Question

Price Corporation acquired 100 percent ownership of Saver Company on January 1, 20X8, for $109,600. At that date, the fair value of Saver's buildings and

Price Corporation acquired 100 percent ownership of Saver Company on January 1, 20X8, for $109,600. At that date, the fair value of Saver's buildings and equipment was $15,000 more than the book value. Accumulated depreciation on this date was $15,000. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, Price’s management concluded at December 31, 20X8, that goodwill involved in its acquisition of Saver shares had been impaired and the correct carrying value was $2,600. No additional impairment occurred in 20X9.

Trial balance data for Price and Saver on December 31, 20X9, are as follows:

| Price Corporation | Saver Company | ||||||||||||||

| Item | Debit | Credit | Debit | Credit | |||||||||||

| Cash | $ | 51,500 | $ | 33,000 | |||||||||||

| Accounts Receivable | 92,000 | 20,000 | |||||||||||||

| Inventory | 104,000 | 30,000 | |||||||||||||

| Land | 52,000 | 31,000 | |||||||||||||

| Buildings & Equipment | 361,000 | 153,000 | |||||||||||||

| Investment in Saver Company | 124,100 | ||||||||||||||

| Cost of Goods Sold | 138,000 | 106,000 | |||||||||||||

| Wage Expense | 30,000 | 15,000 | |||||||||||||

| Depreciation Expense | 20,000 | 10,000 | |||||||||||||

| Interest Expense | 7,000 | 4,000 | |||||||||||||

| Other Expenses | 18,000 | 11,000 | |||||||||||||

| Dividends Declared | 32,000 | 45,500 | |||||||||||||

| Accumulated Depreciation | $ | 155,000 | $ | 35,000 | |||||||||||

| Accounts Payable | 47,000 | 15,000 | |||||||||||||

| Wages Payable | 14,000 | 4,000 | |||||||||||||

| Notes Payable | 147,000 | 103,500 | |||||||||||||

| Common Stock | 182,000 | 53,000 | |||||||||||||

| Retained Earnings | 127,100 | 41,000 | |||||||||||||

| Sales | 298,000 | 207,000 | |||||||||||||

| Income from Saver Company | 59,500 | ||||||||||||||

| $ | 1,029,600 | $ | 1,029,600 | $ | 458,500 | $ | 458,500 | ||||||||

Required:

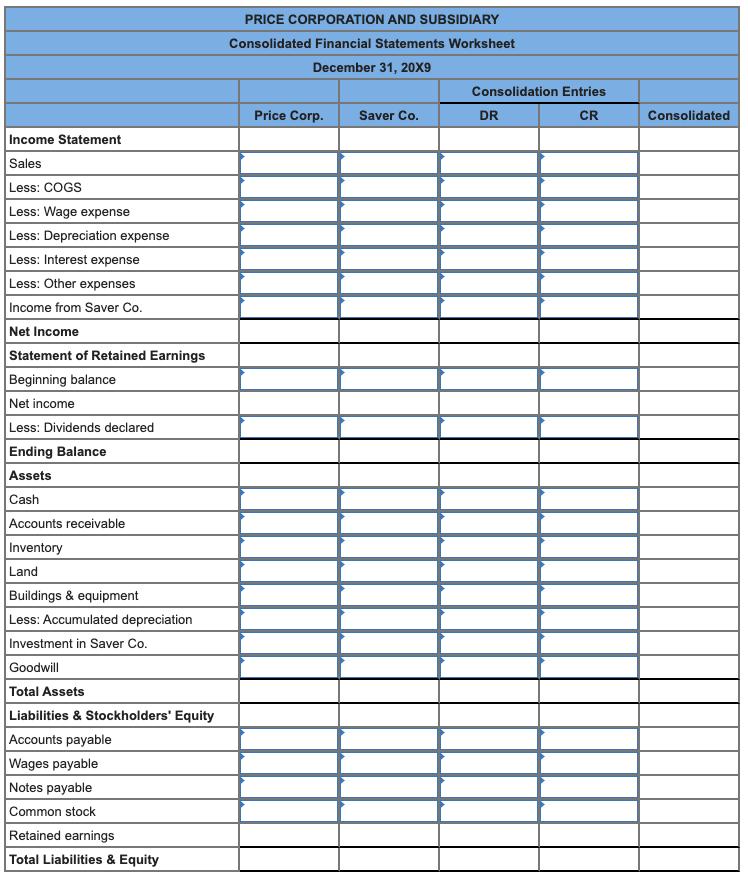

a. Prepare all consolidating entries needed to prepare a three-part consolidation worksheet as of December 31, 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

1a) Record the basic consolidation entry.

2a) Record the amortized excess value reclassification entry.

3a) Record the excess value (differential) reclassification entry.

