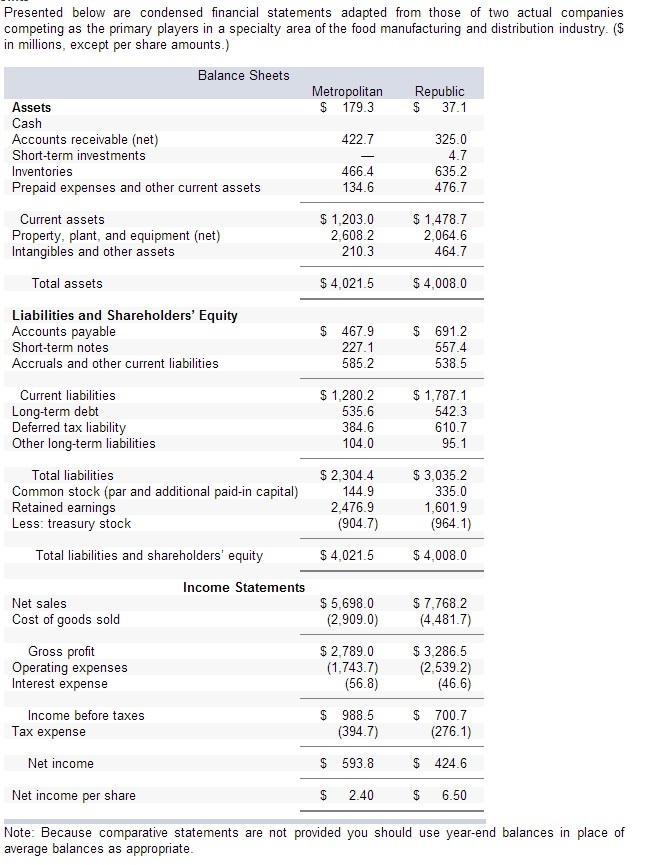

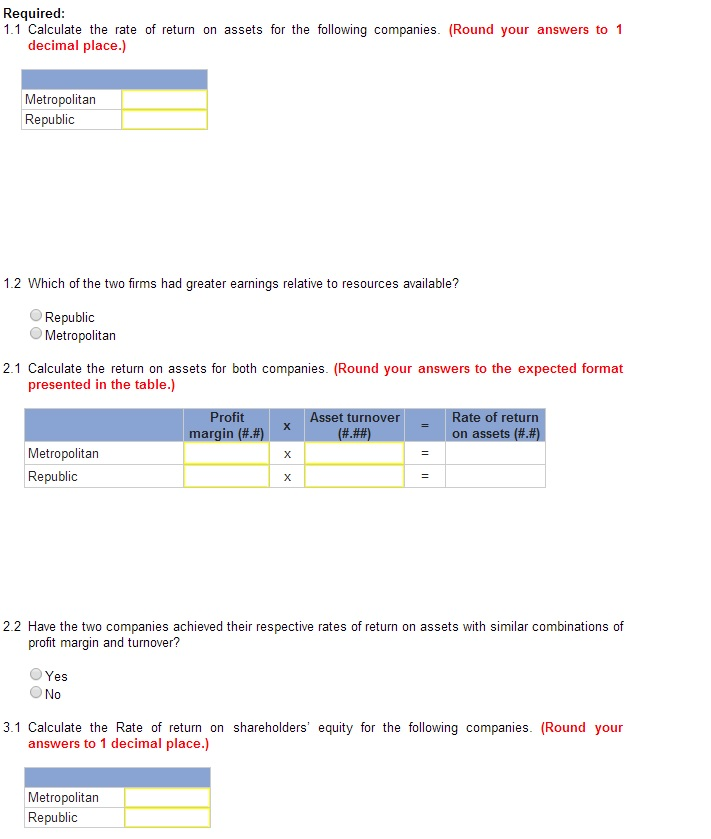

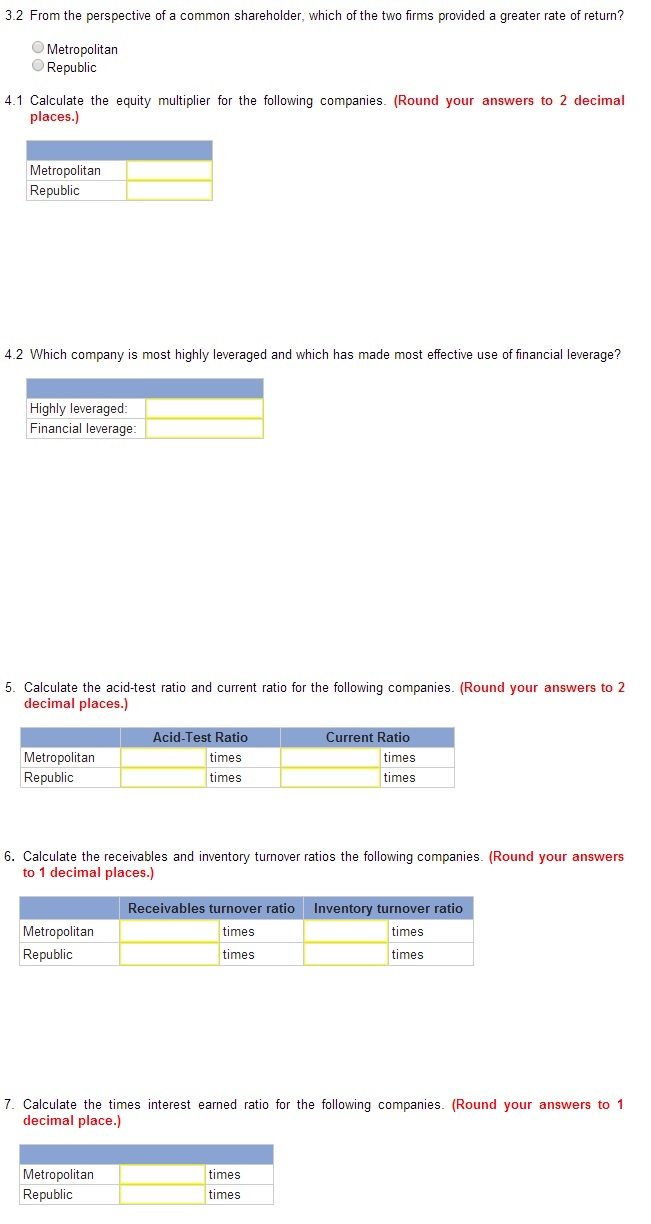

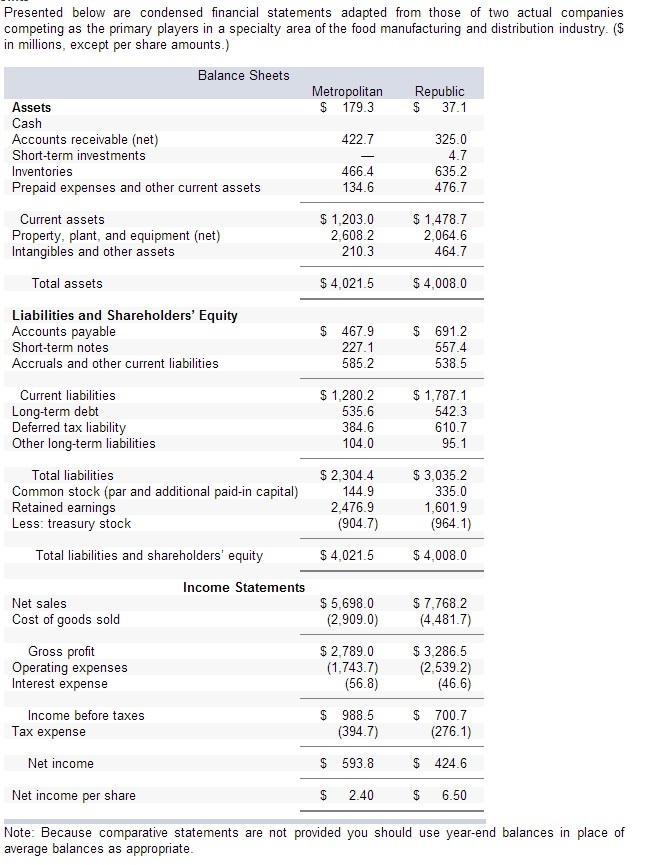

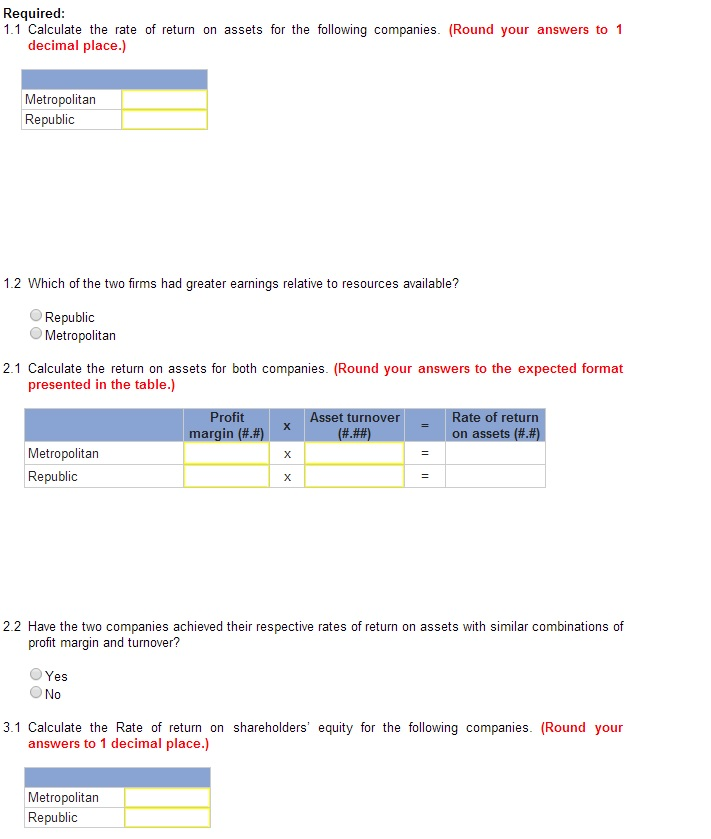

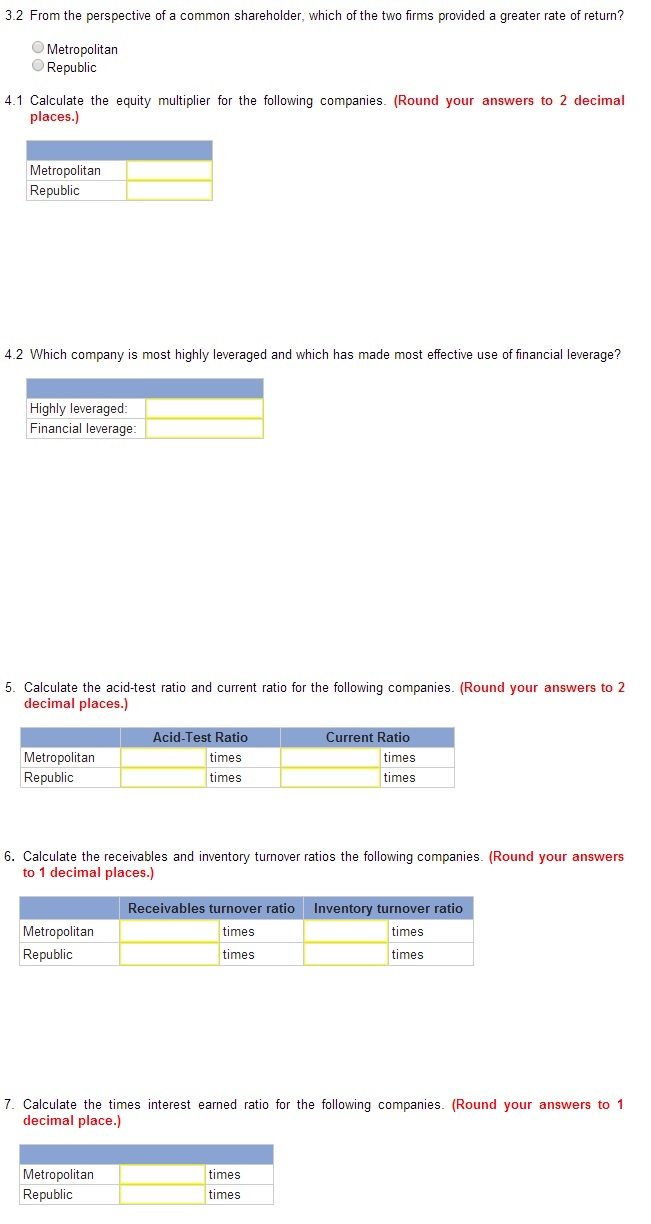

Presented below are condensed financial statements adapted from those of two actual companies competing as the primary players in a specialty area of the food manufacturing and distribution industry. ($ in millions, except per share amounts.) Required: Calculate the rate of return on assets for the following companies. (Round your answers to 1 decimal place.) Which of the two firms had greater earnings relative to resources available? Calculate the return on assets for both companies. (Round your answers to the expected format presented in the table.) Have the two companies achieved their respective rates of return on assets with similar combinations of profit margin and turnover? Calculate the Rate of return on shareholders' equity for the following companies. (Round your answers to 1 decimal place.) From