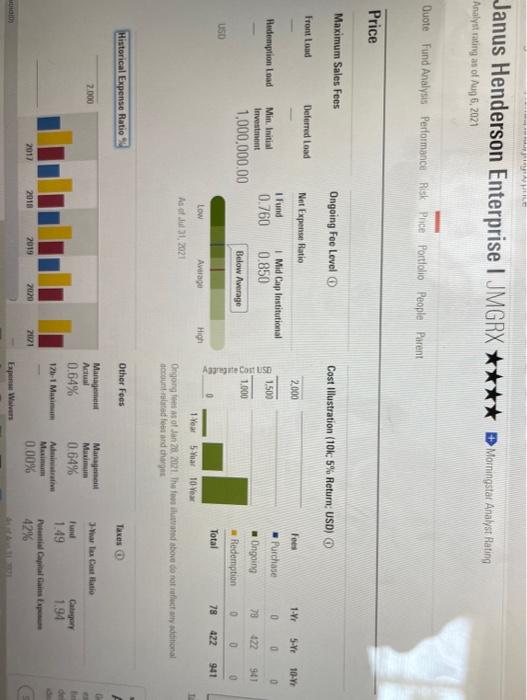

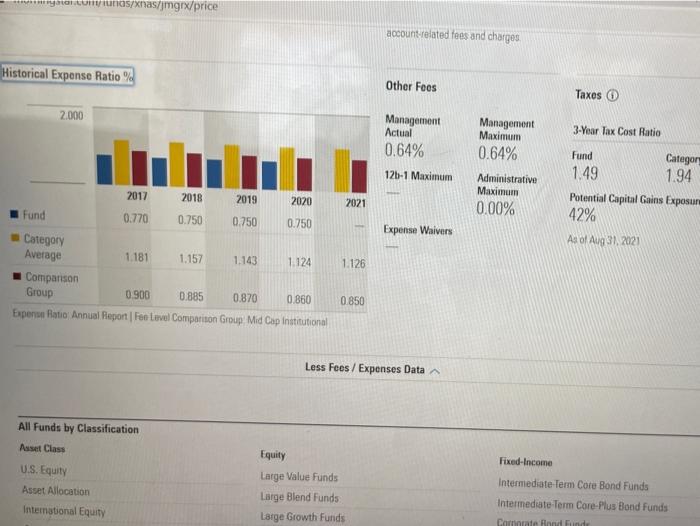

Price und Maximum Sales Fees Ongoing for level Cost Illustration (1015 Hatur USD Morningstar Investment Conference 2021 Freda Tudod 2000 5-9 10-W Nel Expo Hati fund Mid Capital 0.760 0.850 tes th Sept. 22-24 Hederal Mini 1500 MIC 122 1,000,000.00 Helge 100 non fopton Total Explore New Horizons for investors 20 422 961 Ang So As Oyang TO TRADE Historical Expense Rates Other fees Thes INSTI Advisor Digest Det er 2000 Mag A 064% Tax Cell Man Maxima 0.64% At Mam 0.00% 1-1 M und Category 1.49 1.94 Prix 42% Art 2015 20 2011 0.720 2011 0.754 fund Expenses 1136 Age 1181 1.15 1.100 LIN Composto GOD 0300 ODS B. DOSO Am Mapa 050 Tax Analysis (click on the "Price" Tab) Fund Tax Cost Ratio Category Tax Cost Ratio Potential Capital Gains Exposure What positives or red flags do you see in the above numbers? In what situation(s) might an investor not care about the Tax Efficiency of a Fund? FUND MANAGEMENT (Looking under the "People" Tab) How long has the longest-tenured manager been with the fund? How many managers are currently on the fund? To what extent has the manager(s) invested their own money in the fund? Does it appear that there has been much turnover in the management team? (if so, you may wonder if the long-term performance track record is relevant!) Do the managers hold the CFA Certification or graduate degrees? Do you have confidence in this manager or management team? 3 RE Janus Henderson Enterprise | JMGRX **** Morningstar Analyst Rating Analyst rating as of Aug 6, 2021 Quote Fund Analysis Performance Risk Price Portfolio People Parent Price Maximum Sales Fees Ongoing Fee Level Cost Illustration (10k 5% Return; USD) Front Load Deferred Load Net Expense Ratio 2,000 Fees 1.V. 5-Y 10-1 Redemption Load I Fund 0.760 Mid Cap Institutional 0.850 Purchase 0 0 1,500 0 Min. Initial Investment 1,000,000.00 73 122 94 Below Average 1.000 Age Cost USD Ongoing Redemption Total 0 0 USO 78 422 941 High Low Average As of Jul 31, 2021 1 Year 5 Year 10 Ongoing to sol jan 2021. The followed above do not affect way actional und fand charges Historical Expense Ratio Other Fees Taxes 2.000 ar la Coutatio Management Actual 0.64% Management Maximum 0.64% Admin Maxim 0.00% Fund Category 1.49 1.94 Puntatal Gains 42% PETE 121-1 Maxim 2017 2018 2019 2020 2021 Eapens Waves Shaxnas/jmgrx/price account related fees and charges Historical Expense Ratio% Other Fees Taxes 2.000 3-Year Tax Cost Ratio Management Actual 0.64% Management Maximum 0.64% 125-1 Maximum Fund Category 1.49 1.94 Potential Capital Gains Exposure 42% 2017 2018 Administrative Maximum 0.00% 2019 2020 2021 Expense Waivers As of Aug 31, 2021 Fund 0.770 0.750 0.750 0.750 Category Average 1.181 1.157 1.143 1.124 Comparison Group 0.900 0.885 0.870 0.860 Expense Ratio Annual Report For Lovel Comparison Group Mid Cap Institutional 1.126 0.850 Less Fees / Expenses Data All Funds by Classification Asset Class Fixed-Income U.S. Equity Asset Allocation Equity Large Value Funds Large Blend Funds Large Growth Funds Intermediate-Term Cote Bond Funds Intermediate-Term Core Plus Bond Funds Corrate And Funds Interational Equity Tax Analysis (click on the "Price" Tab) Fund Tax Cost Ratio Category Tax Cost Ratio Potential Capital Gains Exposure What positives or red flags do you see in the above numbers? In what situation(s) might an investor not care about the Tax Efficiency of a Fund? FUND MANAGEMENT (Looking under the "People" Tab) How long has the longest-tenured manager been with the fund? How many managers are currently on the fund? To what extent has the manager(s) invested their own money in the fund? Does it appear that there has been much turnover in the management team? (if so, you may wonder if the long-term performance track record is relevant!) Do the managers hold the CFA Certification or graduate degrees? Do you have confidence