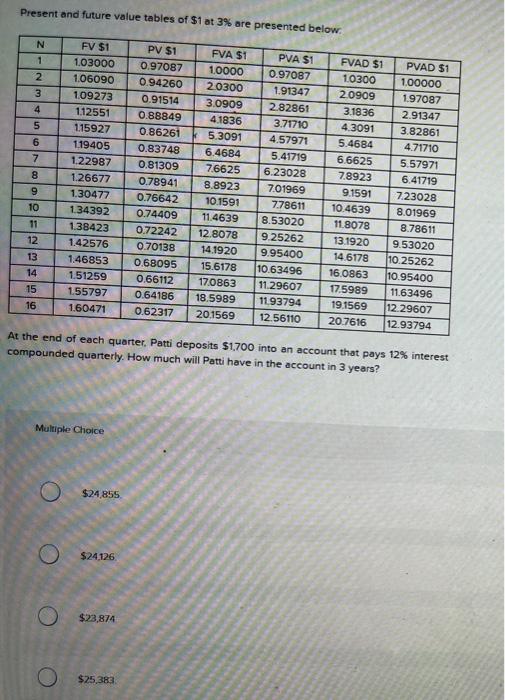

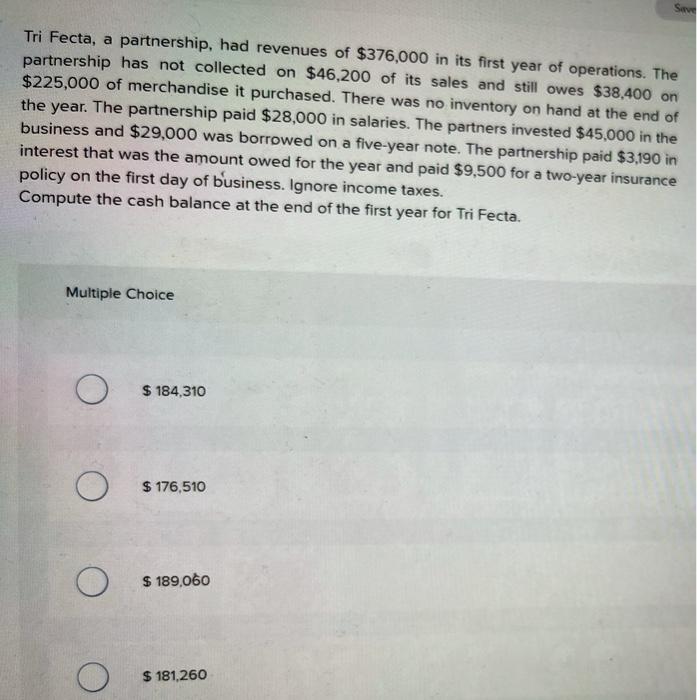

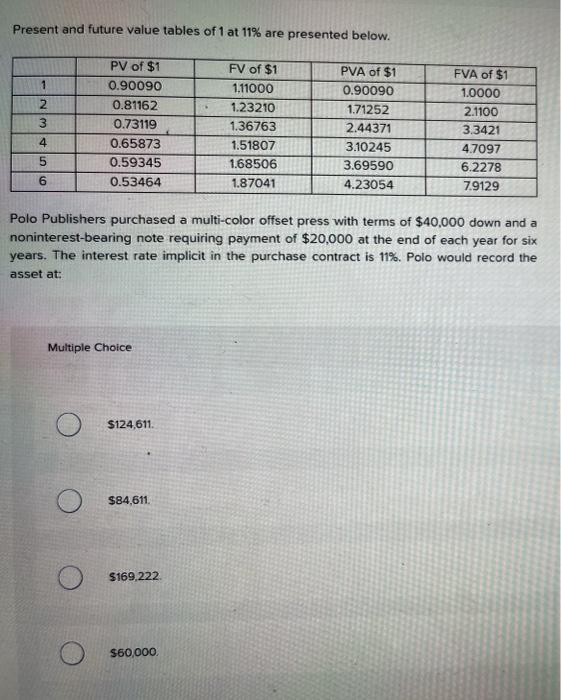

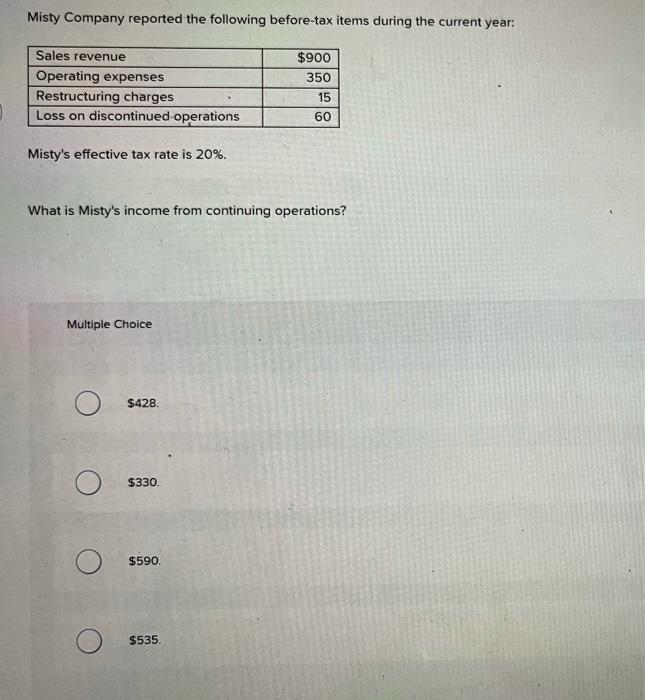

Present and future value tables of $1 at 3% are presented below. N FV $1 1 1.03000 FVA $1 1.0000 PVA $1 0.97087 PVAD $1 2 1.06090 FVAD $1 10300 20909 20300 1.00000 3 1.91347 PV $1 0.97087 0.94260 0.91514 0.88849 0.86261 0.83748 109273 1.12551 1.97087 4 2.82861 3.1836 3.0909 4.1836 5.3091 5 1.15927 3.71710 4.3091 2.91347 3.82861 6 1.19405 4.57971 6.4684 4.71710 7 1.22987 0.81309 5.4684 6.6625 7.8923 5.41719 6.23028 5.57971 7.6625 8 1.26677 0.78941 6.41719 8.8923 9 7.01969 1.30477 9.1591 0.76642 10.1591 10 7.78611 7.23028 8.01969 134392 10.4639 0.74409 11.4639 8.53020 11 1.38423 11.8078 0.72242 8.78611 GWE 0 12 9.25262 1.42576 12.8078 14.1920 13.1920 0.70138 13 14 6178 1.46853 1.51259 0.68095 15.6178 14 9.95400 10.63496 11.29607 0.66112 9.53020 10.25262 10.95400 11.63496 12 29607 15 1.55797 0.64186 17.0863 18.5989 16.0863 17.5989 19.1569 20.7616 1193794 16 1.60471 0.62317 20.1569 12.56110 12.93794 At the end of each quarter, Patti deposits $1,700 into an account that pays 12% interest compounded quarterly. How much will Patti have in the account in 3 years? Multiple Choice $24855 O $24.126 $23,874 O $25,383 Tri Fecta, a partnership, had revenues of $376,000 in its first year of operations. The partnership has not collected on $46,200 of