Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Principal Residence intomation she can in notel. inheritance and the proceeds are out hed below, She entered into a financing a arangement with the buyer

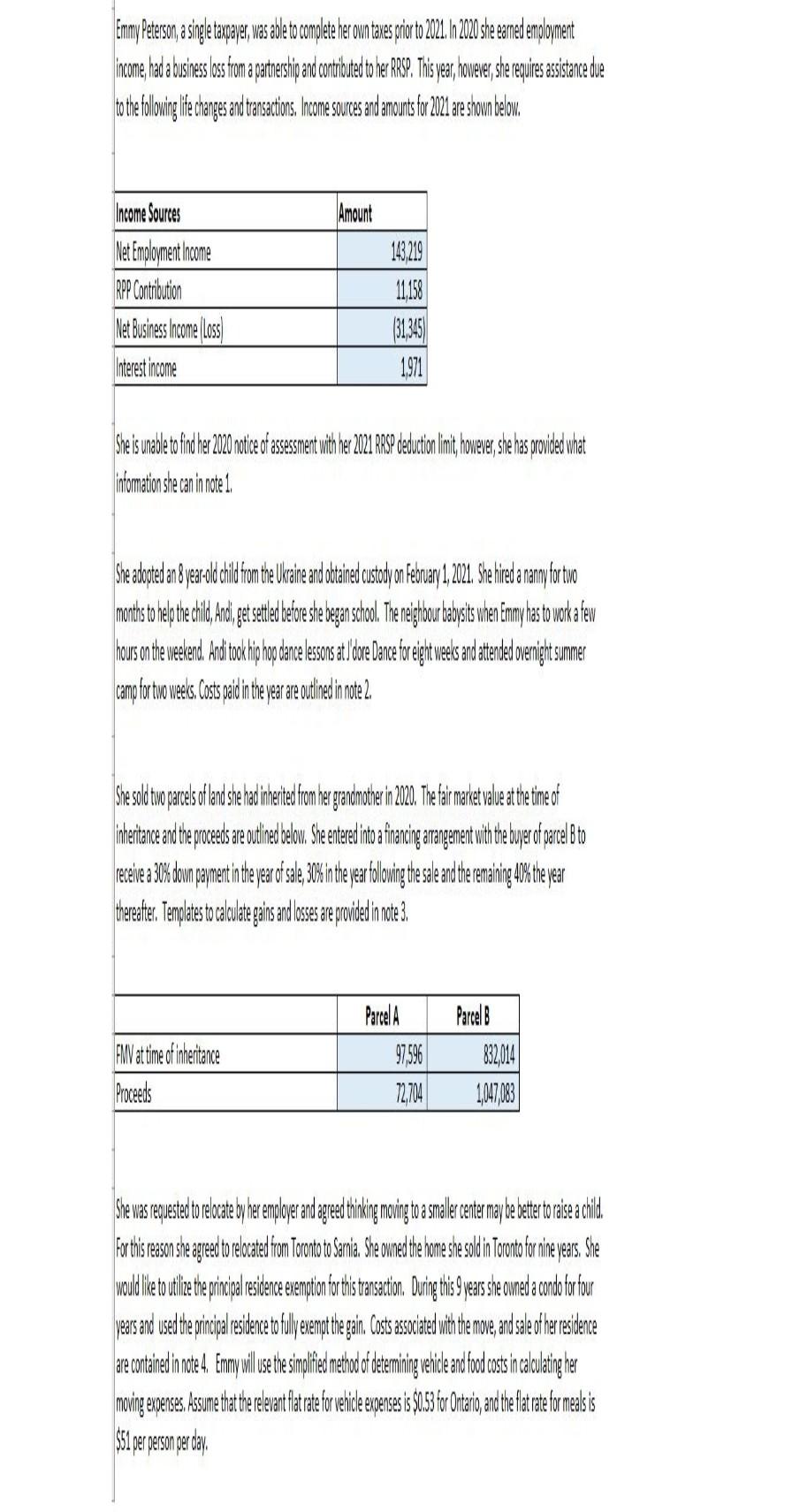

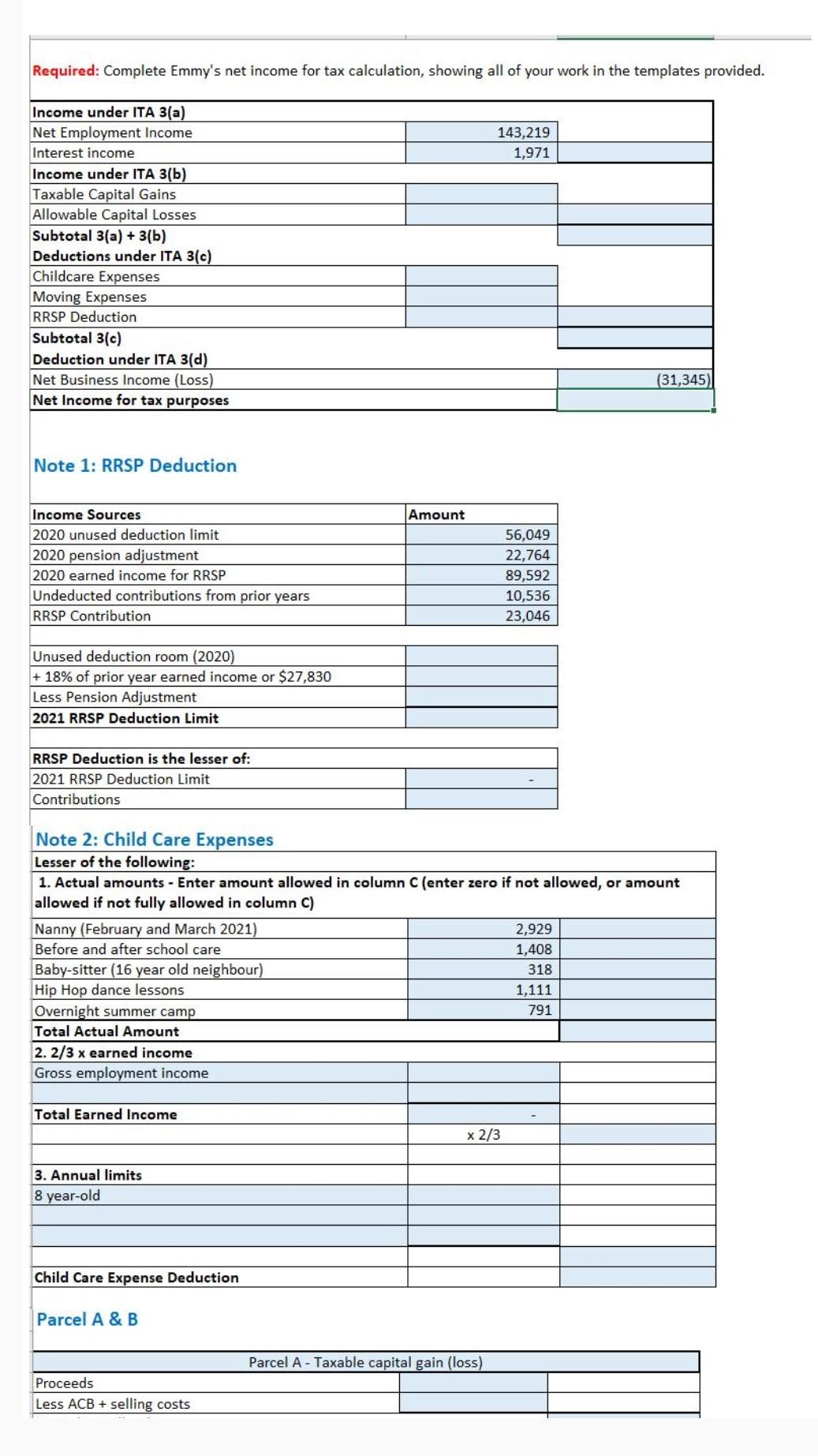

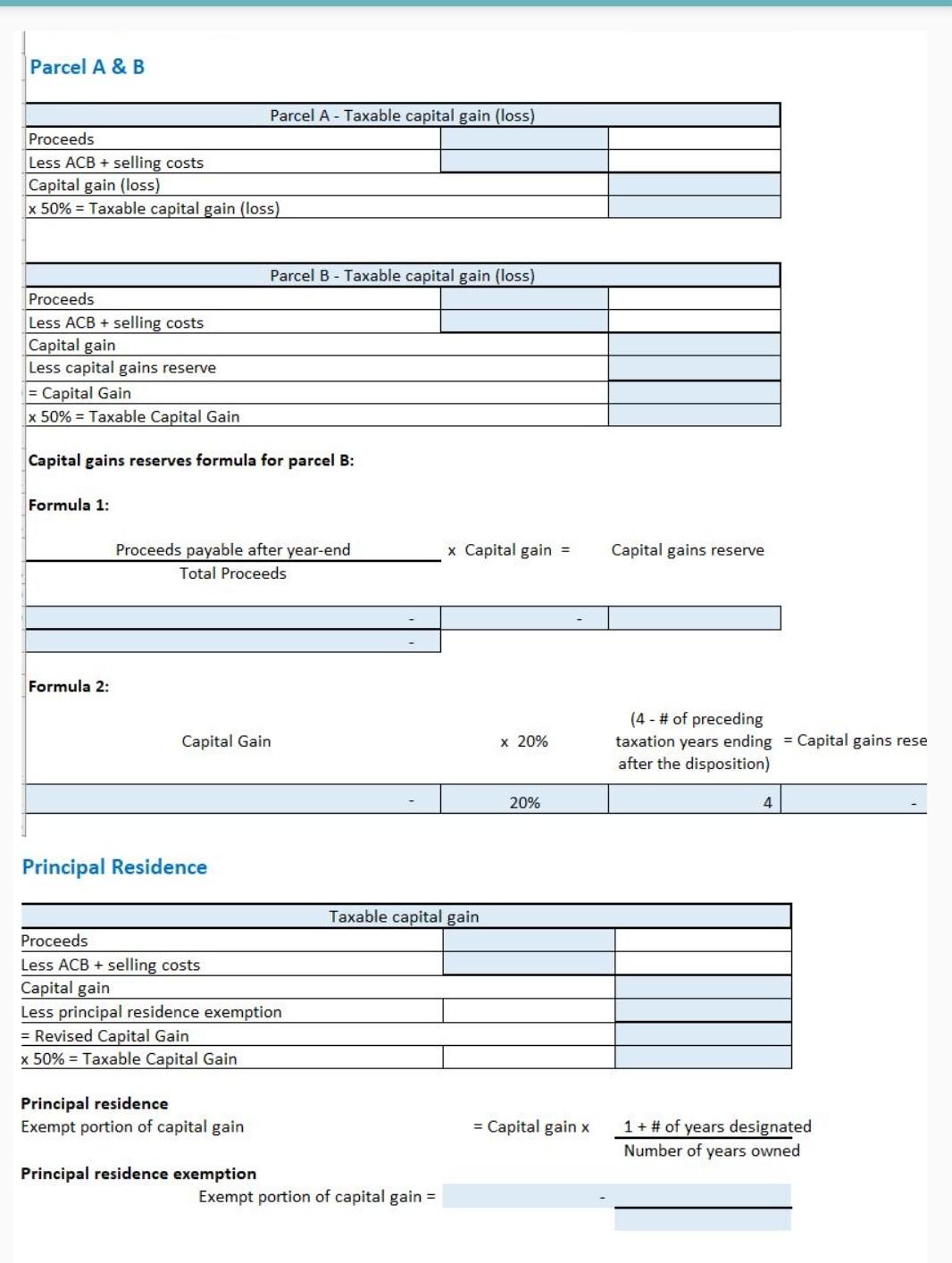

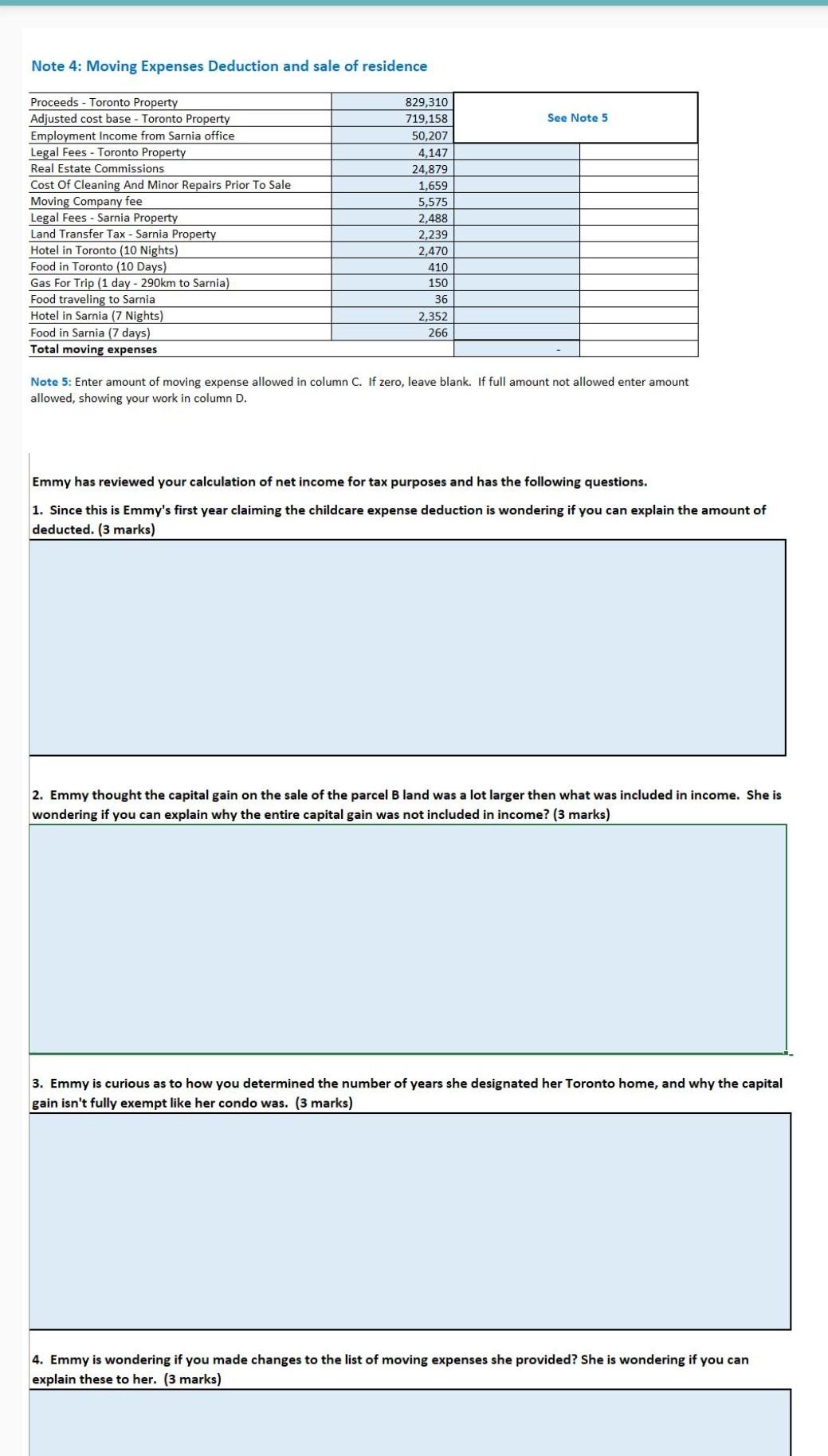

Principal Residence intomation she can in notel. inheritance and the proceeds are out hed below, She entered into a financing a arangement with the buyer of parcel B to thereatter, Templates to calculate gains and losses are pooided in note 3 . For this reason she agreed to relocated trom Toronto to Sarnia, She owned the home she sold in Toronto for nine veass. She woud like to ut the the pincical residence exemontion for this transaction, Duning this 9 years she ouned a condo tor four years and used the principal residence to fully yexemot the gain, Costs assciated with the move, and sal o of her residence. S5I. per