Question

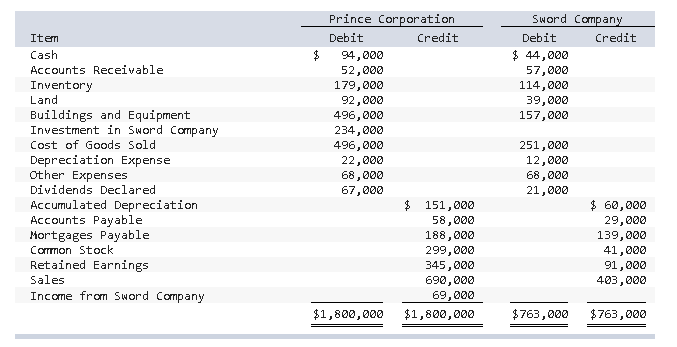

Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $186,000. The trial balances for the two companies on December 31, 20X7,

Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $186,000. The trial balances for the two companies on December 31, 20X7, included the following amounts:

Additional Information

- On January 1, 20X7, Sword reported net assets with a book value of $132,000. A total of $21,000 of the acquisition price is applied to goodwill, which was not impaired in 20X7.

- Swords depreciable assets had an estimated economic life of 11 years on the date of combination. The difference between fair value and book value of tangible assets is related entirely to buildings and equipment.

- Prince used the equity-method in accounting for its investment in Sword.

- Detailed analysis of receivables and payables showed that Sword owed Prince $24,000 on December 31, 20X7.

Required: a. Prepare all journal entries recorded by Prince with regard to its investment in Sword during 20X7. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

A. Record the initial investment in Sword Co.

B. Record Prince Corp's share of Sword Co.'s 20X7 income.

C. Record Prince Corp's share of Sword Co.'s 20X7 dividend.

D. Record the amortization of the excess acquisition price.

b. Prepare all consolidating entries needed to prepare a full set of consolidated financial statements for 20X7. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

A. Record the basic consolidation entry.

B. Record the amortized excess value reclassification entry.

C. Record the excess value (differential) reclassification entry.

D. Record the entry to eliminate the intercompany accounts.

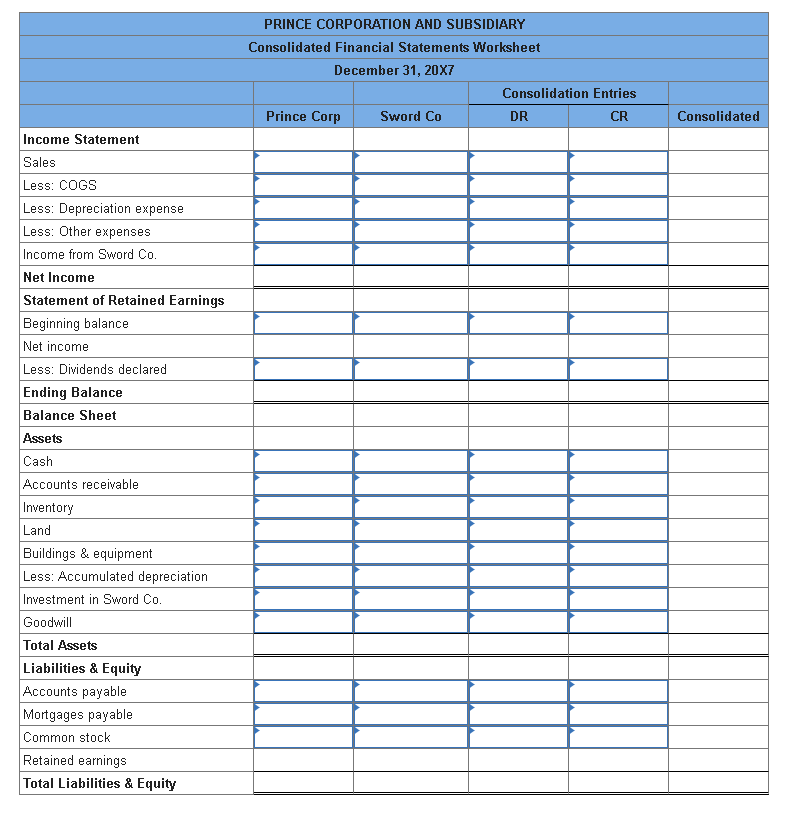

E. Record the optional accumulated depreciation consolidation entry.

c. Prepare a three-part consolidation worksheet as of December 31, 20X7. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

Sword Company Debit Credit $ 44,000 57,000 114,000 39,000 157,000 Item Cash Accounts Receivable Inventory Land Buildings and Equipment Investment in Sword Company Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Mortgages Payable Corrmon Stock Retained Earnings Sales Income from Sword Company Prince Corporation Debit Credit $ 94,000 52,000 179,000 92,000 496,000 234,000 496,000 22,000 68,000 67,000 $ 151,000 58,000 188,000 299,000 345,000 690,000 69,000 $1,800,000 $1,800,000 251,000 12,000 68,000 21,000 $ 60,000 29,000 139,000 41,000 91,000 403,000 $763,000 $763,000 Note: Enter debits before credits. General Journal Debit Credit Event 1 Record entry Clear entry View general journal Note: Enter debits before credits. General Journal Debit Credit Event 1 Record entry Clear entry View general journal PRINCE CORPORATION AND SUBSIDIARY Consolidated Financial Statements Worksheet December 31, 20X7 Consolidation Entries Prince Corp Sword Co DR CR Consolidated Income Statement Sales Less: COGS Less: Depreciation expense Less: Other expenses Income from Sword Co. Net Income Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Assets Cash Accounts receivable Inventory Land Buildings & equipment Less: Accumulated depreciation Investment in Sword Co. Goodwill Total Assets Liabilities & Equity Accounts payable Mortgages payable Common stock Retained earnings Total Liabilities & Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started