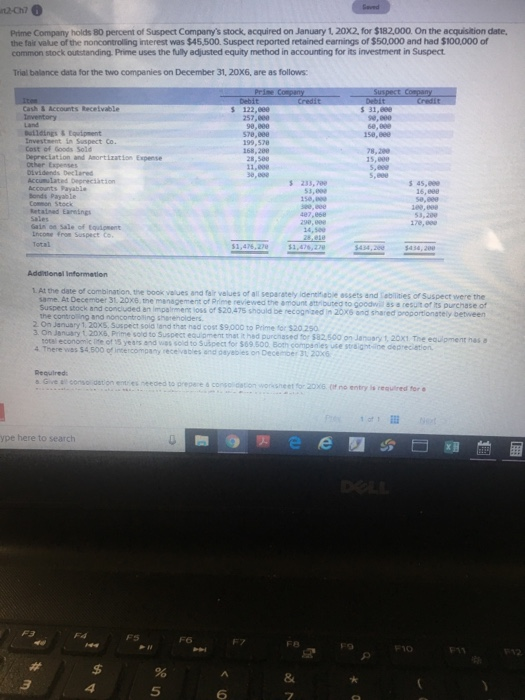

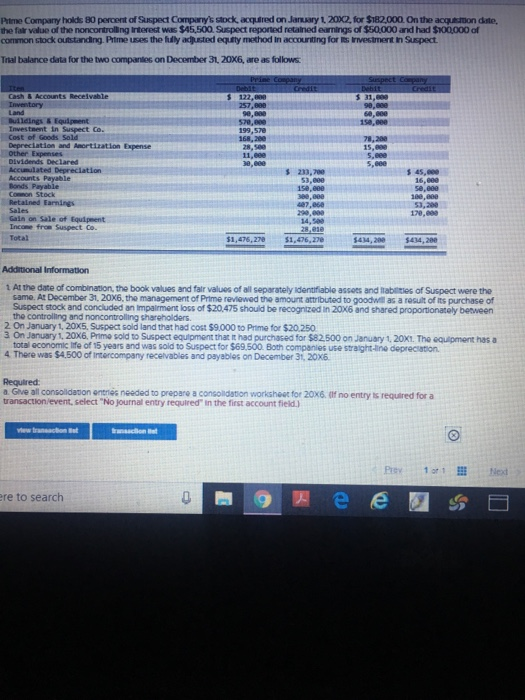

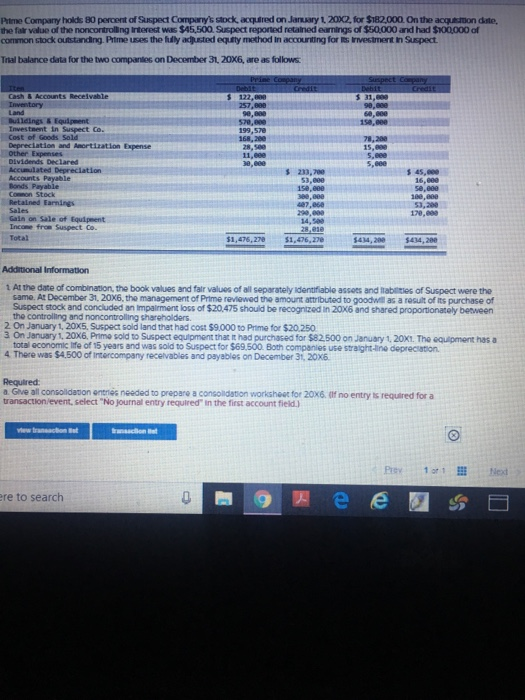

Prime Company holds 80 percent of Suspect Company's stock, acquired on January 1, 20X2, for $182,000. On the acquisition date, the fair value of the noncontrolling interest was $45,500. Suspect reported retained earnings of $50,000 and had $100,000 of common stock outstanding. Prime uses the fully adjusted equity method in accounting for its investment in Suspect Trial balance data for the two companies on December 31, 20x6, are as follows s 122,ee 98,800 6e, ee 15e, 8ee 578,900 168, 200 11,000 Investment in Suspect Co. Cost of Goods Sold bepreciat ion and Amort.izatlon Expense other Expenses 78,200 15,000 3e,000 S, ee s 233,70 $ 45,999 16,eee Accounts Payable Bonds Payable detatned Eareings 178, 809 14, 5ee Licone fron Suspect Co. Total 1,476,270 At the date of combination, the book values and fair values of all separately identmiabie assets and Sebilities of Suspect were the same. At Decemoer 31, 20xe Suspect stock and concluded the controling and noncontroiting sharenoiders the management of Prime reviewed the amount attributed to goodwil as a resut of its purchase of an Impalrmen loss of $20,475 should be recognized in 20x8 and shared proportionately between reviewed the amount 2 On January 1, 20XS, Suspect soid tand thar nad cost $9,000 to Prime for $20 250 On January t 20x6, Prime sold to Suspect equipment tnat it hed purchased for $82 500 on Janupry t, 20x1. The equipment nas a notal economic litfe of '5 years and was sold to Sulpect for $69.500 Both companies use 4 There was $4500 of inter company receivables and dayebies on December 3 206 etres needed to worksheet for 20X6, (it no entry ls required for ype here to search Fd FS F8 FAY 12 5 6 Ptme Company holds 80 percent of Suspect Company's stock, acquired on Jaruary 1 20x2, for $182,000. On the acquestion date, the fair value of the noncontroling Interest was $A5,500 Suspect repoted retained eamings of $50000 and had $100,000 of common stock outstanding Phtme uses the fuly adjusted equity method in accouniting for its Investment in Suspect Trnal balance data for the two compantes on December 31 20x6, are as follows ts Recelvah 257,8e0 Tnvestaent 1n Suspect co. Cost of Goods Sold Depreciation and Anortization Expense Other Expenses Dividends Declared 78, 200 15,890 11,890 45,000 16,000 $ 233, 70e Accounts Payable 158,e00 se,800 Retalned Earnings 170,999 Galn on Sale of Equipeent Income from Suspect Co. Total 5414, 200 $434,20e $1,476,278 $1,476, 27e t At the date of combinason, the book values and fair values of all separately identifablo assoes and niabities of Suspect were the same. At December 31, 20X6, the management of Prime reviewed the amount attributed to goodwill as a result of its purchase of Suspect stock and concluded an impairment loss of $20.475 should be recognitzed in 20x6 and shared proportionately besween the controlling and 2. On January 1, 20x5, Suspect sold land that had cost $9.000 to Prime for $20.250 3 On January 1,20x6, Prime sold to Suspect equroment that t had purchaced for $82500 on January 1, 20X1. The equipment has a total economic life of 15 years and was sold to Suspect for $69.500. Both companies use straight-ine deprecation. 4 There was $4.500 of intercompany recelvables and payables on December 31, 20x6 Required n Give all consoldaton entnes needed to prepare a consolildation worksheet for 20x6. