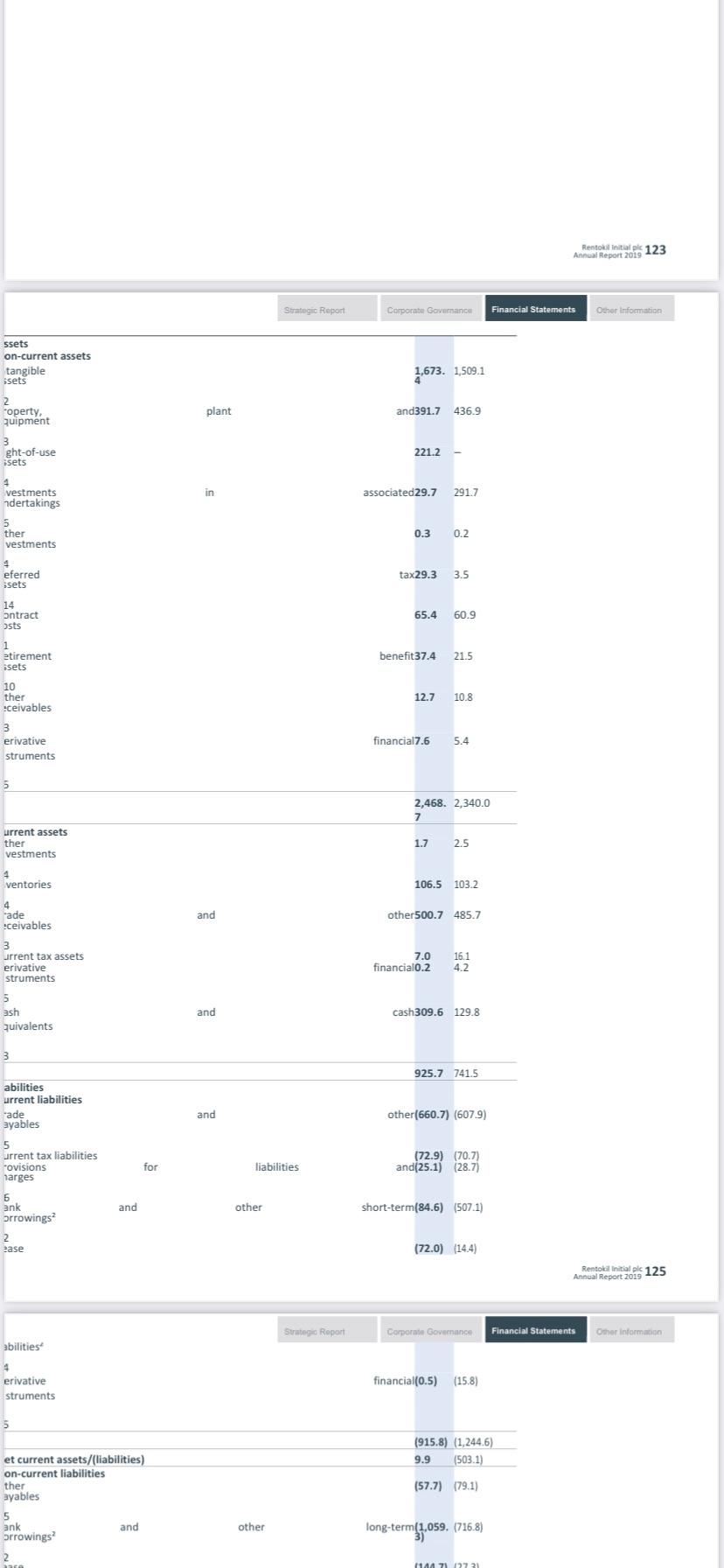

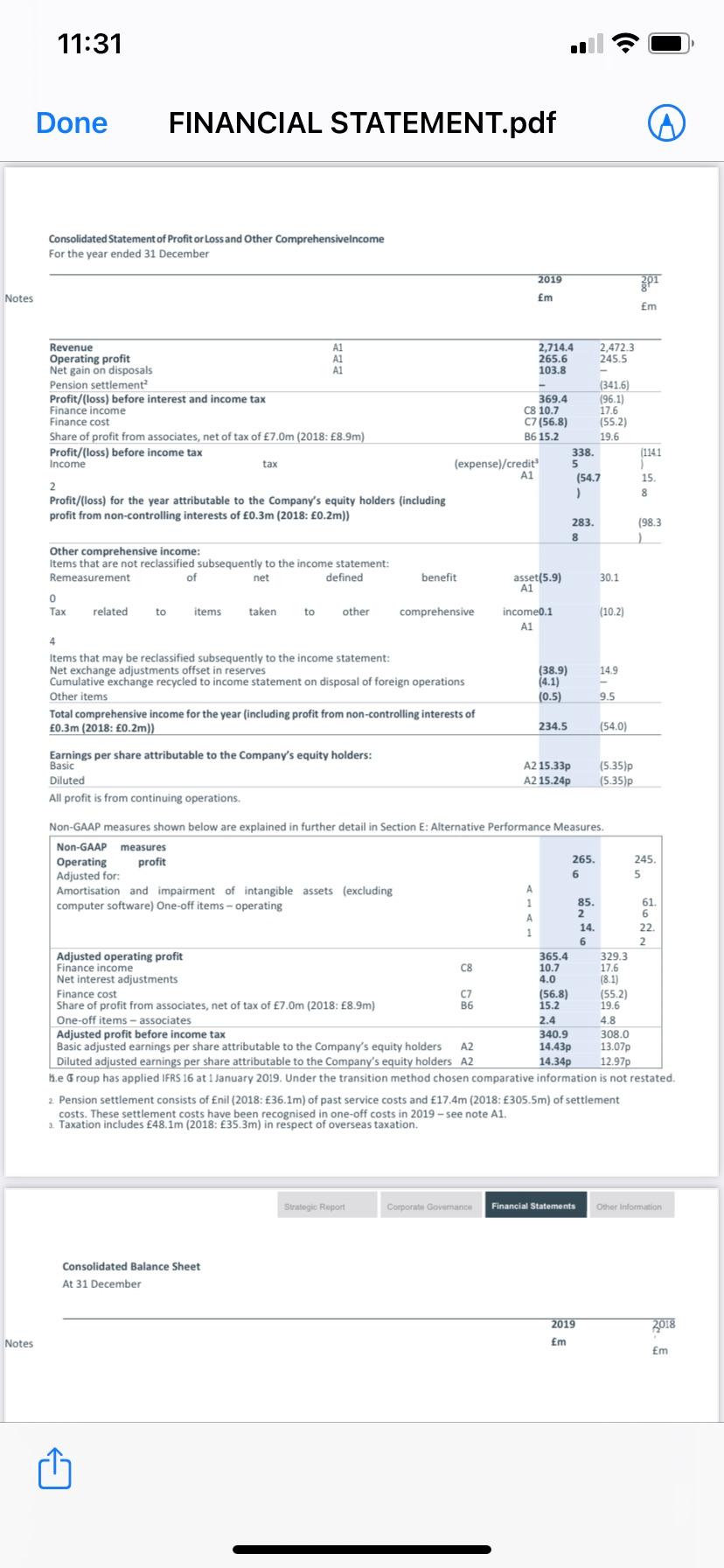

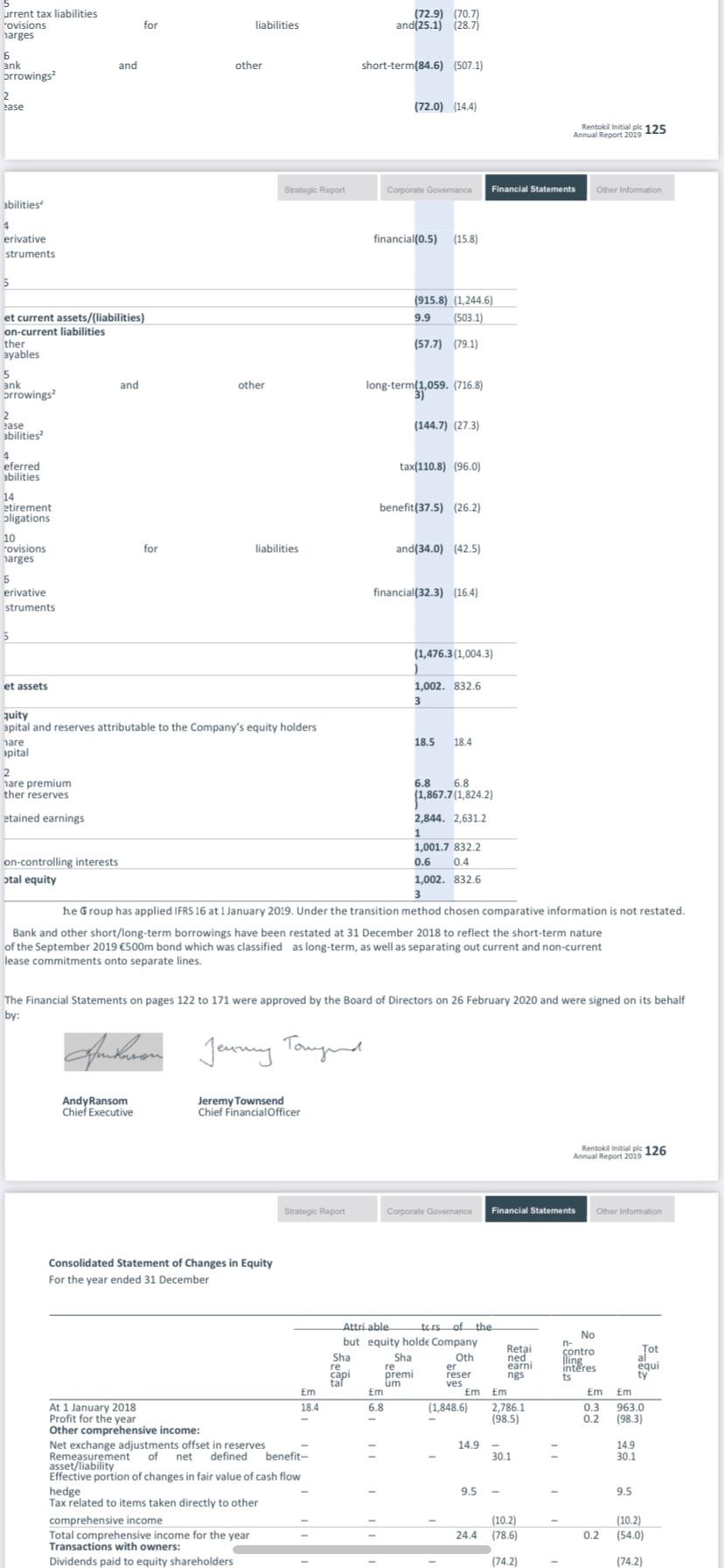

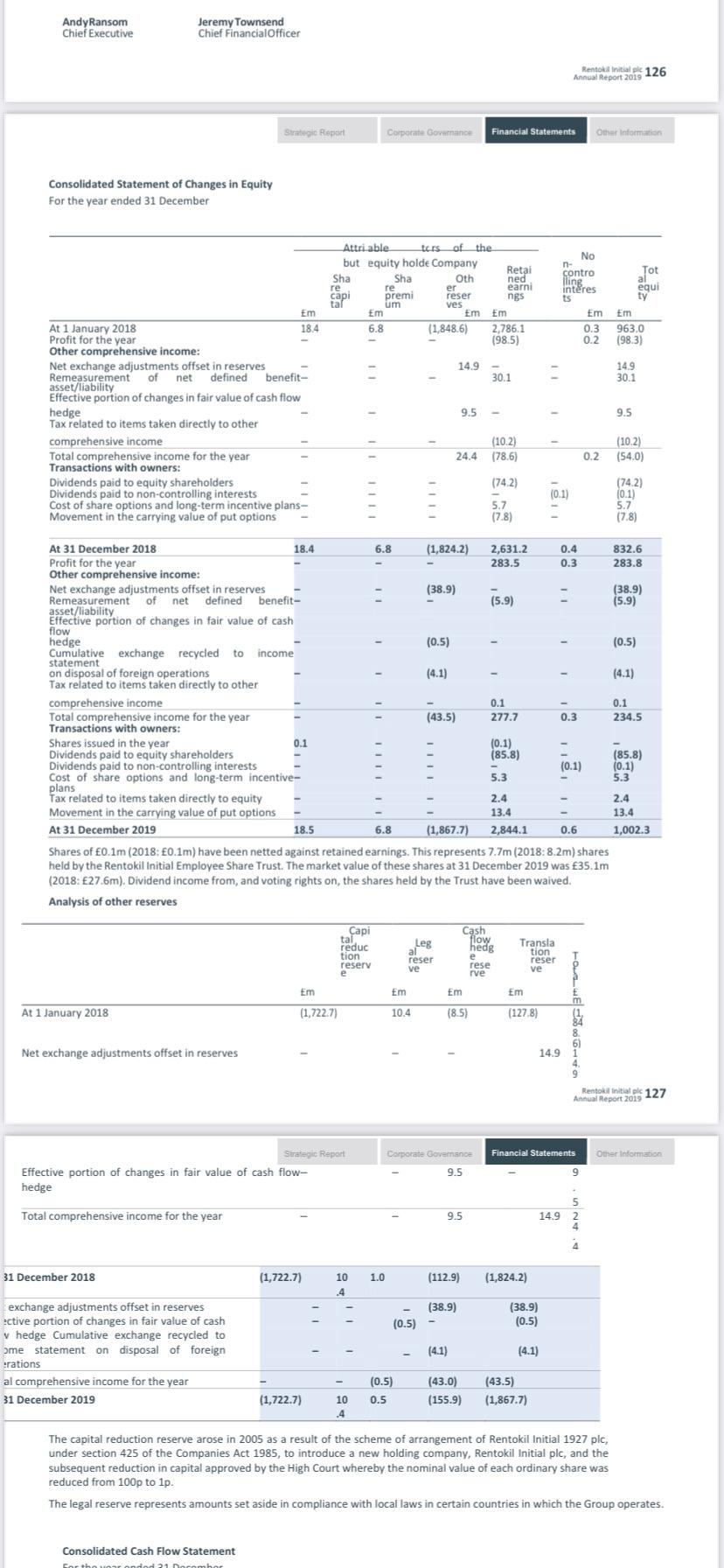

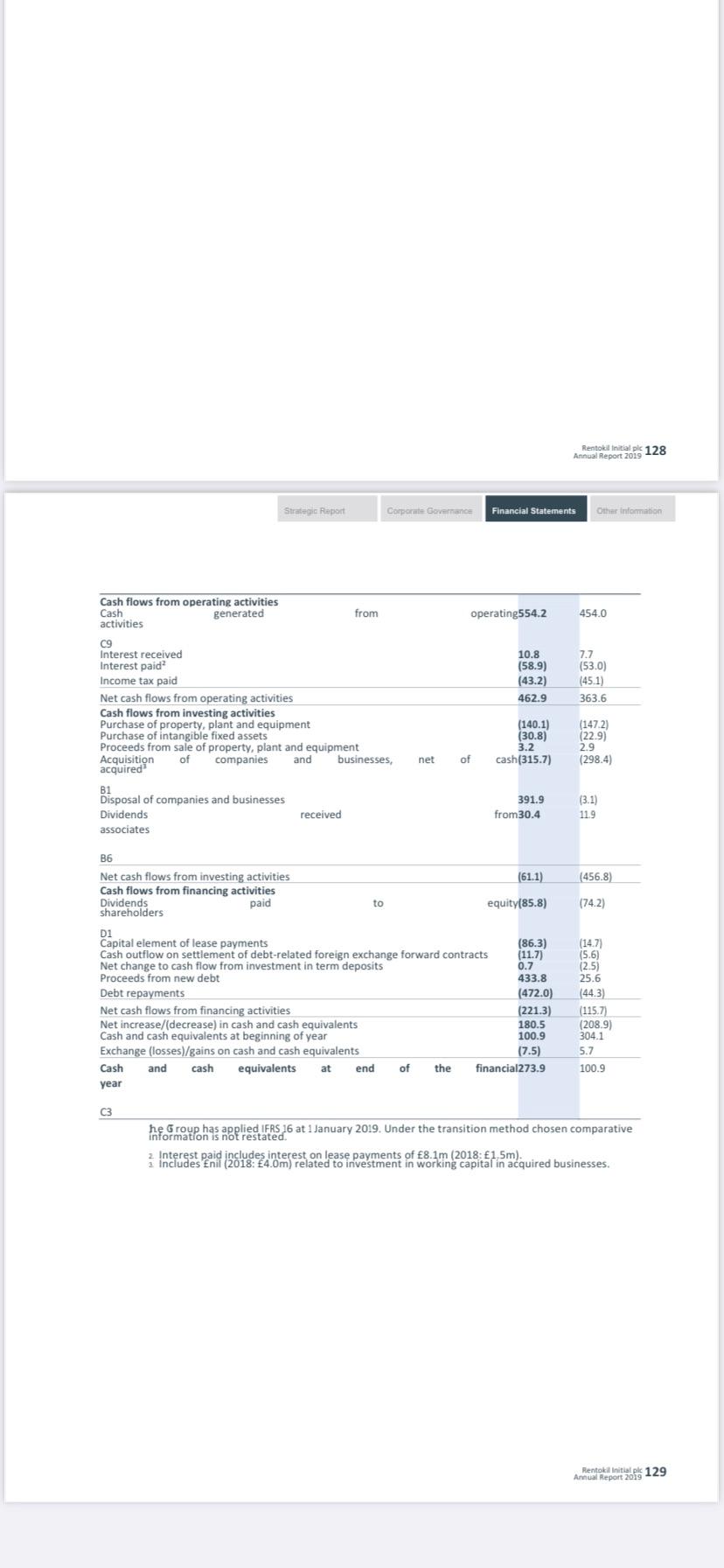

Rentonital pis 123 Annual Report 2019 Strategic Report Corporate Govenance Financial Statements Other Information 1.673. 1,509.1 ssets on-current assets tangible ssets 2 operty, quipment 3 ght-of-use ssets plant and391.7 436.9 221.2 in associated 29.7 291.7 4 vestments ndertakings 5 ther vestments 4 eferred ssets 0.3 0.2 tax29.3 3.5 14 ontract osts 65.4 60.9 1 etirement sets benefit37.4 21.5 12.7 10.8 10 ther ceivables 3 erivative struments financial7.6 5.4 5 2,468. 2,340.0 7 urrent assets ther vestments 1.7 2.5 ventories 106.5 103.2 and other500.7 485.7 4 ade ceivables 3 urrent tax assets erivative struments 7.0 financialo.2 161 4.2 5 ash quivalents and cash309.6 129.8 3 925.7 741.5 and other(660.7) (607.9) abilities urrent liabilities ade ayables 5 urrent tax liabilities "ovisions harges 6 ank brrowings? 2 ease for liabilities (72.9) (70.7) and(25.1) (28.7) and other short-term (84.6) (507.1) (72.0) (14.4) Rentokil nitial ple 125 Annual Report 2019 Strategic Report Corporate Governance Financial Statements Other information abilities financial(0.5) (15.8) erivative struments 5 (915.8) (1,244.6) 9.9 (503.1) (57.7) 179.1) et current assets/(liabilities) on-current liabilities ther ayables 5 ank and prrowings? other long-term 4,059. (716,8) 11:31 Done FINANCIAL STATEMENT.pdf Consolidated Statement of Profit or Loss