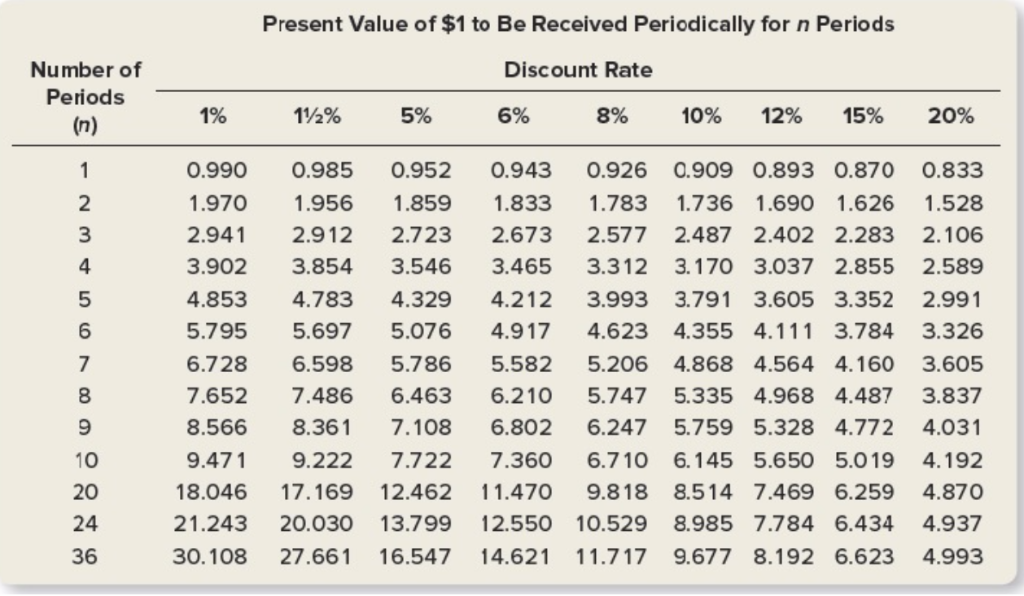

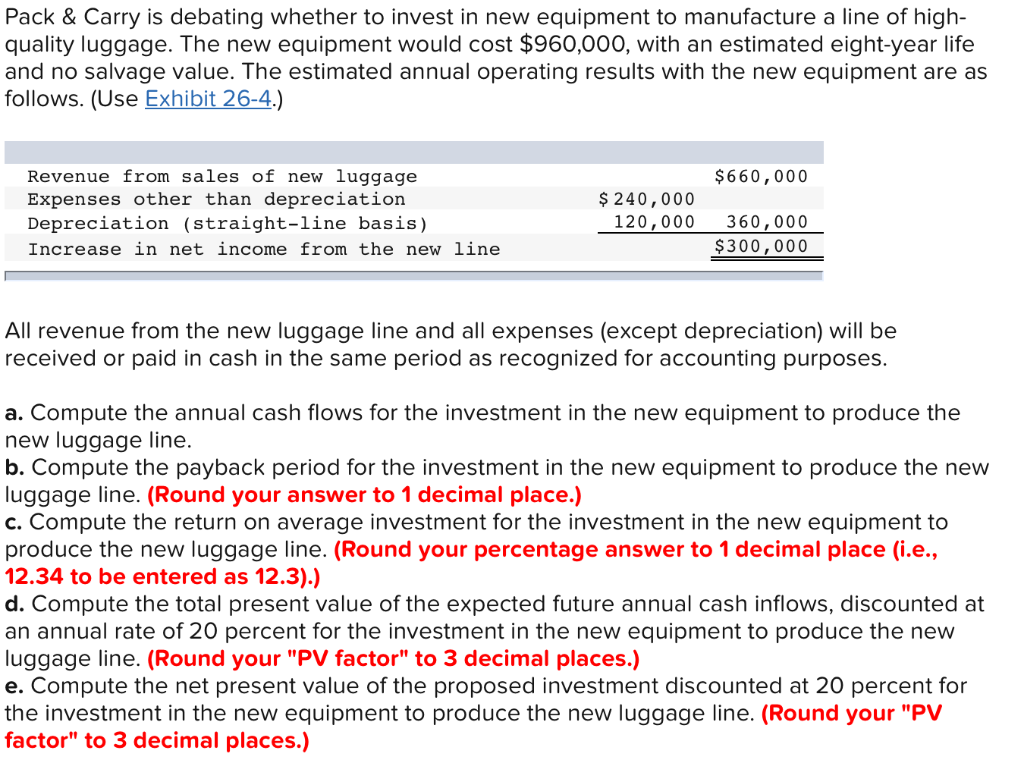

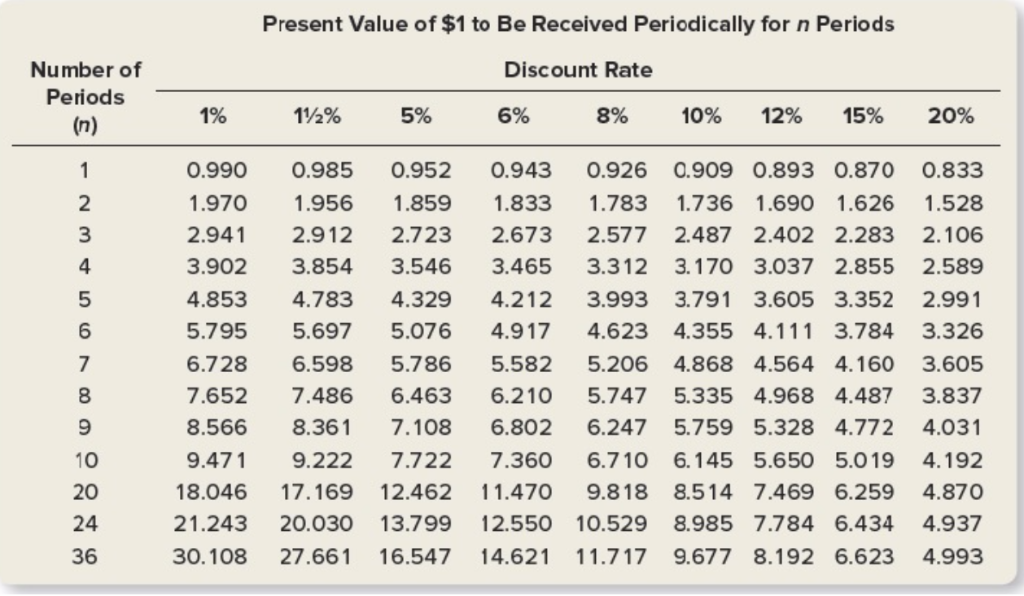

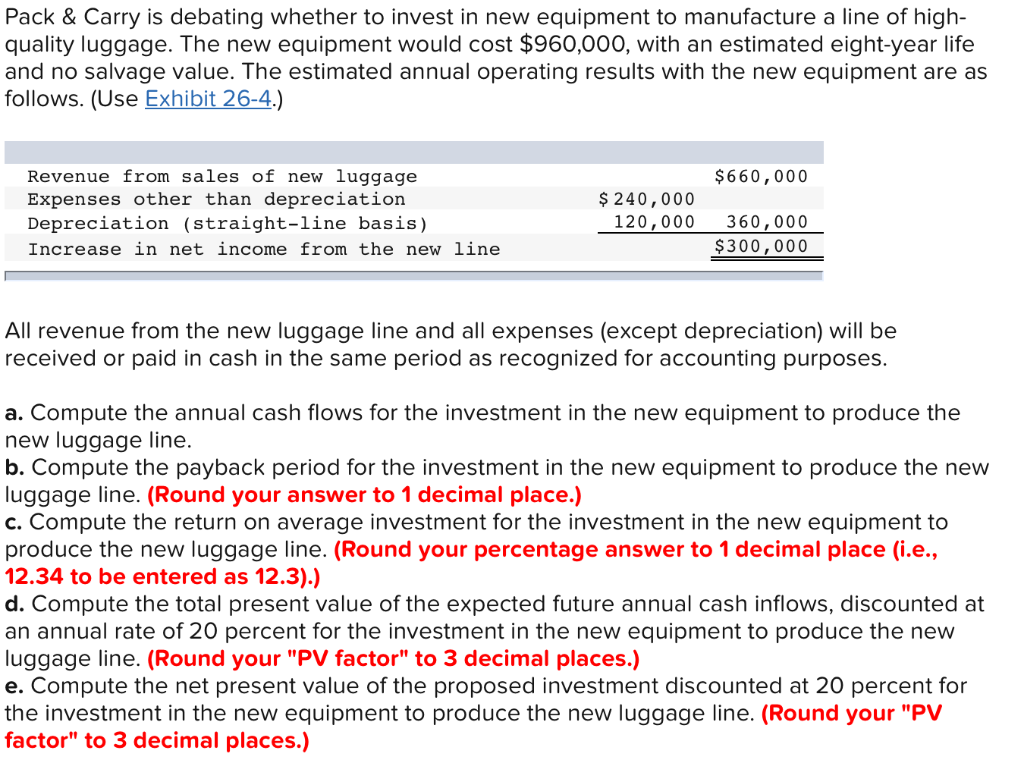

Present Value of $1 to Be Received Periodically for n Periods Discount Rate Number of Periods 1% 5% 6% 8% 10% 12% 15% 20% 0.990 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 .970 1.956 1.859 1.833 1.783 1.736 1.690 1.626 1.528 2.941 2.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 3.902 3.854 3.546 3.465 3.312 3.170 3.037 2.855 2.589 4.853 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 5.795 5.697 5.076 4.9174.623 4.355 4.111 3.784 3.326 6.728 6.598 5.786 5.582 5.206 4.868 4.564 4.160 3.605 7.652 7.486 6.463 6.210 5.747 5.335 4.968 4.487 3.837 8.566 8.361 7.108 6.802 6.247 5.759 5.328 4.772 4.031 9.471 9.222 7.722 7.360 6.7 10 6.145 5.650 5.019 4.192 18.046 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.870 21.243 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 30.108 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993 5 6 10 20 24 36 Pack & Carry is debating whether to invest in new equipment to manufacture a line of high- quality luggage. The new equipment would cost $960,000, with an estimated eight-year life and no salvage value. The estimated annual operating results with the new equipment are as follows. (Use Exhibit 26-4.) Revenue from sales of new luggage Expenses other than depreciation Depreciation (straight-line basis) Increase in net income from the new line $660,000 $240,000 120,000 360,000 $300,000 All revenue from the new luggage line and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes