primarily need number 4 answered

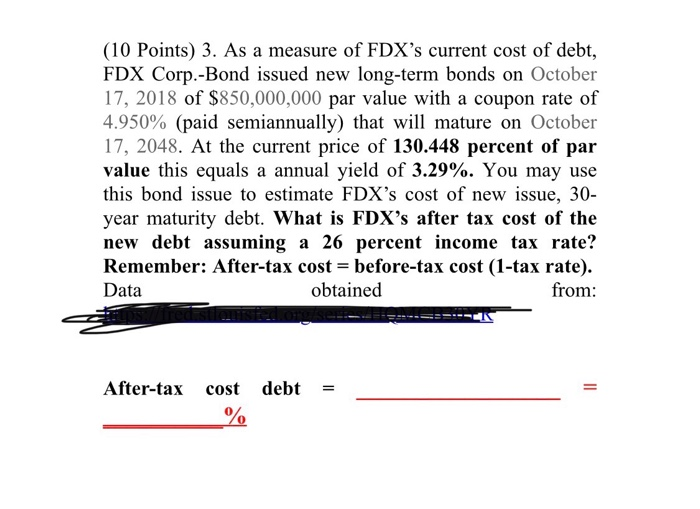

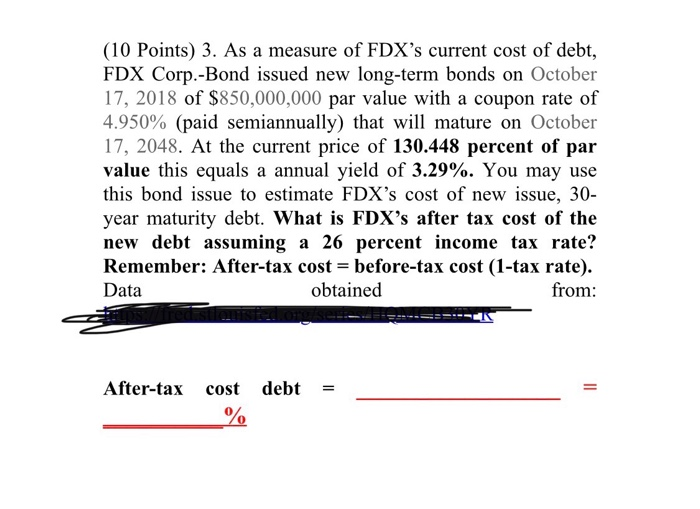

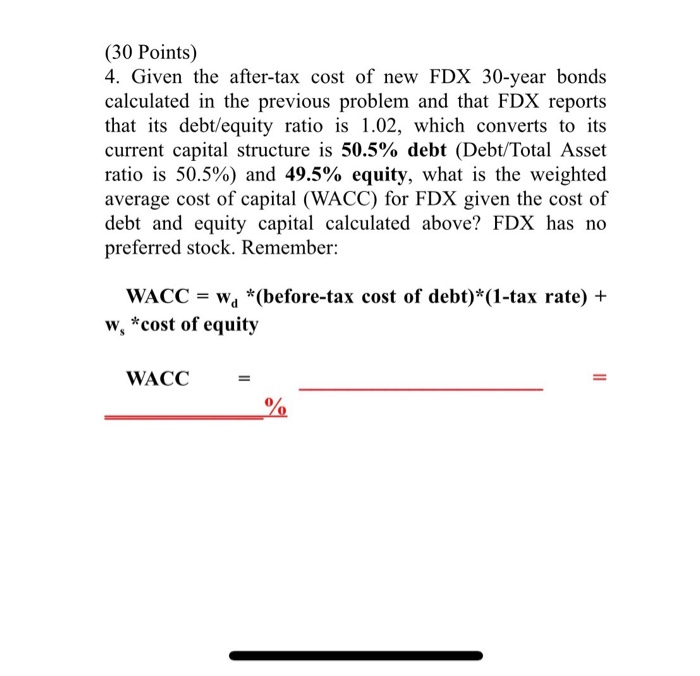

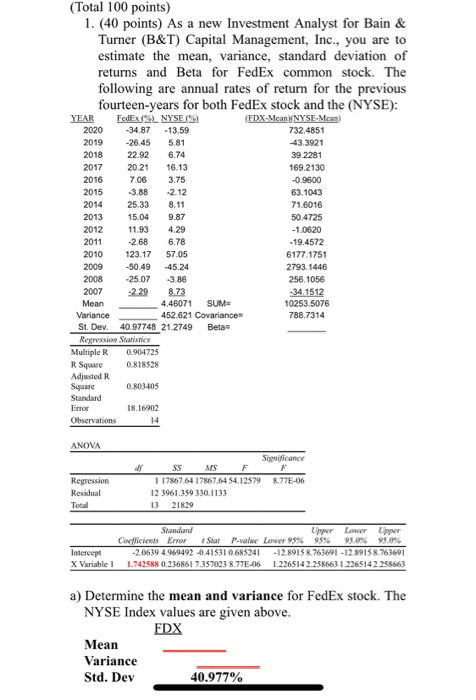

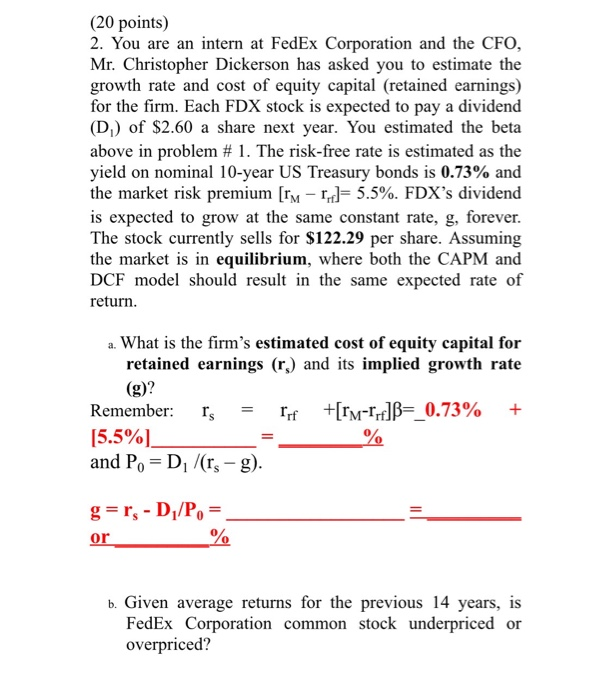

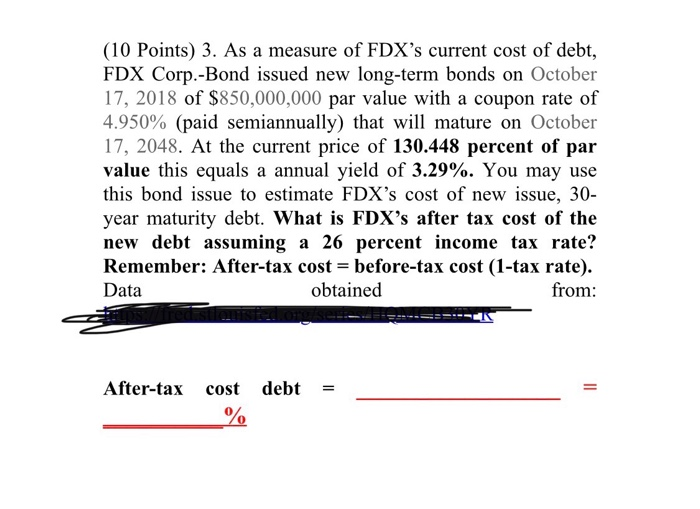

(10 Points) 3. As a measure of FDX's current cost of debt, FDX Corp.-Bond issued new long-term bonds on October 17, 2018 of $850,000,000 par value with a coupon rate of 4.950% (paid semiannually) that will mature on October 17, 2048. At the current price of 130.448 percent of par value this equals a annual yield of 3.29%. You may use this bond issue to estimate FDX's cost of new issue, 30- year maturity debt. What is FDX's after tax cost of the new debt assuming a 26 percent income tax rate? Remember: After-tax cost = before-tax cost (1-tax rate). Data obtained from: H orse - - -K After-tax cost debt = (30 Points) 4. Given the after-tax cost of new FDX 30-year bonds calculated in the previous problem and that FDX reports that its debt/equity ratio is 1.02, which converts to its current capital structure is 50.5% debt (Debt/Total Asset ratio is 50.5%) and 49.5% equity, what is the weighted average cost of capital (WACC) for FDX given the cost of debt and equity capital calculated above? FDX has no preferred stock. Remember: WACC = w, *(before-tax cost of debt)*(1-tax rate) + w, *cost of equity WACC % (Total 100 points) 1. (40 points) As a new Investment Analyst for Bain & Turner (B&T) Capital Management, Inc., you are to estimate the mean, variance, standard deviation of returns and Beta for FedEx common stock. The following are annual rates of return for the previous fourteen-years for both FedEx stock and the (NYSE): YEAR FedEx ( NYSE (9 (FDX-MicanNYSE-Man 2020 - 34.87 -13.59 732.4851 2019 -26.45 5.81 43.3921 2018 22.92 6.74 392281 2017 20.21 16.13 169.2130 2016 7.06 3.75 -0.9600 2015 3.88 -2.12 63.1043 2014 25.33 8.11 71.6016 2013 15 049.87 50.4725 2012 11.934.29 -1.0620 2011 -2.68 6.78 -19.4572 2010 123.17 57.05 6177.1751 2009 -50.49 45.24 2793.1446 2008 -25.07 -3.86 256.1056 2007 -229 8.73 -34.1512 Mean 4.46071 SUM= 10253 5076 Variance 452.621 Covariance 788.7314 St. Dev. 40.97748 21.2749 Beta Regression Statistics Multiple R 0.904725 R Square 0.818528 Adjusted Square 0.803-405 Standard 18.16902 Observations 14 ET ANOVA Regression Residual Total Senificance $ M F F 17867.64 17867.5454.125798.77E-06 12 