and Other ComprehensiveIncome For the year ended 31 December 2019 PT Notes Em Em Revenue Al Operating profit Al Net gain on disposals A1 Pension settlement Profit/(loss) before interest and income tax Finance income Finance cost Share of profit from associates, net of tax of 7.0m (2018: 8.9m) Profit/(loss) before income tax Income 2 Profit/(loss) for the year attributable to the Company's equity holders (including profit from non-controlling interests of 0.3m (2018: 0.2m)) 2,714.4 2,472.3 265.6 245.5 103.8 (341.6) 369.4 196.1) C8 10.7 17.6 C7(56.8) (55.2) B6 15.2 19.6 338. (expense)/credit 5 A1 (54.7 ) tax 15 8 283. 8 1983 ) Other comprehensive income: items that are not reclassified subsequently to the income statement: Remeasurement of net defined 0 Tax related to items taken to other benefit asset(5.9) A1 30.1 comprehensive (10.2) income0.1 A1 14.9 4 Items that may be reclassified subsequently to the income statement: Net exchange adjustments offset in reserves Cumulative exchange recycled to income statement on disposal of foreign operations Other items Total comprehensive income for the year (including profit from non-controlling interests of 0.3m (2018: 0.2m)) (38.9) (4.1) (0.5) 9.5 234.5 (54.0) Earnings per share attributable to the Company's equity holders: Basic Diluted All profit is from continuing operations, A2 15.33p A2 15.24p (5.35)p (5.35) Non-GAAP measures shown below are explained in further detail in Section E: Alternative Performance Measures. Non-GAAP measures Operating profit 265. 