Answered step by step

Verified Expert Solution

Question

1 Approved Answer

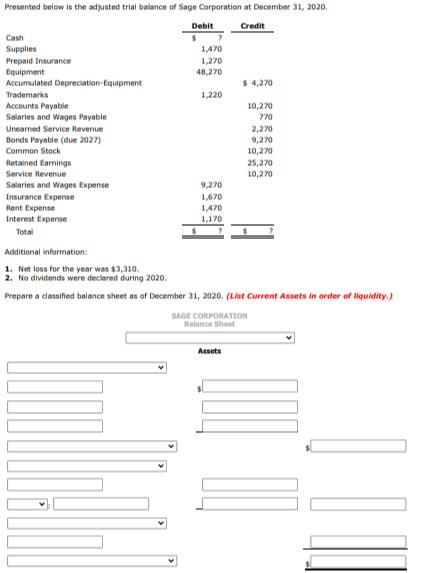

Presented below is the adjusted trial balance of Sage Corporation at December 31, 2020. Debit Credit Cash Supplies 1,470 Prepaid Insurance 1,270 Equipment 48,270

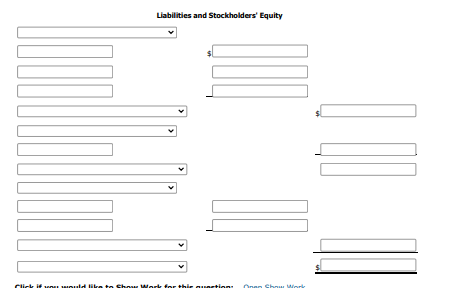

Presented below is the adjusted trial balance of Sage Corporation at December 31, 2020. Debit Credit Cash Supplies 1,470 Prepaid Insurance 1,270 Equipment 48,270 Accumulated Depreciation-Equipment $ 4,270 Trademarks 1,220 Accounts Payable 10,270 Salaries and Wages Payable 770 Unearned Service Revenue 2,270 9,270 Bonds Payable (due 2027) Common Stock 10,270 Retained Earnings 25,270 Service Revenue 10,270 Salaries and Wages Expense 9,270 Insurance Expense 1,670 Rent Expense 1,470 Interest Expense 1,170 Total Additional information: 1. Net loss for the year was $3,310. 2. No dividends were declared during 2020. Prepare a classified balance sheet as of December 31, 2020. (List Current Assets in order of liquidity.) SAGE CORPORATION Balance Sheet Assets |||| Click if you woul Liabilities and Stockholders' Equity Show Work for this question: Onan Show Work

Step by Step Solution

★★★★★

3.36 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

SAGE CORPORATION Balance Sheet At December 312020 Assets Current assets Cash 6850 Supplies 1470 Prep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started