Answered step by step

Verified Expert Solution

Question

1 Approved Answer

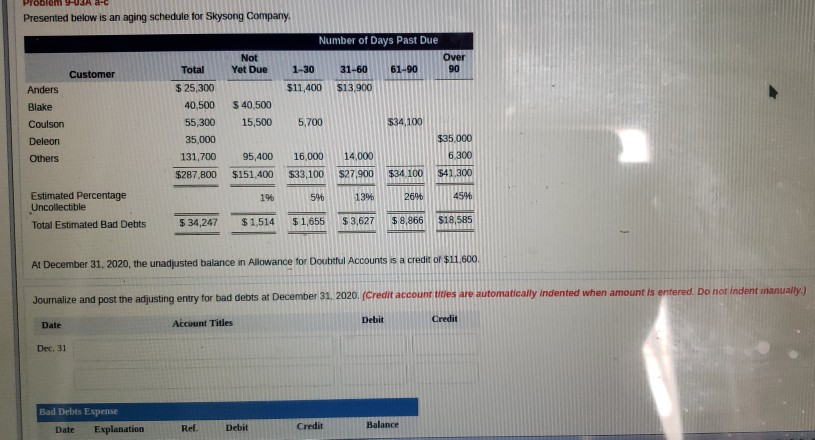

Presented below is an aging schedule for Skysong Company Number of Days Past Due Not Over Total Yet Due 1-30 31-6061-9090 $ 25,300 $11,400 $13,900