245. Adjusted for: 6 5 Amortisation and impairment of intangible assets (excluding A computer software) One-off items-operating 1 85. 61. 2 6 1 14. 22 6 2 Adjusted operating profit 365.4 329.3 Finance income C8 10.7 17.6 Net interest adjustments 4.0 (8.1) Finance cost C7 (56.8) (55.2) Share of profit from associates, net of tax of 7.0m (2018: 8.9m) B6 15.2 19.6 One-off items - associates 2.4 4.8 Adjusted profit before income tax 340.9 308.0 Basic adjusted earnings per share attributable to the Company's equity holders A2 14.43p 13.07p Diluted adjusted earnings per share attributable to the Company's equity holders A2 14.34p 12.97p Be Group has applied IFRS 16 at 1 January 2019. Under the transition method chosen comparative information is not restated. 2. Pension settlement consists of Enil (2018: 36.1m) of past service costs and 17.4m (2018: 305.5m) of settlement costs. These settlement costs have been recognised in one-off costs in 2019 - see note A1. 2 Taxation includes 48.1m (2018: 35.3m) espect of overseas taxation. Strategic Report Corporate Governo Financial Statements Other Information Consolidated Balance Sheet At 31 December 2019 Em 2018 Notes Em for liabilities (72.9) 70.7) and(25.1) (28.7) urrent tax liabilities "ovisions harges 6 ank brrowings? and other short-term (84.6) (507.1) 2 ease (72.0) (14.4) Rento initial ple 125 Annual Report 2019 Strategic Report Corporate Governance Financial Statements Other Information abilities 1 erivative struments financial(0.5) (15.8) 5 (915.8) (1,244.6) 9.9 (503.1) (57.7) 79.1) et current