Answered step by step

Verified Expert Solution

Question

1 Approved Answer

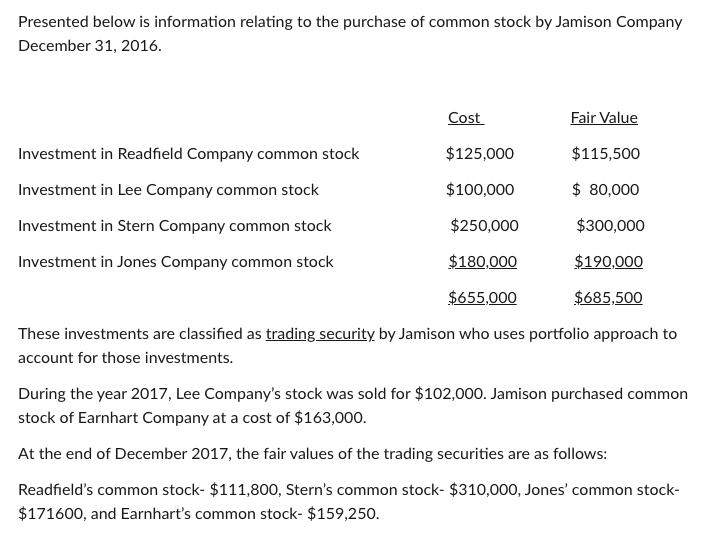

Presented below is information relating to the purchase of common stock by Jamison Company December 31, 2016. Cost Fair Value Investment in Readfield Company

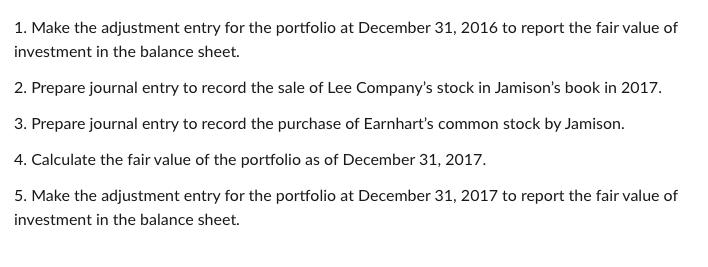

Presented below is information relating to the purchase of common stock by Jamison Company December 31, 2016. Cost Fair Value Investment in Readfield Company common stock $125,000 $115,500 Investment in Lee Company common stock $100,000 $ 80,000 Investment in Stern Company common stock $250,000 $300,000 Investment in Jones Company common stock $180,000 $190,000 $655,000 $685,500 These investments are classified as trading security by Jamison who uses portfolio approach to account for those investments. During the year 2017, Lee Company's stock was sold for $102,000. Jamison purchased common stock of Earnhart Company at a cost of $163,000. At the end of December 2017, the fair values of the trading securities are as follows: Readfield's common stock- $111,800, Stern's common stock- $310,00o0, Jones' common stock- $171600, and Earnhart's common stock- $159,250. 1. Make the adjustment entry for the portfolio at December 31, 2016 to report the fair value of investment in the balance sheet. 2. Prepare journal entry to record the sale of Lee Company's stock in Jamison's book in 2017. 3. Prepare journal entry to record the purchase of Earnhart's common stock by Jamison. 4. Calculate the fair value of the portfolio as of December 31, 2017. 5. Make the adjustment entry for the portfolio at December 31, 2017 to report the fair value of investment in the balance sheet.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

When investment in equities are treated as trading securities then are they are recorded with fair market value at the end of period Generally trading ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started