Answered step by step

Verified Expert Solution

Question

1 Approved Answer

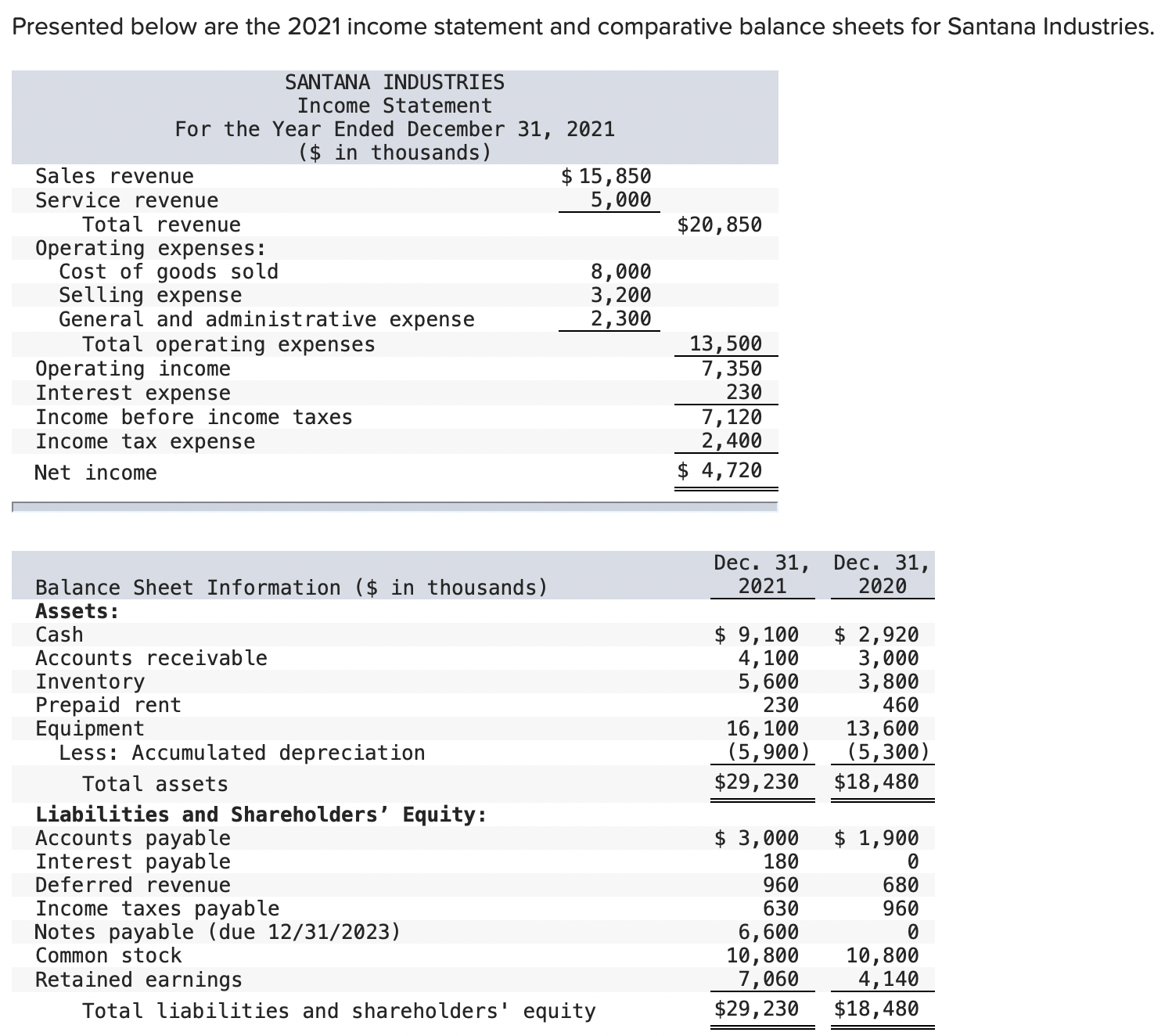

Presented below are the 2021 income statement and comparative balance sheets for Santana Industries. Additional information for the 2021 fiscal year ( $ in thousands):