assets/(liabilities) on-current liabilities ther ayables 5 ank and orrowings 2 tase abilities other long-term(1.059. (716.8) (144.7) (27.3) tax(110.8) (96.0) benefit(37.5) (26.2) 4 eferred abilities 14 etirement bligations 10 ovisions harges 5 erivative struments for liabilities and(34.0) (42.5) financial(32.3) (16.4) 5 (1,476.3(1,004.3) et assets 1,002. 832.6 3 18.5 18.4 quity apital and reserves attributable to the Company's equity holders hare apital 2 are premium ther reserves 6.8 6.8 (1,867.7(1,824.2) stained earnings 2,844. 2,6312 1 1,001.7 832.2 0.6 0.4 1,002.832.6 on-controlling interests otal equity he Group has applied IFRS 16 at 1 January 2019. Under the transition method chosen comparative information is not restated. Bank and other short/long-term borrowings have been restated at 31 December 2018 to reflect the short-term nature of the September 2019 500m bond which was classified as long-term, as well as separating out current and non-current lease commitments onto separate lines. The Financial Statements on pages 122 to 171 were approved by the Board of Directors on 26 February 2020 and were signed on its behalf by: Anheron Jenny Tougend Andy Ransom Chief Executive Jeremy Townsend Chief FinancialOfficer Rento initial ple 126 Annual Report 2019 Strategic Raport Corporate Governance Financial Statements Other Information Consolidated Statement of Changes in Equity For the year ended 31 December Retai Attri able ters of the but equity holde Company Sha Sha Oth ned re re er earni capi premi reser ngs tal um ves Em Em