3961159 110 1133 1321829 Standard Lower Corticis Emor Shar Par Lowww 99% 95% 95.0 95. Intercept 205394.969492-0.415310.685241 -12.8915 8.763691-12.89158763691 X Variabel 1.942550 236851 73570377506 1226514225561122651425661 a) Determine the mean and variance for FedEx stock. The NYSE Index values are given above. FDX Mean Variance Std. Dev 40.977% (20 points) 2. You are an intern at FedEx Corporation and the CFO, Mr. Christopher Dickerson has asked you to estimate the growth rate and cost of equity capital (retained earnings) for the firm. Each FDX stock is expected to pay a dividend (D) of $2.60 a share next year. You estimated the beta above in problem # 1. The risk-free rate is estimated as the yield on nominal 10-year US Treasury bonds is 0.73% and the market risk premium [IM- U= 5.5%. FDX's dividend is expected to grow at the same constant rate, g, forever. The stock currently sells for $122.29 per share. Assuming the market is in equilibrium, where both the CAPM and DCF model should result in the same expected rate of return. a. What is the firm's estimated cost of equity capital for retained earnings (r) and its implied growth rate (g)? Remember: fs = rf +[rm-14]B=_0.73% + [5.5%) and P, = D/(rs - g). 07 g=rs - D/P, = b. Given average returns for the previous 14 years, is FedEx Corporation common stock underpriced or overpriced? (10 Points) 3. As a measure of FDX's current cost of debt, FDX Corp.-Bond issued new long-term bonds on October 17, 2018 of $850,000,000 par value with a coupon rate of 4.950% (paid semiannually) that will mature on October 17, 2048. At the current price of 130.448 percent of par value this equals a annual yield of 3.29%. You may use this bond issue to estimate FDX's cost of new issue, 30- year maturity debt. What is FDX's after tax cost of the new debt assuming a 26 percent income tax rate? Remember: After-tax cost = before-tax cost (1-tax rate). Data obtained from: H orse - - -K After-tax cost debt = (30 Points) 4. Given the after-tax cost of new FDX 30-year bonds calculated in the previous problem and that FDX reports that its debt/equity ratio is 1.02, which converts to its current capital structure is 50.5% debt (Debt/Total Asset ratio is 50.5%) and 49.5% equity, what is the weighted average cost of capital (WACC) for FDX given the cost of debt and equity capital calculated above? FDX has no preferred stock. Remember: WACC = w, *(before-tax cost of