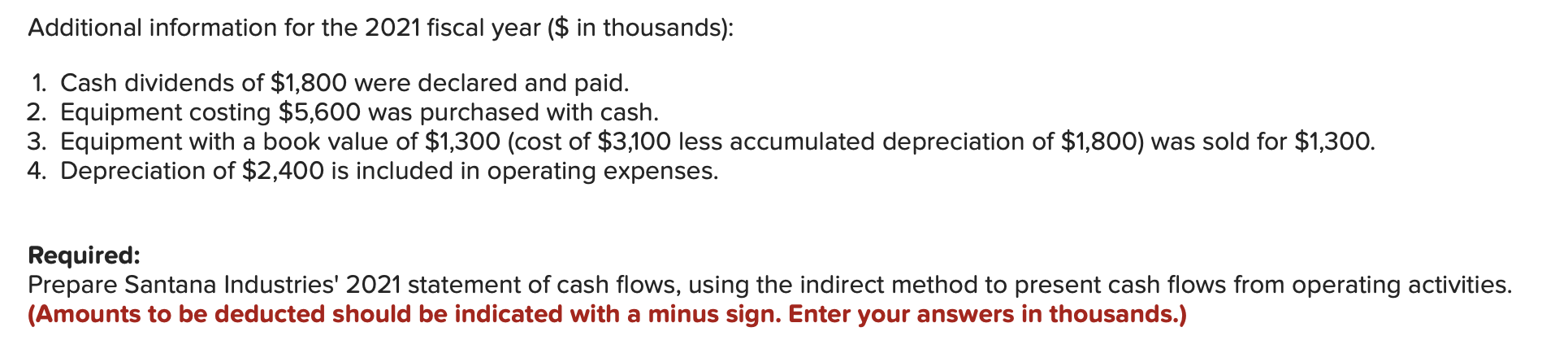

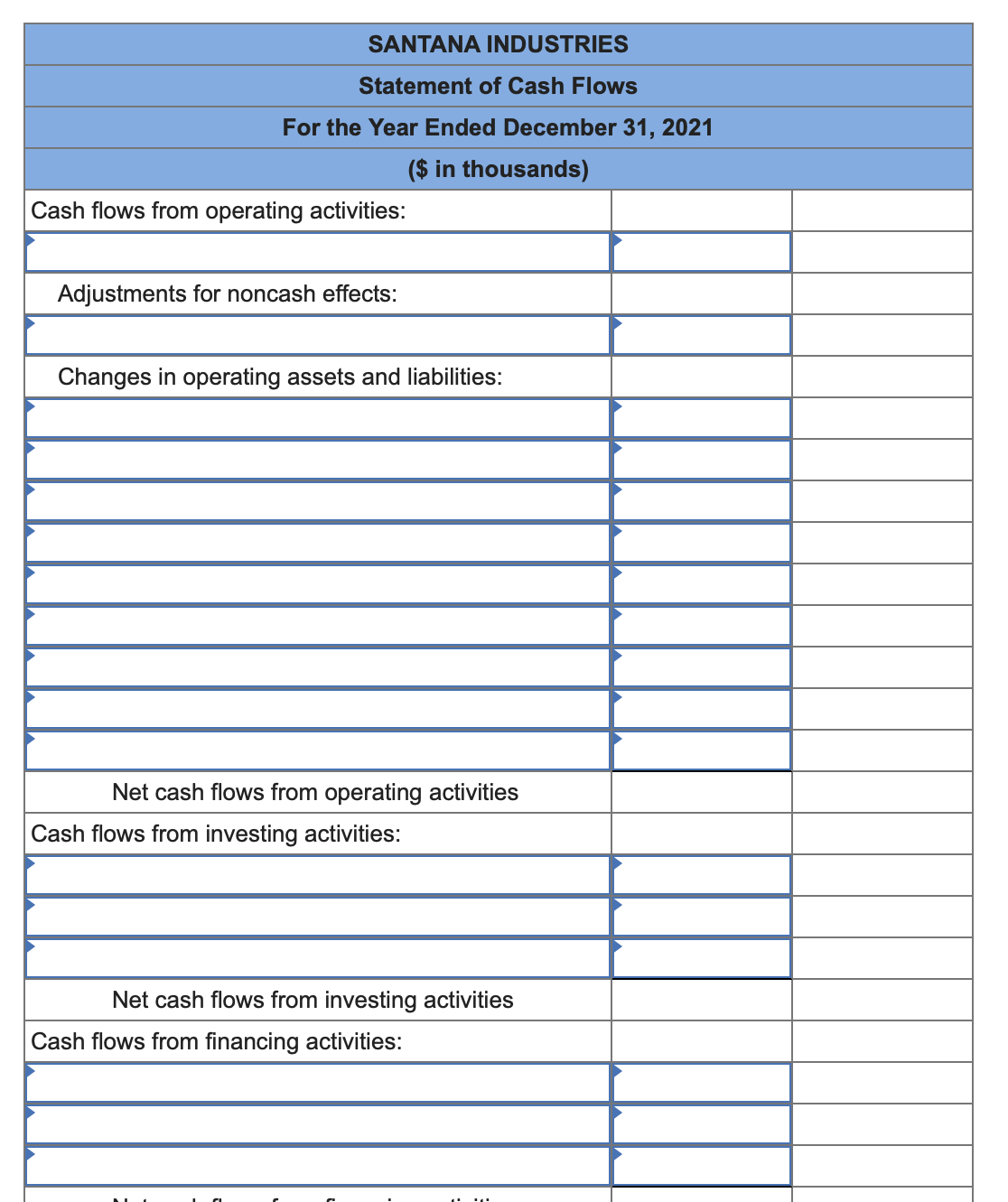

Presented below are the 2021 income statement and comparative balance sheets for Santana Industries. Additional information for the 2021 fiscal year ( $ in thousands): 1. Cash dividends of $1,800 were declared and paid. 2. Equipment costing $5,600 was purchased with cash. 3. Equipment with a book value of $1,300 (cost of $3,100 less accumulated depreciation of $1,800 ) was sold for $1,300. 4. Depreciation of $2,400 is included in operating expenses. Required: Prepare Santana Industries' 2021 statement of cash flows, using the indirect method to present cash flows from operating activities. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands.) \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ SANTANA INDUSTRIES } \\ \hline \multicolumn{2}{|c|}{ Statement of Cash Flows } \\ \hline Cash flows from operating activities: & \\ \hline \multicolumn{2}{|c|}{ in thousands) } \\ \hline Adjustments for noncash effects: & \\ \hline & \\ \hline Changes in operating assets and liabilities: & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline Cash flows from investing activities: & \\ \hline & \\ \hline Net cash flows from investing activities & \\ \hline \end{tabular}

Presented below are the 2021 income statement and comparative balance sheets for Santana Industries. Additional information for the 2021 fiscal year ( $ in thousands): 1. Cash dividends of $1,800 were declared and paid. 2. Equipment costing $5,600 was purchased with cash. 3. Equipment with a book value of $1,300 (cost of $3,100 less accumulated depreciation of $1,800 ) was sold for $1,300. 4. Depreciation of $2,400 is included in operating expenses. Required: Prepare Santana Industries' 2021 statement of cash flows, using the indirect method to present cash flows from operating activities. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands.) \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ SANTANA INDUSTRIES } \\ \hline \multicolumn{2}{|c|}{ Statement of Cash Flows } \\ \hline Cash flows from operating activities: & \\ \hline \multicolumn{2}{|c|}{ in thousands) } \\ \hline Adjustments for noncash effects: & \\ \hline & \\ \hline Changes in operating assets and liabilities: & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline Cash flows from investing activities: & \\ \hline & \\ \hline Net cash flows from investing activities & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started