Em 6.8 (1,848.6) 2,786.1 (98.5) No n- contro interes ts Em 0.3 0.2 Tot equi ty Em 963.0 (98.3) 149 30.1 14.9 30.1 Em At 1 January 2018 184 Profit for the year Other comprehensive income: Net exchange adjustments offset in reserves Remeasurement of net defined benefit- asset/liability Effective portion of changes in fair value of cash flow hedge Tax related to items taken directly to other comprehensive income Total comprehensive income for the year Transactions with owners: Dividends paid to equity shareholders 9.5 9.5 (10.2) (78.6) (10.2) (54.0) 24.4 0.2 (742) (742) Andy Ransom Chief Executive Jeremy Townsend Chief FinancialOfficer Rentokiniai 126 Annual Report 2019 Strategic Report Corporate Governance Financial Statements Other Information Consolidated Statement of Changes in Equity For the year ended 31 December Attri able of the but equity holde Company Retai Sha Sha Oth ned re re earni capi ngs tal um ves Em Em Em 6.8 (1,848.6) 2,786.1 (98.5) eleser Tot al equi ty No n- contro lling interes ts Em 0.3 0.2 premi Em 963.0 (98.3) 14.9 30.1 30.1 14.9 30.1 Em At 1 January 2018 184 Profit for the year Other comprehensive income: Net exchange adjustments offset in reserves Remeasurement of net defined benefit- asset/liability Effective portion of changes in fair value of cash flow hedge Tax related to items taken directly to other comprehensive income Total comprehensive income for the year Transactions with owners: Dividends paid to equity shareholders Dividends paid to non-controlling interests Cost of share options and