its sales and still owes $38,400 on $225,000 of merchandise it purchased. There was no inventory on hand at the end of the year. The partnership paid $28,000 in salaries. The partners invested $45,000 in the business and $29,000 was borrowed on a five-year note. The partnership paid $3,190 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. Ignore income taxes. Compute the cash balance at the end of the first year for Tri Fecta. Multiple Choice O $ 184,310 $ 176,510 O $ 189,060 $ 181,260 Present and future value tables of 1 at 11% are presented below. PV of $1 FV of $1 PVA of $1 FVA of $1 1 0.90090 1.11000 0.90090 1.0000 2 0.81162 1.23210 1.71252 2.1100 3 0.73119 1.36763 2.44371 3.3421 4 0.65873 1.51807 3.10245 4.7097 5 0.59345 1.68506 3.69590 6.2278 6 0.53464 1.87041 4.23054 7.9129 Polo Publishers purchased a multi-color offset press with terms of $40,000 down and a noninterest-bearing note requiring payment of $20,000 at the end of each year for six years. The interest rate implicit in the purchase contract is 11%. Polo would record the asset at: Multiple Choice $124,611 $84,611 $169,222 $60,000 Misty Company reported the following before-tax items during the current year: Sales revenue $900 350 Operating expenses Restructuring charges Loss on discontinued operations 15 60 Misty's effective tax rate is 20%. What is Misty's income from continuing operations? Multiple Choice $428 O $330. O $590. $535