Question

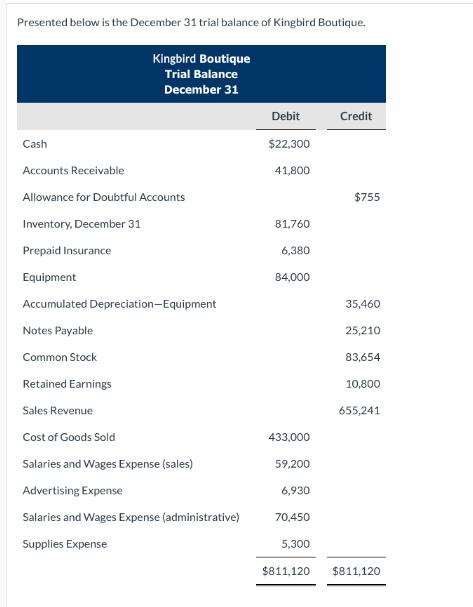

Presented below is the December 31 trial balance of Kingbird Boutique. Cash Kingbird Boutique Trial Balance December 31 Accounts Receivable Allowance for Doubtful Accounts

Presented below is the December 31 trial balance of Kingbird Boutique. Cash Kingbird Boutique Trial Balance December 31 Accounts Receivable Allowance for Doubtful Accounts Inventory, December 31 Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Salaries and Wages Expense (sales) Advertising Expense Salaries and Wages Expense (administrative) Supplies Expense Debit $22,300 41,800 81,760 6,380 84,000 433,000 59,200 6,930 70,450 5,300 $811,120 Credit $755 35,460 25,210 83,654 10,800 655,241 $811,120 Construct T-Accounts and enter the balances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare an income statement and a classified balance sheet for Kingbird Boutique as of December 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting principles and analysis

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso

2nd Edition

471737933, 978-0471737933

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App