long-term incentive plans- Movement in the carrying value of put options 9.5 9.5 (10.2) (78.6) - (10.2) (54.0) 24.4 0.2 (742) (0.1) 5.2 (7.8) (74.2) 10.1) 5.7 (7.8) At 31 December 2018 18.4 6.8 (1,824.2) 2,631.2 0.4 832.6 Profit for the year 283.5 0.3 283.8 Other comprehensive income: Net exchange adjustments offset in reserves (38.9) (38.9) Remeasurement of net defined benefit- (5.9) (5.9) asset/liability Effective portion of changes in fair value of cash flow hedge (0.5) (0.5) Cumulative exchange recycled to income statement on disposal of foreign operations (4.1) (4.1) Tax related to items taken directly to other comprehensive income 0.1 0.1 Total comprehensive income for the year (43.5) 277.7 0.3 234.5 Transactions with owners: Shares issued in the year 0.1 (0.1) Dividends paid to equity shareholders (85.8) (85.8) Dividends paid to non-controlling interests (0.1) (0.1) Cost of share options and long-term incentive- 5.3 5.3 plans Tax related to items taken directly to equity 2.4 2.4 Movement in the carrying value of put options 13.4 13.4 At 31 December 2019 18.5 6.8 (1,867.7) 2,844.1 0.6 1,002.3 Shares of 0.1m (2018: 0.1m) have been netted against retained earnings. This represents 7.7m (2018:8.2m) shares held by the Rentokil Initial Employee Share Trust. The market value of these shares at 31 December 2019 was 35.1m (2018: 27.6m). Dividend income from, and voting rights on the shares held by the Trust have been waived. Analysis of other reserves Leg reser Cash flow hedg e rese rve Transla tion reser ve ve Em Em Em