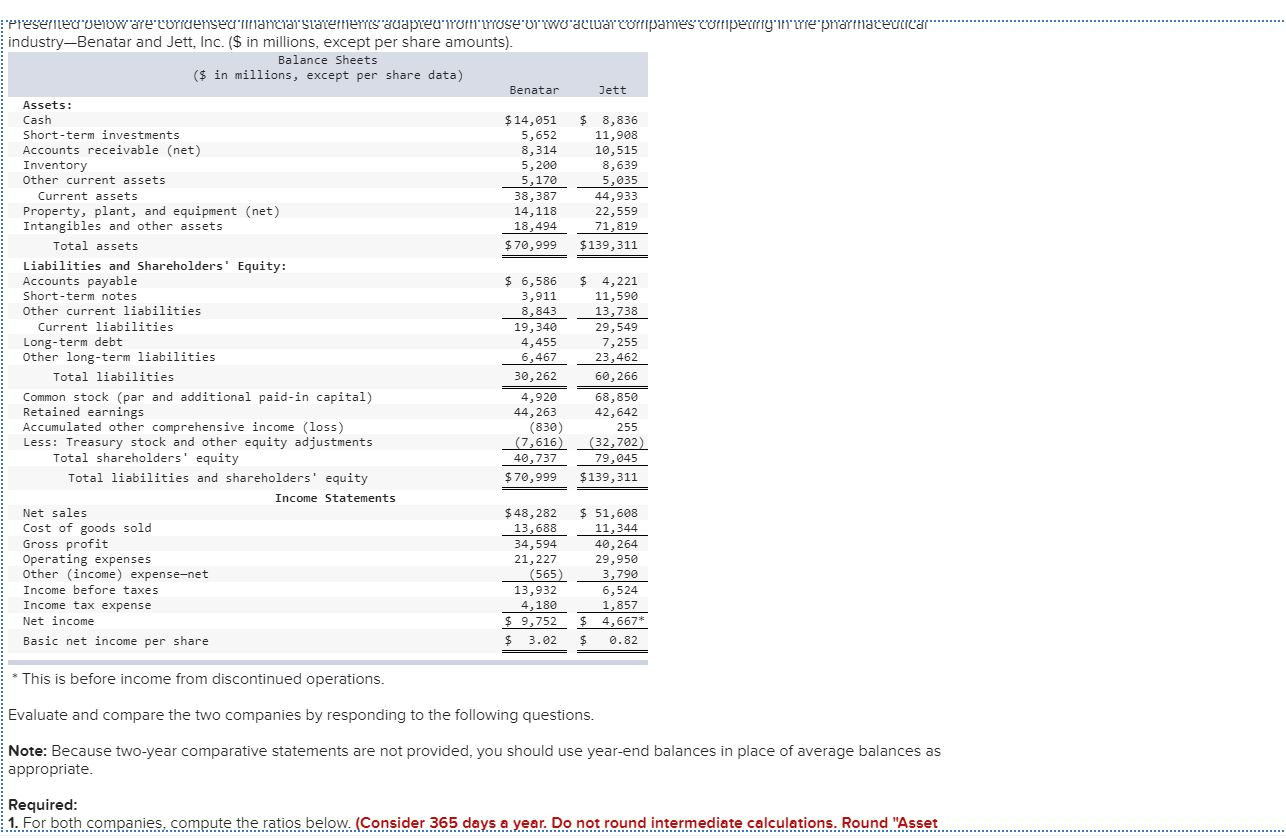

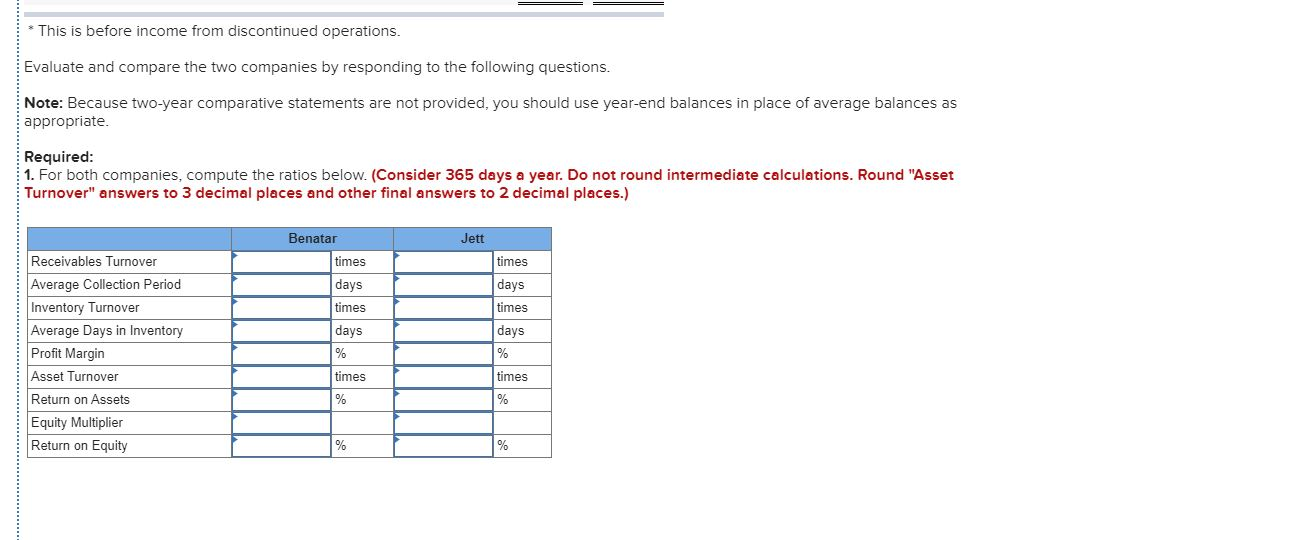

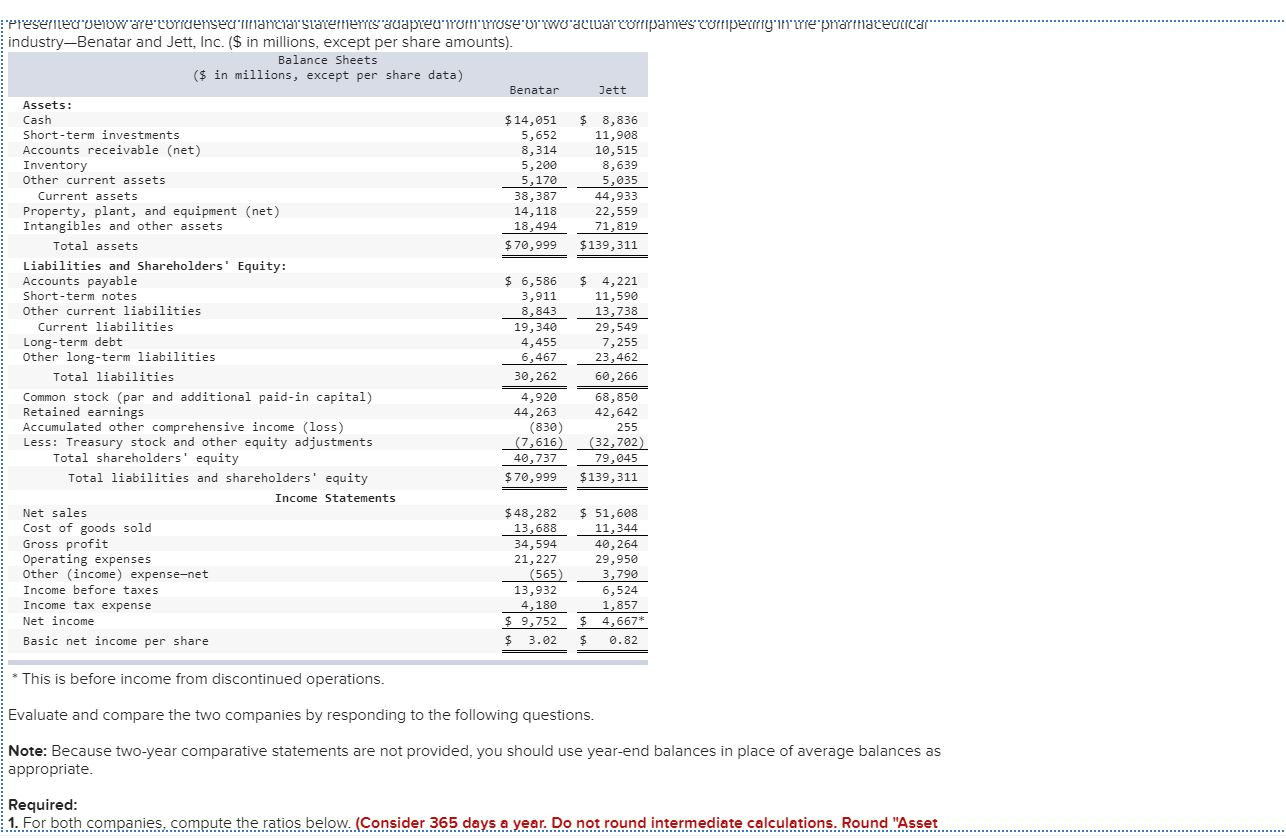

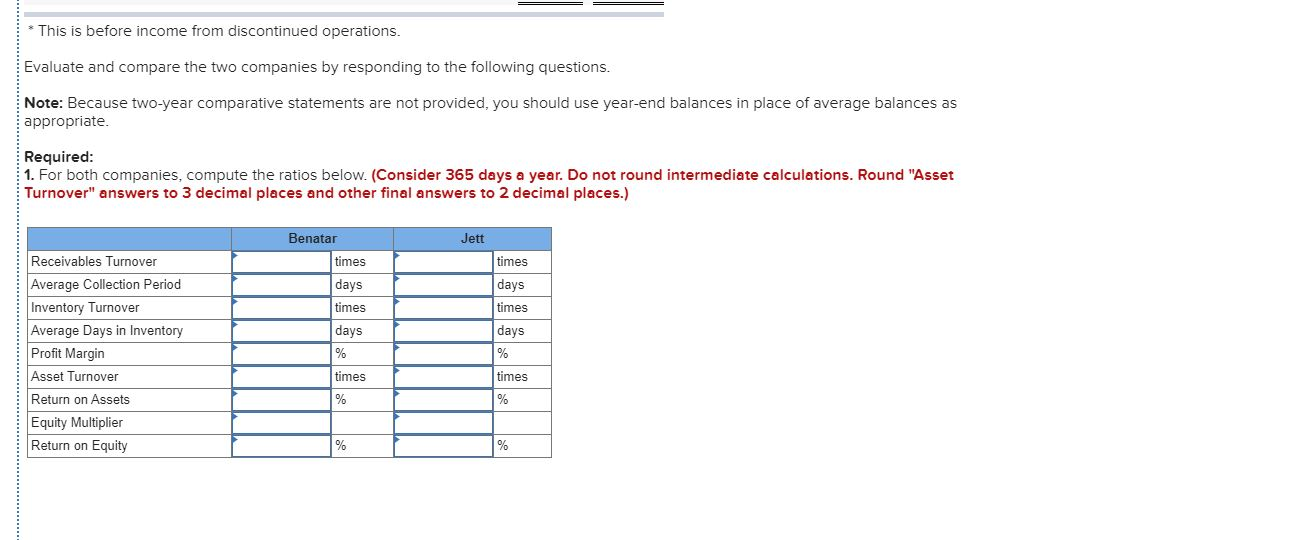

Preserleg veidw are corruenseurmanciarstatements auapreunior USE'Ur wo actuar corripamies corripetry in me prarmaceuticar industry-Benatar and Jett, Inc. ($ in millions, except per share amounts). Balance Sheets ($ in millions, except per share data) Benatar Jett Assets: Cash $14,051 $ 8,836 Short-term investments 5,652 11,908 Accounts receivable (net) 8,314 10,515 Inventory 5,200 8,639 Other current assets 5,170 5,035 Current assets 38,387 44,933 Property, plant, and equipment (net) 14,118 22,559 Intangibles and other assets 18,494 71,819 Total assets $ 70,999 $139,311 Liabilities and Shareholders' Equity: Accounts payable $ 6,586 $ 4,221 Short-term notes 3,911 11,590 Other current liabilities 8,843 