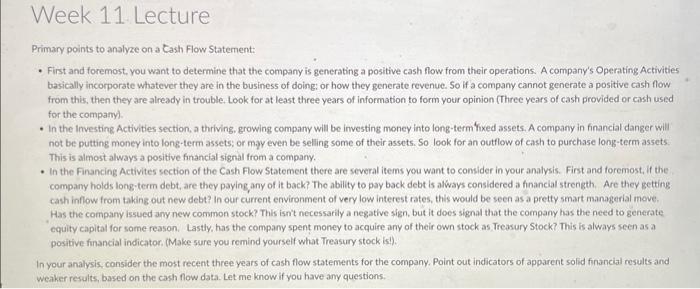

Primary points to analyze on a Cash Flow Statement: - First and foremost, you waint to determine that the company is generating a positive cash flow from their operations. A company's Operating Activities basically incorporate whatever they are in the business of doing: or how they generate revenue. So if a company cannot generate a positive cash flow from this, then they are already in trouble. Look for at least three years of information to form your opinion (Three years of cash provided or cash used for the company). - In the Investing, Activities section, a thriving, growing company will be investing money into long-term fuxed assets. A company in financial danger will not be putting money into long-term assets; or may even be selling some of their assets. So look for an outflow of cash to purchase long-term assets. This is almost always a positive financial signal from a company. - In the Financing Activites section of the Cash Flow Statement there are several items you want to consider in your analysis. First and foremost, if the company holds long-term debt, are they paying, any of it back? The ability to pay back debt is always considered a financial strength. Are they getting cash inflow from taking out new debt? In our current environment of very low interest rates, this would be seen as a pretty smart managerial move. Has the company issued any new common stock? This isn't necessarily a negative sign, but it does signal that the company has the need to generate equity capital for some reason. Lastly, has the company spent money to acquire any of their own stock as Treasury Stock? This is always seen as a positive financial indicator, (Make sure you remind yourself what Treasury stock is!). In your analysis, consider the most recent three years of cash flow statements for the company. Point out indicators of apparent solid financial results and Weaker results, based on the cash flow data. Let me know if you have any questions. For this assignment, you will analyze a cash flow statement, using the criteria found in the Lecture section of the Weck 11 Module. You may choose a cash flow statement of any publicly-traded company, but fair warning, the more straight-forward and condensed the cash flow statement is, the easier your task will be. Uplond s copy of the cash flow statement you have chosen, along with your analysis of the financial condition of the company, based on their cash flows