4a) Record the optional accumulated depreciation consolidation entry.

b. Prepare a three-part consolidation worksheet for 20X9. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

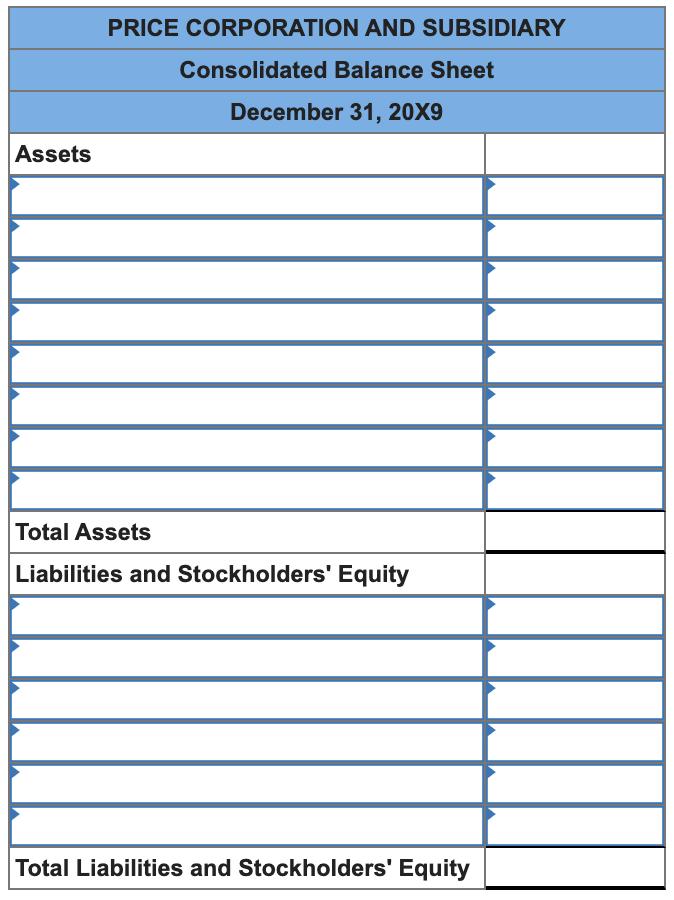

c-1. Prepare a consolidated balance sheet for 20X9. (Amounts to be deducted should be indicated with a minus sign.)

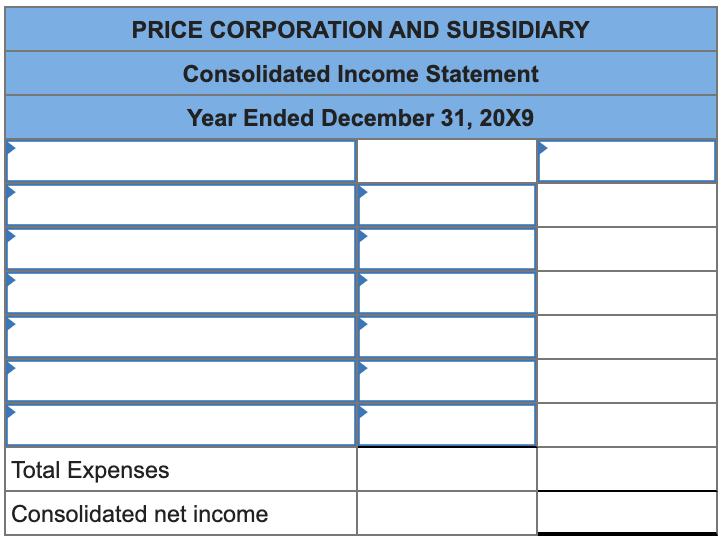

c-2. Prepare a consolidated income statement for 20X9.

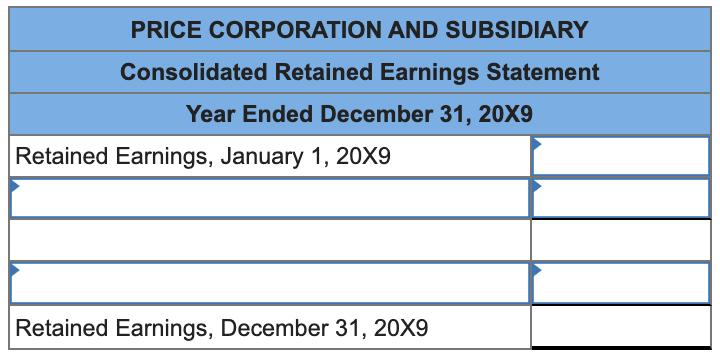

c-3. Prepare a retained earnings statement for 20X9.

PRICE CORPORATION AND SUBSIDIARY Consolidated Financial Statements Worksheet December 31, 20X9 Consolidation Entries Price Corp. Saver Co. DR CR Consolidated Income Statement Sales Less: COGS Less: Wage expense Less: Depreciation expense Less: Interest expense Less: Other expenses Income from Saver Co. Net Income Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Assets Cash Accounts receivable Inventory Land Buildings & equipment Less: Accumulated depreciation Investment in Saver Co. Goodwill Total Assets Liabilities & Stockholders' Equity Accounts payable Wages payable Notes payable Common stock Retained earnings Total Liabilities & Equity

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started