OE- At 1 January 2018 (1,722.7) 10.4 (8.5) (1278) (1 8 6) Net exchange adjustments offset in reserves - - 14.9 9 Rentokil initialle 127 Annual Report 2019 Corporate Governance Financial Statements Other information Strategic Report Effective portion of changes in fair value of cash flow- hedge 9.5 Total comprehensive income for the year 9.5 14.9 4 31 December 2018 (1,722.7) 1.0 10 .4 (112.9) (1,824.2) (38.9) (38.9) (0.5) (0.5) exchange adjustments offset in reserves active portion of changes in fair value of cash V hedge Cumulative exchange recycled to ome statement on disposal of foreign rations al comprehensive income for the year 31 December 2019 (4.1) (4.1) (0.5) 0.5 (43.0) (155.9) (43.5) (1,867.7) (1,722.7) 10 .4 The capital reduction reserve arose in 2005 as a result of the scheme of arrangement of Rentokil Initial 1927 plc, under section 425 of the Companies Act 1985, to introduce a new holding company, Rentokil Initial plc, and the subsequent reduction in capital approved by the High Court whereby the nominal value of each ordinary share was reduced from 100p to 1p. The legal reserve represents amounts set aside in compliance with local laws in certain countries in which the Group operates. Consolidated Cash Flow Statement Rentokil initial pl 128 Annual Report 2019 Strategic Report Corporate Governance Financial Statements Other information operating554.2 454.0 Cash flows from operating activities Cash generated from activities 09 Interest received Interest paid Income tax paid Net cash flows from operating activities