Answered step by step

Verified Expert Solution

Question

1 Approved Answer

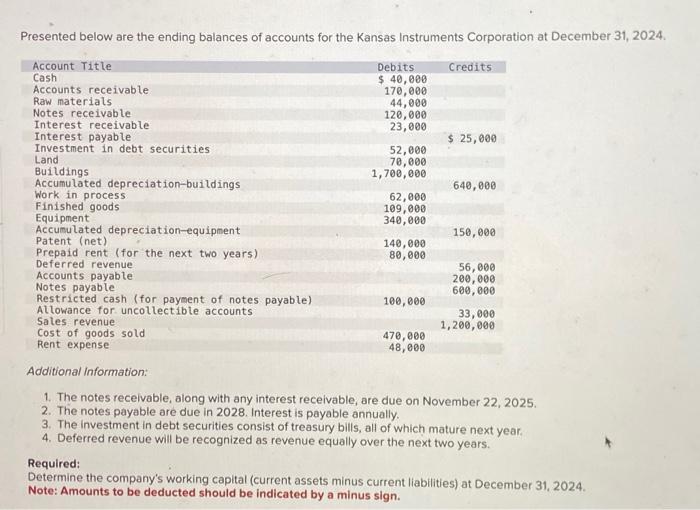

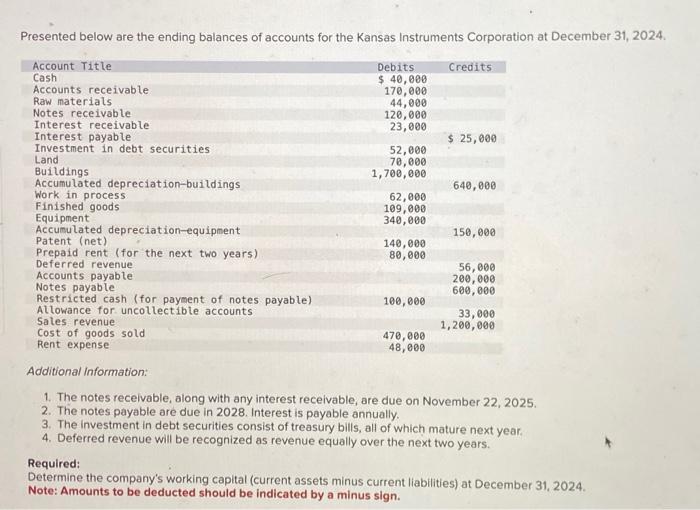

Presented below are the ending balances of accounts for the Kansas Instruments Corporation at December 31 , 2024 Credits Debits 40,000 170,000 44,000 120,000 23,000

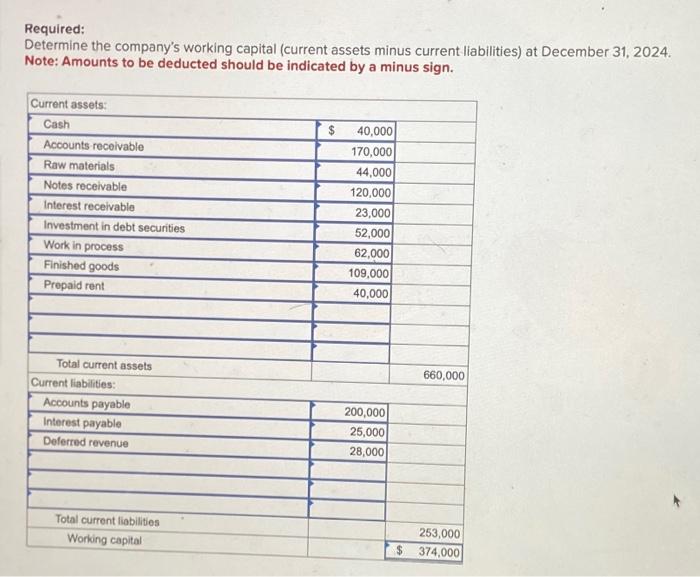

Presented below are the ending balances of accounts for the Kansas Instruments Corporation at December 31 , 2024 Credits Debits 40,000 170,000 44,000 120,000 23,000 25,000 52,000 70,000 1,700,000 640,000 Account Title Cash Accounts receivable Raw materials Notes receivable Interest receivable Interest payable Investment in debt securities Land Buildings Accumulated depreciation - buildings Work in process Finished goods Equipment Accumulated depreciation -equipment Patent (net) Prepaid rent (for the next two years ) Deferred revenue Accounts payable Notes payable Restricted cash (for payment of notes payable ) Allowance for uncollectible accounts Sales revenue Cost of goods sold Rent expense 62,000 109,000 340,000 150,000 140,000 80,000 56,000 200,000 600,000 100,000 33,000 1,200,000 470,000 48,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started