Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prime Products hopes to borrow $30,000 on April 1 and repay it plus interest of $1,200 on June 30. The following data are available

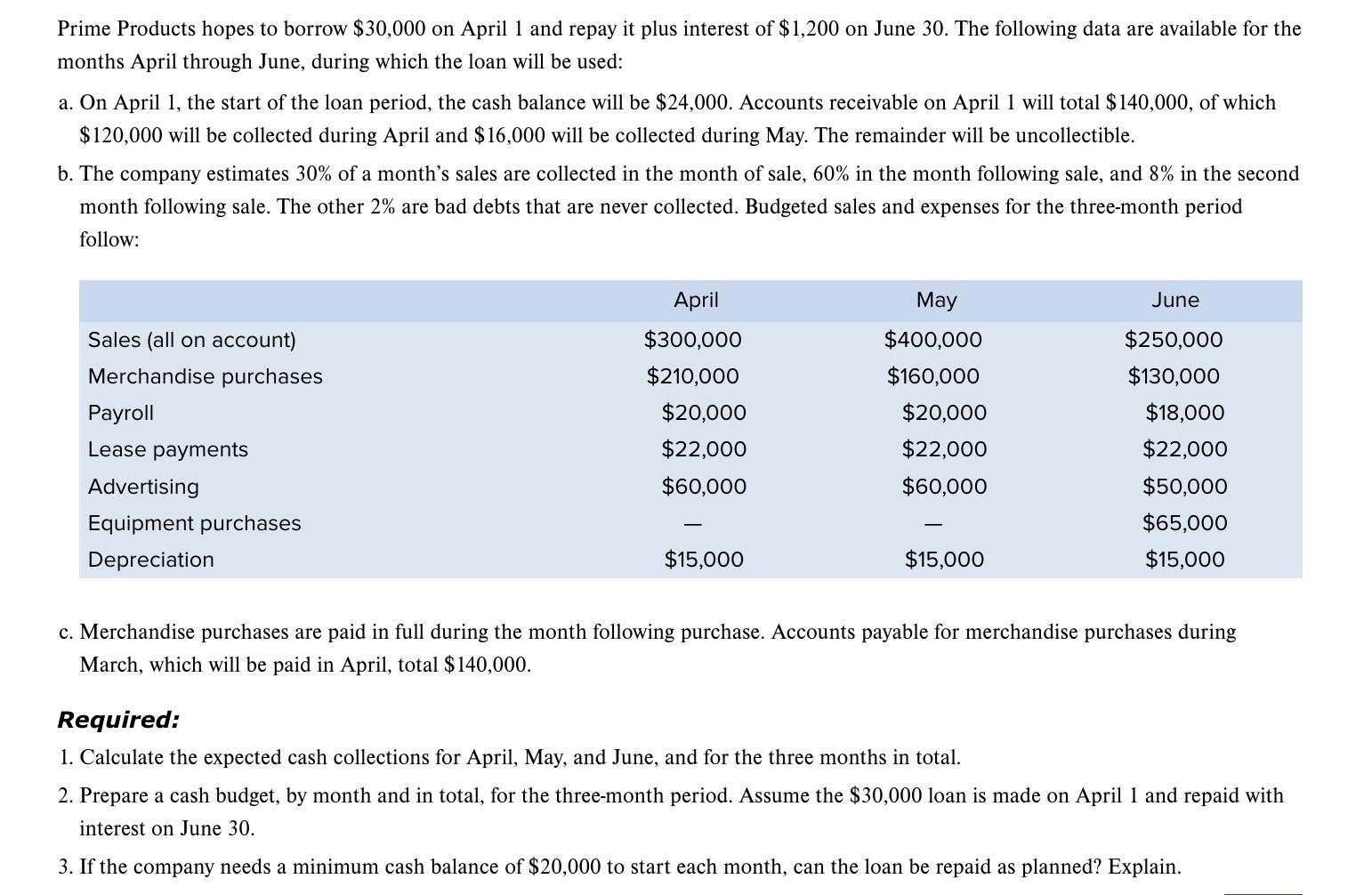

Prime Products hopes to borrow $30,000 on April 1 and repay it plus interest of $1,200 on June 30. The following data are available for the months April through June, during which the loan will be used: a. On April 1, the start of the loan period, the cash balance will be $24,000. Accounts receivable on April 1 will total $140,000, of which $120,000 will be collected during April and $16,000 will be collected during May. The remainder will be uncollectible. b. The company estimates 30% of a month's sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% are bad debts that are never collected. Budgeted sales and expenses for the three-month period follow: Sales (all on account) Merchandise purchases Payroll Lease payments Advertising Equipment purchases Depreciation April May June $300,000 $400,000 $250,000 $210,000 $160,000 $130,000 $20,000 $20,000 $18,000 $22,000 $22,000 $22,000 $60,000 $60,000 $50,000 $65,000 $15,000 $15,000 $15,000 c. Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases during March, which will be paid in April, total $140,000. Required: 1. Calculate the expected cash collections for April, May, and June, and for the three months in total. 2. Prepare a cash budget, by month and in total, for the three-month period. Assume the $30,000 loan is made on April 1 and repaid with interest on June 30. 3. If the company needs a minimum cash balance of $20,000 to start each month, can the loan be repaid as planned? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started