Cash flows from investing activities Purchase of property, plant and equipment Purchase of intangible fixed assets Proceeds from sale of property, plant and equipment Acquisition of companies and businesses, acquired 10.8 (58.9) (43.2) 462.9 7.7 (53.0) (45.1) 363.6 (140.1) (30.8) 3.2 cash(315.7) (1472) (229) 2.9 (298.4) net of Disposal of companies and businesses Dividends associates 391.9 from 30.4 (3.1) 119 received (456.8) (74.2) B6 Net cash flows from investing activities (61.1) Cash flows from financing activities Dividends paid to shareholders equity(85.8) D1 Capital element of lease payments (86.3) Cash outflow on settlement of debt-related foreign exchange forward contracts (11.7) Net change to cash flow from investment in term deposits 0.7 Proceeds from new debt 433.8 Debt repayments (472.0) Net cash flows from financing activities (221.3) Net increase/(decrease) in cash and cash equivalents 180.5 Cash and cash equivalents at beginning of year 100.9 Exchange (losses)/gains on cash and cash equivalents (7.5) Cash and cash equivalents at end of the financial273.9 year (14.7) (5.6) 12.5 25.6 (443) (115.7) (208.9) 304.1 5.7 100.9 C3 he Group has applied IFRS 16 at 1 January 2019. Under the transition method chosen comparative information is not restated. 2. Interest paid includes interest on lease payments of 8.1m (2018: 1.5m). Includes Enil (2018: 4.0m) related to investment in working capital in acquired businesses. Rentokil Initial ple 129 Annual Report 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started