13,738 Current liabilities 19,340 29,549 Long-term debt 4,455 7,255 Other long-term liabilities 6,467 23,462 Total liabilities 30,262 60,266 Common stock (par and additional paid-in capital) 4,920 68,850 Retained earnings 44,263 42,642 Accumulated other comprehensive income (loss) (830) 255 Less: Treasury stock and other equity adjustments (7,616) (32,702) Total shareholders' equity 40,737 79,045 Total liabilities and shareholders' equity $70,999 $139,311 Income Statements Net sales $ 48,282 $ 51,608 Cost of goods sold 13,688 11,344 Gross profit 34.594 40, 264 Operating expenses 21,227 29,950 Other (income) expense-net (565) 3,790 Income before taxes 13,932 6,524 Income tax expense 4,180 1,857 Net income $ 9,752 $ 4,667* Basic net income per share $ 3.02 $ 0.82 * This is before income from discontinued operations. Evaluate and compare the two companies by responding to the following questions. Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate. Required: 1. For both companies, compute the ratios below. (Consider 365 days a year. Do not round intermediate calculations. Round "Asset * This is before income from discontinued operations. Evaluate and compare the two companies by responding to the following questions. Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate. Required: 1. For both companies, compute the ratios below. (Consider 365 days a year. Do not round intermediate calculations. Round "Asset Turnover" answers to 3 decimal places and other final answers to 2 decimal places.) Jett Benatar times days times days times days times days Receivables Turnover Average Collection Period Inventory Turnover Average Days in Inventory Profit Margin Asset Turnover Return on Assets Equity Multiplier Return on Equity times times