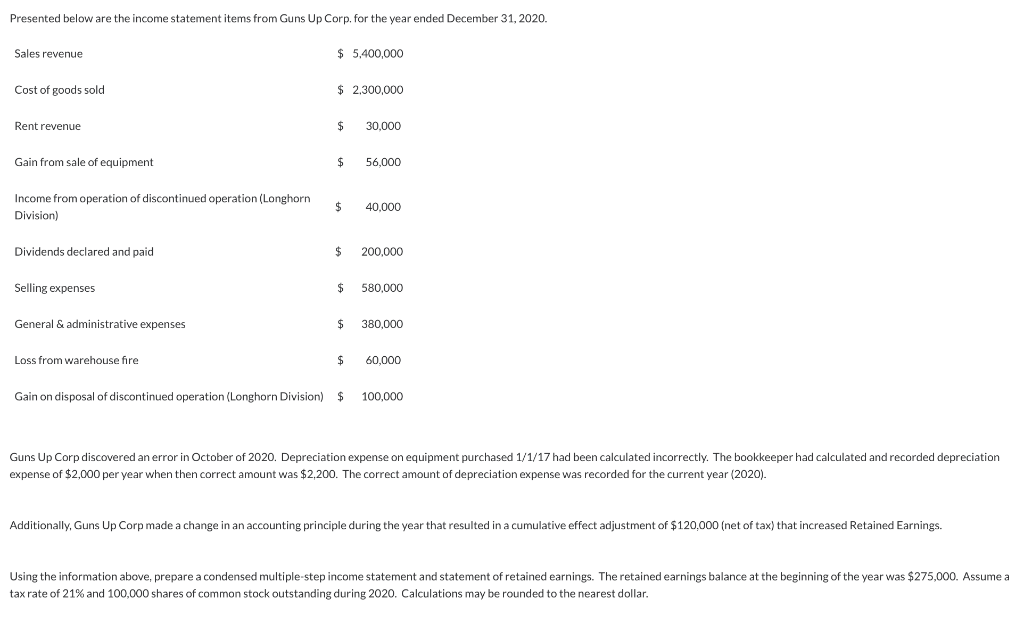

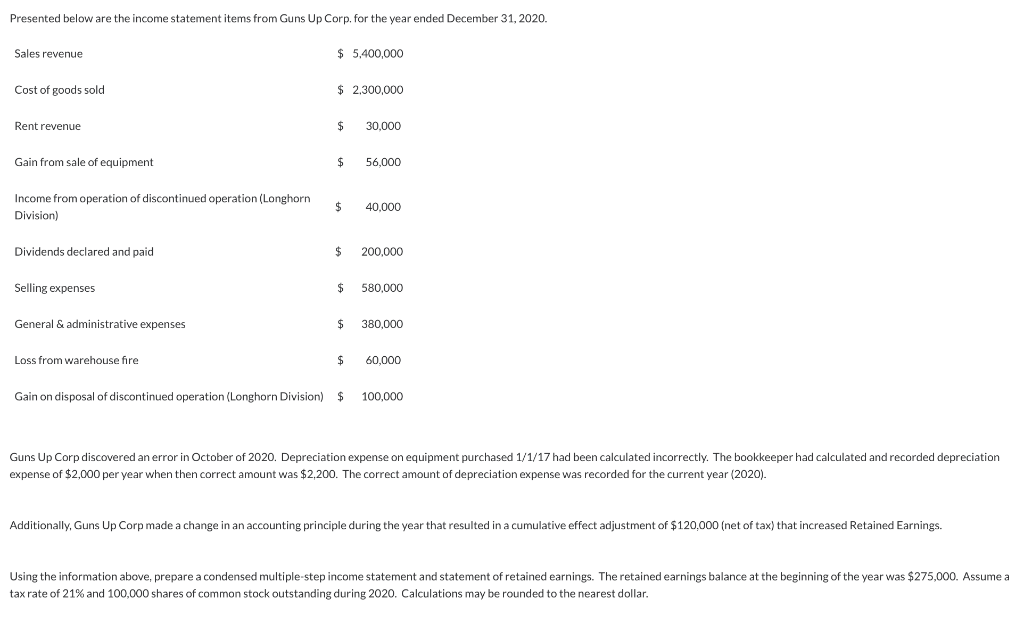

Presented below are the income statement items from Guns Up Corp. for the year ended December 31, 2020. Sales revenue $ 5,400,000 Cost of goods sold $ 2,300,000 Rent revenue $ 30,000 Gain from sale of equipment $ 56,000 Income from operation of discontinued operation (Longhorn Division) $ 40,000 Dividends declared and paid $ 200,000 Selling expenses $ 580,000 General & administrative expenses $ 380,000 Loss from warehouse fire $ 60,000 Gain on disposal of discontinued operation (Longhorn Division) $ 100,000 Guns Up Corp discovered an error in October of 2020. Depreciation expense on equipment purchased 1/1/17 had been calculated incorrectly. The bookkeeper had calculated and recorded depreciation expense of $2,000 per year when then correct amount was $2,200. The correct amount of depreciation expense was recorded for the current year (2020). Additionally, Guns Up Corp made a change in an accounting principle during the year that resulted in a cumulative effect adjustment of $120,000 (net of tax) that increased Retained Earnings. Using the information above, prepare a condensed multiple-step income statement and statement of retained earnings. The retained earnings balance at the beginning of the year was $275,000. Assume a tax rate of 21% and 100,000 shares of common stock outstanding during 2020. Calculations may be rounded to the nearest dollar. Presented below are the income statement items from Guns Up Corp. for the year ended December 31, 2020. Sales revenue $ 5,400,000 Cost of goods sold $ 2,300,000 Rent revenue $ 30,000 Gain from sale of equipment $ 56,000 Income from operation of discontinued operation (Longhorn Division) $ 40,000 Dividends declared and paid $ 200,000 Selling expenses $ 580,000 General & administrative expenses $ 380,000 Loss from warehouse fire $ 60,000 Gain on disposal of discontinued operation (Longhorn Division) $ 100,000 Guns Up Corp discovered an error in October of 2020. Depreciation expense on equipment purchased 1/1/17 had been calculated incorrectly. The bookkeeper had calculated and recorded depreciation expense of $2,000 per year when then correct amount was $2,200. The correct amount of depreciation expense was recorded for the current year (2020). Additionally, Guns Up Corp made a change in an accounting principle during the year that resulted in a cumulative effect adjustment of $120,000 (net of tax) that increased Retained Earnings. Using the information above, prepare a condensed multiple-step income statement and statement of retained earnings. The retained earnings balance at the beginning of the year was $275,000. Assume a tax rate of 21% and 100,000 shares of common stock outstanding during 2020. Calculations may be rounded to the nearest dollar