Answered step by step

Verified Expert Solution

Question

1 Approved Answer

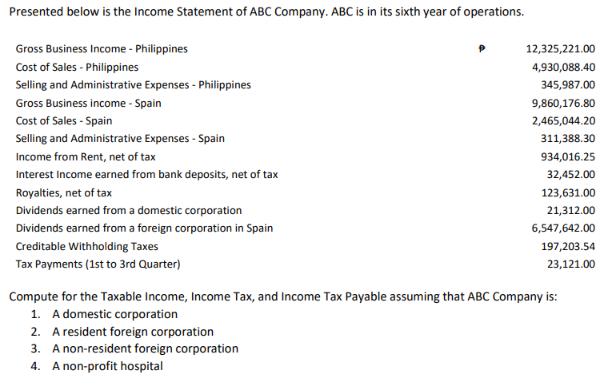

Presented below is the Income Statement of ABC Company. ABC is in its sixth year of operations. Gross Business Income - Philippines Cost of

Presented below is the Income Statement of ABC Company. ABC is in its sixth year of operations. Gross Business Income - Philippines Cost of Sales - Philippines Selling and Administrative Expenses - Philippines Gross Business income - Spain Cost of Sales - Spain Selling and Administrative Expenses - Spain Income from Rent, net of tax Interest Income earned from bank deposits, net of tax Royalties, net of tax Dividends earned from a domestic corporation Dividends earned from a foreign corporation in Spain Creditable Withholding Taxes Tax Payments (1st to 3rd Quarter) 12,325,221.00 4,930,088.40 345,987.00 9,860,176.80 2,465,044.20 311,388.30 934,016.25 32,452.00 123,631.00 21,312.00 6,547,642.00 197,203.54 23,121.00 Compute for the Taxable Income, Income Tax, and Income Tax Payable assuming that ABC Company is: 1. A domestic corporation 2. A resident foreign corporation 3. A non-resident foreign corporation 4. A non-profit hospital

Step by Step Solution

★★★★★

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To compute the Taxable Income Income Tax and Income Tax Payable for ABC Company under different scen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started