the perspective of a common shareholder, which of the two firms provided a greater rate of return? Calculate the equity multiplier for the following companies. (Round your answers to 2 decimal places.) Which company is most highly leveraged and which has made most effective use of financial leverage? Calculate the acid-test ratio and current ratio for the following companies. (Round your answers to 2 decimal places.) Calculate the receivables and inventory turnover ratios the following companies. (Round your answers to 1 decimal places.) Calculate the times interest earned ratio for the following companies. (Round your answers to 1 decimal place.) Presented below are condensed financial statements adapted from those of two actual companies competing as the primary players in a specialty area of the food manufacturing and distribution industry. ($ in millions, except per share amounts.) Required: Calculate the rate of return on assets for the following companies. (Round your answers to 1 decimal place.) Which of the two firms had greater earnings relative to resources available? Calculate the return on assets for both companies. (Round your answers to the expected format presented in the table.) Have the two companies achieved their respective rates of return on assets with similar combinations of profit margin and turnover? Calculate the Rate of return on shareholders' equity for the following companies. (Round your answers to 1 decimal place.) From the perspective of a common shareholder, which of the two firms provided a greater rate of return? Calculate the equity multiplier for the following companies. (Round your answers to 2 decimal places.) Which company is most highly leveraged and which has made most effective use of financial leverage? Calculate the acid-test ratio and current ratio for the following companies. (Round your answers to 2 decimal places.) Calculate the receivables and inventory turnover ratios the following companies. (Round your answers to 1 decimal places.) Calculate the times interest earned ratio for the following companies. (Round your answers to 1 decimal place.)