person ner day. Note 4: Moving Expenses Deduction and sale of residence Note 5: Enter amount of moving expense allowed in column C. If zero, leave blank. If full amount not allowed enter amount allowed, showing your work in column D. Emmy has reviewed your calculation of net income for tax purposes and has the following questions. 1. Since this is Emmy's first year claiming the childcare expense deduction is wondering if you can explain the amount of deducted. (3 marks) 2. Emmy thought the capital gain on the sale of the parcel B land was a lot larger then what was included in income. She is wondering if you can explain why the entire capital gain was not included in income? ( 3 marks) 4. Emmy is wondering if you made changes to the list of moving expenses she provided? She is wondering if you can explain these to her. ( 3 marks) Required: Complete Emmy's net income for tax calculation, showing all of your work in the templates provided. Note 1: RRSP Deduction Note 2: Child Care Expenses Lesser of the following: 1. Actual amounts - Enter amount allowed in column C (enter zero if not allowed, or amount allowed if not fullv allowed in column Cl Principal Residence intomation she can in notel. inheritance and the proceeds are out hed below, She entered into a financing a arangement with the buyer of parcel B to thereatter, Templates to calculate gains and losses are pooided in note 3 . For this reason she agreed to relocated trom Toronto to Sarnia, She owned the home she sold in Toronto for nine veass. She woud like to ut the the pincical residence exemontion for this transaction, Duning this 9 years she ouned a condo tor four years and used the principal residence to fully yexemot the gain, Costs assciated with the move, and sal o of her residence. S5I. per person ner day. Note 4: Moving Expenses Deduction and sale of residence Note 5: Enter amount of moving expense allowed in column C. If zero, leave blank. If full amount not allowed enter amount allowed, showing your work in column D. Emmy has reviewed your calculation of net income for tax purposes and has the following questions. 1. Since this is Emmy's first year claiming the childcare expense deduction is wondering if you can explain the amount of deducted. (3 marks) 2. Emmy thought the capital gain on the sale of the parcel B land was a lot larger then what was included in income. She is wondering if you can explain why the entire capital gain was not included in income? ( 3 marks) 4. Emmy is wondering if you made changes to the list of moving expenses she provided? She is wondering if you can explain these to her. ( 3 marks) Required: Complete Emmy's net income for tax calculation, showing all of your work in the templates provided. Note 1: RRSP Deduction Note 2: Child Care Expenses Lesser of the following: 1. Actual amounts - Enter amount allowed in column C (enter zero if not allowed, or amount allowed if not fullv allowed in column Cl

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started