a. Compute the annual cash flows for the investment in the new equipment to produce the new luggage line. b. Compute the payback period for the investment in the new equipment to produce the new luggage line. (Round your answer to 1 decimal place.) c. Compute the return on average investment for the investment in the new equipment to produce the new luggage line. (Round your percentage answer to 1 decimal place (ie, 12.34 to be entered as 12.3).) d. Compute the total present value of the expected future annual cash inflows, discounted at an annual rate of 20 percent for the investment in the new equipment to produce the nevw luggage line. (Round your "PV factor" to 3 decimal places.) e. Compute the net present value of the proposed investment discounted at 20 percent for the investment in the new equipment to produce the new luggage line. (Round your "PV factor" to 3 decimal places.) Present Value of $1 to Be Received Periodically for n Periods Discount Rate Number of Periods 1% 5% 6% 8% 10% 12% 15% 20% 0.990 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 .970 1.956 1.859 1.833 1.783 1.736 1.690 1.626 1.528 2.941 2.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 3.902 3.854 3.546 3.465 3.312 3.170 3.037 2.855 2.589 4.853 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 5.795 5.697 5.076 4.9174.623 4.355 4.111 3.784 3.326 6.728 6.598 5.786 5.582 5.206 4.868 4.564 4.160 3.605 7.652 7.486 6.463 6.210 5.747 5.335 4.968 4.487 3.837 8.566 8.361 7.108 6.802 6.247 5.759 5.328 4.772 4.031 9.471 9.222 7.722 7.360 6.7 10 6.145 5.650 5.019 4.192 18.046 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.870 21.243 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 30.108 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993 5 6 10 20 24 36 Pack & Carry is debating whether to invest in new equipment to manufacture a line of high- quality luggage. The new equipment would cost $960,000, with an estimated eight-year life and no salvage value. The estimated annual operating results with the new equipment are as follows. (Use Exhibit 26-4.) Revenue from sales of new luggage Expenses other than depreciation Depreciation (straight-line basis) Increase in net income from the new line $660,000 $240,000 120,000 360,000 $300,000 All revenue from the new luggage line and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes a. Compute the annual cash flows for the investment in the new equipment to produce the new luggage line. b. Compute the payback period for the investment in the new equipment to produce the new luggage line. (Round your answer to 1 decimal place.) c. Compute the return on average investment for the investment in the new equipment to produce the new luggage line. (Round your percentage answer to 1 decimal place (ie, 12.34 to be entered as 12.3).) d. Compute the total present value of the expected future annual cash inflows, discounted at an annual rate of 20 percent for the investment in the new equipment to produce the nevw luggage line. (Round your "PV factor" to 3 decimal places.) e. Compute the net present value of the proposed investment discounted at 20 percent for the investment in the new equipment to produce the new luggage line. (Round your "PV factor" to 3 decimal places.)