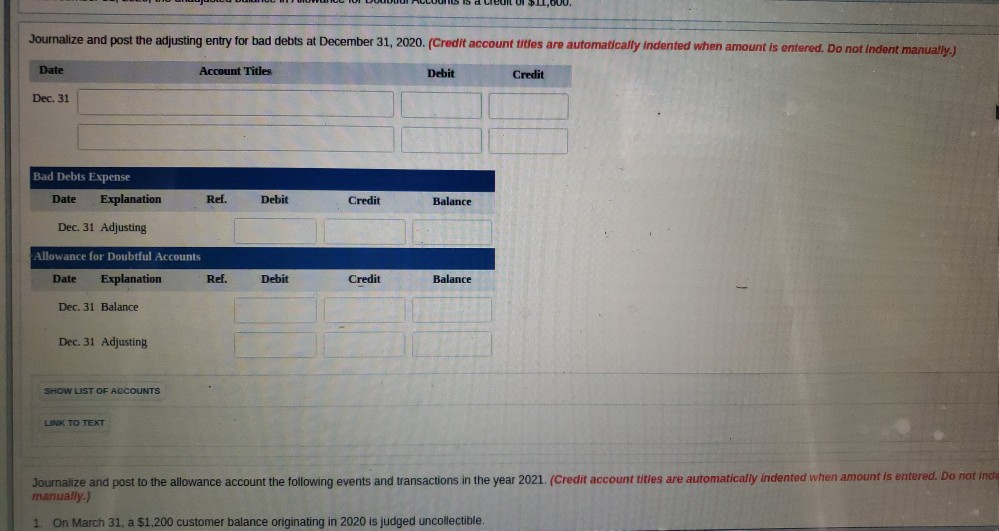

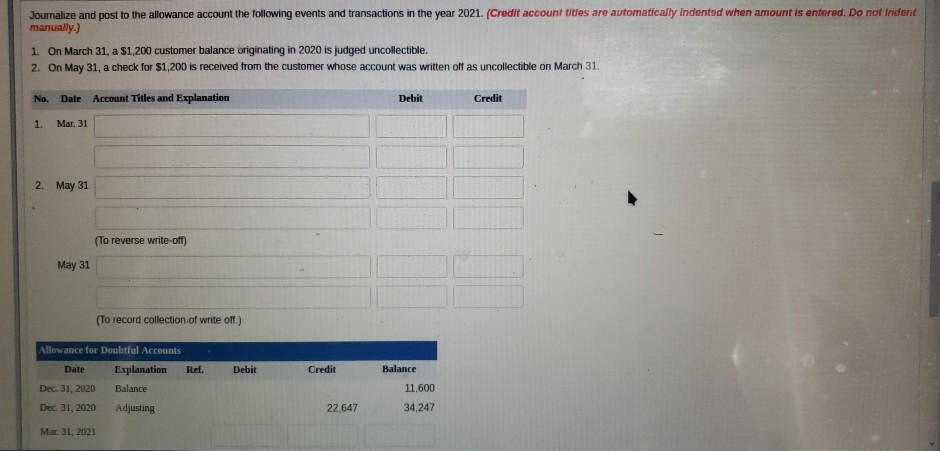

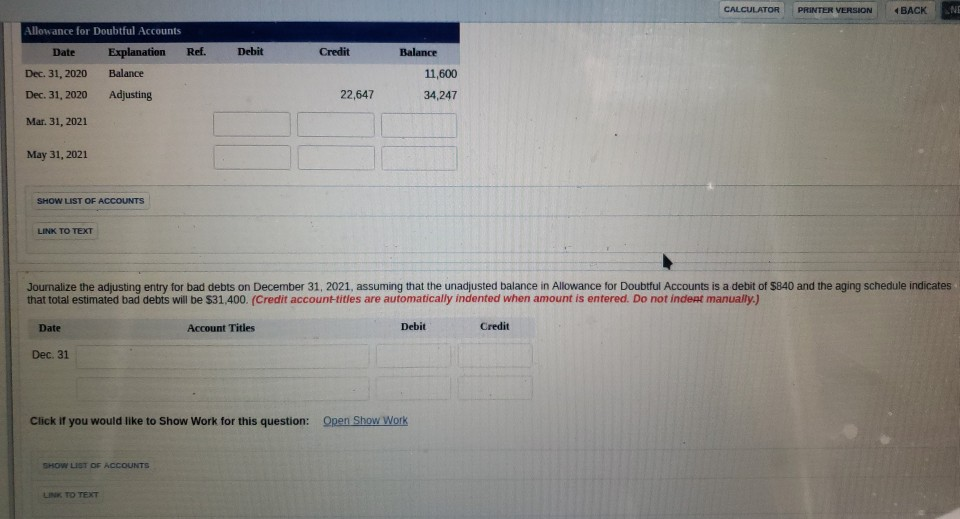

Presented below is an aging schedule for Skysong Company Number of Days Past Due Not Over Total Yet Due 1-30 31-6061-9090 $ 25,300 $11,400 $13,900 Anders Blake Coulson Deleon Others 40,500 $ 40,500 55,300 15,500 5,700 35,000 131,700 95,400 16,000 14,000 $34,100 $35.000 6.300 $287,800 $151.400 $33,100 $27,900 $34 100 $41.300 5% 13% 26% | | 4596 Estimated Percentage 1% Total Estimated Bad Debts 34.247 $154 $1.655 $3,627 $8,866 s8 585 At December 31, 2020, the unadjusted balance in Allowance for Doubthul Accounts s a credie of $ for bad debts at December 31 2020. (Credit account tiies are automatically indented when amount is entered. Do not indent inanually) Debit Account Titles Date Det. 31 Bad Debts Expense Balance Debit Ref. Date Explanation Journalize and post the adjusting entry for bad debts at December 31, 2020.(Credit account titles are automatically indented when amount is entered. Do not Indent manualy) Date Account Titles Debit Credit Dec. 31 Bad Debts Expense Date Explanation Ref. Debit Credit Balance Dec. 31 Adjusting Allowance for Doubtful Accounts Date Explanation Ref. Balance Debit Credit Dec. 31 Balance Dec. 31 Adjusting SHOW LIST OF ACCOUNTS LINK TO TEXT Journalize and post to the allowance account the following events and transactions in the year 2021. (Credit account tities are automatically indented when amount is entered. Do not inde manually) 1. On March 31, a $1,200 customer balance originating in 2020 is judged uncollectible Journalize and post to the allowance account the tollowing events and transactions in the year 2021. (Credit account titles are automatically Indented when amount is entered. Do not Indent manually.) 1. On March 31, a $1,200 customer balance originating in 2020 is judged uncollectible. 2. On May 31, a check for $1,200 is received from the customer whose account was witten off as uncollectible on March 31. Account Titles and Explanation Debit Credit No. Date 1. Mar. 31 2. May 31 To reverse write-off) May 31 (To record collection.of write off.) Allowance for Doubtful Accounts Date Explanation Ref.Debit Balance Adjusting Credit Balance Dec. 31, 2020 Dec. 31, 2020 Mar. 31, 2021 11,600 34,247 22,647 | CALCULATOR PRNTEVERSION | BACK Allowance for Doubtful Accounts Date Explanation Ref.Debit Credit Balance Balance 11,600 Dec. 31, 2020 Dec. 31, 2020 Mar. 31, 2021 May 31, 2021 Adjusting 22,647 34,247 SHOW LIST OF ACCOUNTS LINK TO TEXT Journalize the adjusting entry for bad debts on December 31, 2021, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $840 and the aging schedule indicates that total estimated bad debts will be $31,400. (Credit accounHtitles are automatically indented when amount is entered. Do not indent manually.) Credit Date Debit Account Titles Dec. 31 Open Show Work Click if you would like to Show Work for this question: SHOW LIST OF ACCOUNTS TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started