in this manager or management team? 3 Price und Maximum Sales Fees Ongoing for level Cost Illustration (1015 Hatur USD Morningstar Investment Conference 2021 Freda Tudod 2000 5-9 10-W Nel Expo Hati fund Mid Capital 0.760 0.850 tes th Sept. 22-24 Hederal Mini 1500 MIC 122 1,000,000.00 Helge 100 non fopton Total Explore New Horizons for investors 20 422 961 Ang So As Oyang TO TRADE Historical Expense Rates Other fees Thes INSTI Advisor Digest Det er 2000 Mag A 064% Tax Cell Man Maxima 0.64% At Mam 0.00% 1-1 M und Category 1.49 1.94 Prix 42% Art 2015 20 2011 0.720 2011 0.754 fund Expenses 1136 Age 1181 1.15 1.100 LIN Composto GOD 0300 ODS B. DOSO Am Mapa 050 Tax Analysis (click on the "Price" Tab) Fund Tax Cost Ratio Category Tax Cost Ratio Potential Capital Gains Exposure What positives or red flags do you see in the above numbers? In what situation(s) might an investor not care about the Tax Efficiency of a Fund? FUND MANAGEMENT (Looking under the "People" Tab) How long has the longest-tenured manager been with the fund? How many managers are currently on the fund? To what extent has the manager(s) invested their own money in the fund? Does it appear that there has been much turnover in the management team? (if so, you may wonder if the long-term performance track record is relevant!) Do the managers hold the CFA Certification or graduate degrees? Do you have confidence in this manager or management team? 3 RE Janus Henderson Enterprise | JMGRX **** Morningstar Analyst Rating Analyst rating as of Aug 6, 2021 Quote Fund Analysis Performance Risk Price Portfolio People Parent Price Maximum Sales Fees Ongoing Fee Level Cost Illustration (10k 5% Return; USD) Front Load Deferred Load Net Expense Ratio 2,000 Fees 1.V. 5-Y 10-1 Redemption Load I Fund 0.760 Mid Cap Institutional 0.850 Purchase 0 0 1,500 0 Min. Initial Investment 1,000,000.00 73 122 94 Below Average 1.000 Age Cost USD Ongoing Redemption Total 0 0 USO 78 422 941 High Low Average As of Jul 31, 2021 1 Year 5 Year 10 Ongoing to sol jan 2021. The followed above do not affect way actional und fand charges Historical Expense Ratio Other Fees Taxes 2.000 ar la Coutatio Management Actual 0.64% Management Maximum 0.64% Admin Maxim 0.00% Fund Category 1.49 1.94 Puntatal Gains 42% PETE 121-1 Maxim 2017 2018 2019 2020 2021 Eapens Waves Shaxnas/jmgrx/price account related fees and charges Historical Expense Ratio% Other Fees Taxes 2.000 3-Year Tax Cost Ratio Management Actual 0.64% Management Maximum 0.64% 125-1 Maximum Fund Category 1.49 1.94 Potential Capital Gains Exposure 42% 2017 2018 Administrative Maximum 0.00% 2019 2020 2021 Expense Waivers As of Aug 31, 2021 Fund 0.770 0.750 0.750 0.750 Category Average 1.181 1.157 1.143 1.124 Comparison Group 0.900 0.885 0.870 0.860 Expense Ratio Annual Report For Lovel Comparison Group Mid Cap Institutional 1.126 0.850 Less Fees / Expenses Data All Funds by Classification Asset Class Fixed-Income U.S. Equity Asset Allocation Equity Large Value Funds Large Blend Funds Large Growth Funds Intermediate-Term Cote Bond Funds Intermediate-Term Core Plus Bond Funds Corrate And Funds Interational Equity Tax Analysis (click on the "Price" Tab) Fund Tax Cost Ratio Category Tax Cost Ratio Potential Capital Gains Exposure What positives or red flags do you see in the above numbers? In what situation(s) might an investor not care about the Tax Efficiency of a Fund? FUND MANAGEMENT (Looking under the "People" Tab) How long has the longest-tenured manager been with the fund? How many managers are currently on the fund? To what extent has the manager(s) invested their own money in the fund? Does it appear that there has been much turnover in the management team? (if so, you may wonder if the long-term performance track record is relevant!) Do the managers hold the CFA Certification or graduate degrees? Do you have confidence in this manager or management team? 3