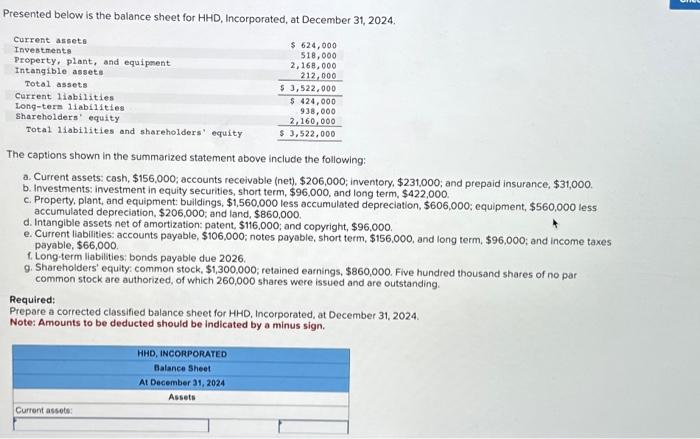

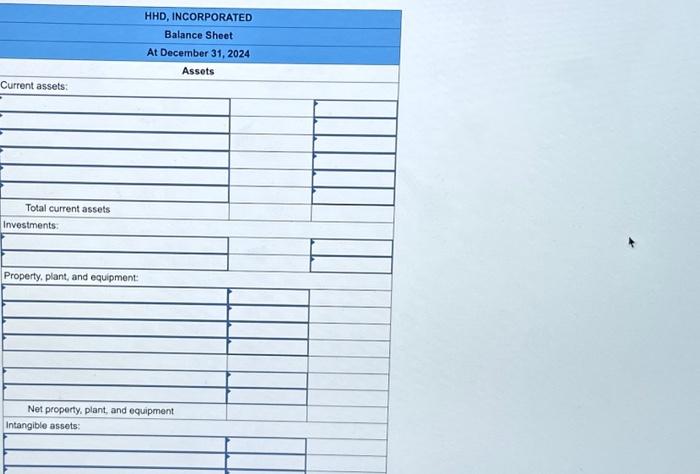

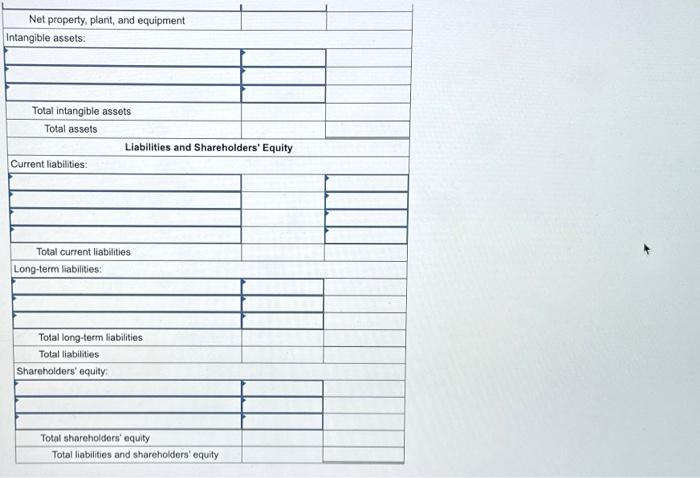

Presented below is the balance sheet for HHD, Incorporated, at December 31, 2024. The captions shown in the summarized statement above include the following: a. Current assets: cash, $156,000; accounts receivable (net), $206,000; inventory, $231,000; and prepaid insurance, $31,000. b. Investments: investment in equity securities, short term, $96,000, and long term, $422,000. c. Property, plant, and equipment: buildings, $1,560,000 less accumulated depreciation, $606,000; equipment, $560,000 less accumulated depreciation, $206,000; and land, $860,000. d. Intangible assets net of amortization: patent, $116,000; and copyright, $96,000. e. Current liabilities: accounts payable, $106,000; notes payable, short term, $156,000, and long term, $96,000; and income taxes payable, $66,000. 1. Long-term liabilities: bonds payable due 2026. 9. Shareholders' equity: common stock, $1,300,000; retained earnings, $860,000. Five hundred thousand shares of no par common stock are authorized, of which 260,000 shares were issued and are outstanding. Required: Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sian. \begin{tabular}{|l|l|} \multicolumn{2}{|c|}{ HHD, INCORPORATED } \\ \multicolumn{2}{|c|}{ Balance Sheet } \\ \hline Assets \\ \hline \end{tabular} Presented below is the balance sheet for HHD, Incorporated, at December 31, 2024. The captions shown in the summarized statement above include the following: a. Current assets: cash, $156,000; accounts receivable (net), $206,000; inventory, $231,000; and prepaid insurance, $31,000. b. Investments: investment in equity securities, short term, $96,000, and long term, $422,000. c. Property, plant, and equipment: buildings, $1,560,000 less accumulated depreciation, $606,000; equipment, $560,000 less accumulated depreciation, $206,000; and land, $860,000. d. Intangible assets net of amortization: patent, $116,000; and copyright, $96,000. e. Current liabilities: accounts payable, $106,000; notes payable, short term, $156,000, and long term, $96,000; and income taxes payable, $66,000. 1. Long-term liabilities: bonds payable due 2026. 9. Shareholders' equity: common stock, $1,300,000; retained earnings, $860,000. Five hundred thousand shares of no par common stock are authorized, of which 260,000 shares were issued and are outstanding. Required: Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sian. \begin{tabular}{|l|l|} \multicolumn{2}{|c|}{ HHD, INCORPORATED } \\ \multicolumn{2}{|c|}{ Balance Sheet } \\ \hline Assets \\ \hline \end{tabular}