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) re to search Prime Company holds 80 percent of Suspect Company's stock, acquired on January 1, 20X2, for $182,000. On the acquisition date, the fair value of the noncontrolling interest was $45,500. Suspect reported retained earnings of $50,000 and had $100,000 of common stock outstanding. Prime uses the fully adjusted equity method in accounting for its investment in Suspect Trial balance data for the two companies on December 31, 20x6, are as follows s 122,ee 98,800 6e, ee 15e, 8ee 578,900 168, 200 11,000 Investment in Suspect Co. Cost of Goods Sold bepreciat ion and Amort.izatlon Expense other Expenses 78,200 15,000 3e,000 S, ee s 233,70 $ 45,999 16,eee Accounts Payable Bonds Payable detatned Eareings 178, 809 14, 5ee Licone fron Suspect Co. Total 1,476,270 At the date of combination, the book values and fair values of all separately identmiabie assets and Sebilities of Suspect were the same. At Decemoer 31, 20xe Suspect stock and concluded the controling and noncontroiting sharenoiders the management of Prime reviewed the amount attributed to goodwil as a resut of its purchase of an Impalrmen loss of $20,475 should be recognized in 20x8 and shared proportionately between reviewed the amount 2 On January 1, 20XS, Suspect soid tand thar nad cost $9,000 to Prime for $20 250 On January t 20x6, Prime sold to Suspect equipment tnat it hed purchased for $82 500 on Janupry t, 20x1. The equipment nas a notal economic litfe of '5 years and was sold to Sulpect for $69.500 Both companies use 4 There was $4500 of inter company receivables and dayebies on December 3 206 etres needed to worksheet for 20X6, (it no entry ls required for ype here to search Fd FS F8 FAY 12 5 6 Ptme Company holds 80 percent of Suspect Company's stock, acquired on Jaruary 1 20x2, for $182,000. On the acquestion date, the fair value of the noncontroling Interest was $A5,500 Suspect repoted retained eamings of $50000 and had $100,000 of common stock outstanding Phtme uses the fuly adjusted equity method in accouniting for its Investment in Suspect Trnal balance data for the two compantes on December 31 20x6, are as follows ts Recelvah 257,8e0 Tnvestaent 1n Suspect co. Cost of Goods Sold Depreciation and Anortization Expense Other Expenses Dividends Declared 78, 200 15,890 11,890 45,000 16,000 $ 233, 70e Accounts Payable 158,e00 se,800 Retalned Earnings 170,999 Galn on Sale of Equipeent Income from Suspect Co. Total 5414, 200 $434,20e $1,476,278 $1,476, 27e t At the date of combinason, the book values and fair values of all separately identifablo assoes and niabities of Suspect were the same. At December 31, 20X6, the management of Prime reviewed the amount attributed to goodwill as a result of its purchase of Suspect stock and concluded an impairment loss of $20.475 should be recognitzed in 20x6 and shared proportionately besween the controlling and 2. On January 1, 20x5, Suspect sold land that had cost $9.000 to Prime for $20.250 3 On January 1,20x6, Prime sold to Suspect equroment that t had purchaced for $82500 on January 1, 20X1. The equipment has a total economic life of 15 years and was sold to Suspect for $69.500. Both companies use straight-ine deprecation. 4 There was $4.500 of intercompany recelvables and payables on December 31, 20x6 Required n Give all consoldaton entnes needed to prepare a consolildation worksheet for 20x6. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) re to search