debt)*(1-tax rate) + w, *cost of equity WACC % (Total 100 points) 1. (40 points) As a new Investment Analyst for Bain & Turner (B&T) Capital Management, Inc., you are to estimate the mean, variance, standard deviation of returns and Beta for FedEx common stock. The following are annual rates of return for the previous fourteen-years for both FedEx stock and the (NYSE): YEAR FedEx ( NYSE (9 (FDX-MicanNYSE-Man 2020 - 34.87 -13.59 732.4851 2019 -26.45 5.81 43.3921 2018 22.92 6.74 392281 2017 20.21 16.13 169.2130 2016 7.06 3.75 -0.9600 2015 3.88 -2.12 63.1043 2014 25.33 8.11 71.6016 2013 15 049.87 50.4725 2012 11.934.29 -1.0620 2011 -2.68 6.78 -19.4572 2010 123.17 57.05 6177.1751 2009 -50.49 45.24 2793.1446 2008 -25.07 -3.86 256.1056 2007 -229 8.73 -34.1512 Mean 4.46071 SUM= 10253 5076 Variance 452.621 Covariance 788.7314 St. Dev. 40.97748 21.2749 Beta Regression Statistics Multiple R 0.904725 R Square 0.818528 Adjusted Square 0.803-405 Standard 18.16902 Observations 14 ET ANOVA Regression Residual Total Senificance $ M F F 17867.64 17867.5454.125798.77E-06 12 3961159 110 1133 1321829 Standard Lower Corticis Emor Shar Par Lowww 99% 95% 95.0 95. Intercept 205394.969492-0.415310.685241 -12.8915 8.763691-12.89158763691 X Variabel 1.942550 236851 73570377506 1226514225561122651425661 a) Determine the mean and variance for FedEx stock. The NYSE Index values are given above. FDX Mean Variance Std. Dev 40.977% (20 points) 2. You are an intern at FedEx Corporation and the CFO, Mr. Christopher Dickerson has asked you to estimate the growth rate and cost of equity capital (retained earnings) for the firm. Each FDX stock is expected to pay a dividend (D) of $2.60 a share next year. You estimated the beta above in problem # 1. The risk-free rate is estimated as the yield on nominal 10-year US Treasury bonds is 0.73% and the market risk premium [IM- U= 5.5%. FDX's dividend is expected to grow at the same constant rate, g, forever. The stock currently sells for $122.29 per share. Assuming the market is in equilibrium, where both the CAPM and DCF model should result in the same expected rate of return. a. What is the firm's estimated cost of equity capital for retained earnings (r) and its implied growth rate (g)? Remember: fs = rf +[rm-14]B=_0.73% + [5.5%) and P, = D/(rs - g). 07 g=rs - D/P, = b. Given average returns for the previous 14 years, is FedEx Corporation common stock underpriced or overpriced