Question

Principles of Accounting (1) AACT2113 Question 1. PKB, owner of STAY HOME STAY SAVE Enterprise provides Covid-19 awareness consultation for covid-19 patients in Malaysia. STAY

Principles of Accounting (1)

AACT2113

Question 1.

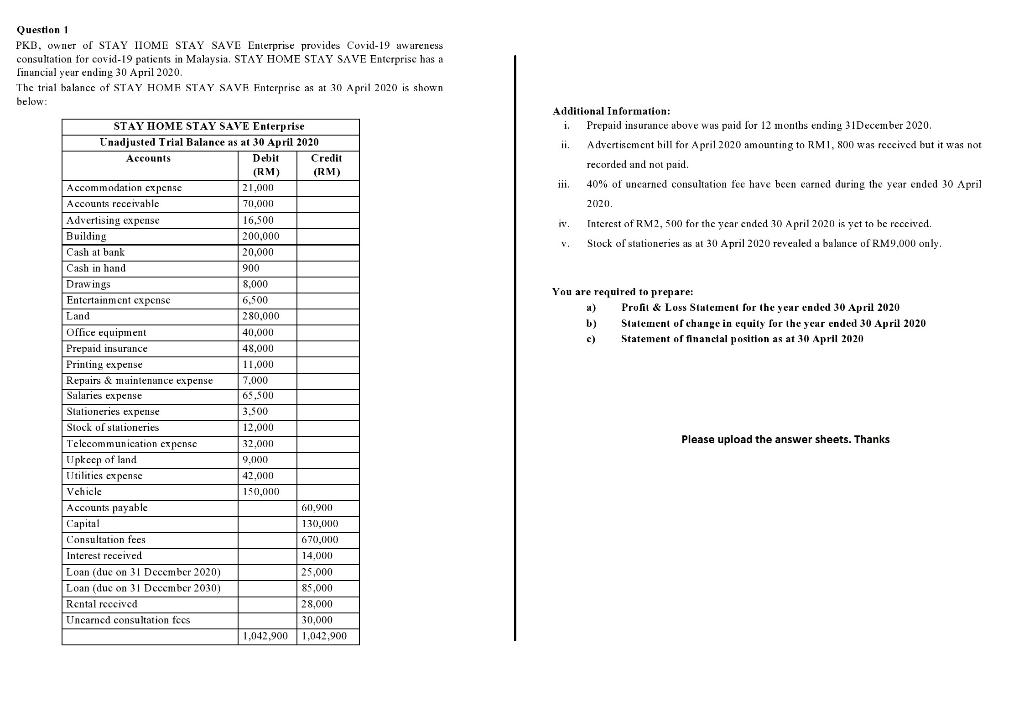

PKB, owner of STAY HOME STAY SAVE Enterprise provides Covid-19 awareness consultation for covid-19 patients in Malaysia. STAY HOME STAY SAVE Enterprise has a financial year ending 30 April 2020.

The trial balance of STAY HOME STAY SAVE Enterprise as at 30 April 2020 is shown below:

Additional Information: i. Prepaid insurance above was paid for 12 months ending 31December 2020. ii. Advertisement bill for April 2020 amounting to RM1, 800 was received but it was not recorded and not paid. iii. 40% of unearned consultation fee have been earned during the year ended 30 April 2020. iv. Interest of RM2, 500 for the year ended 30 April 2020 is yet to be received. v. Stock of stationeries as at 30 April 2020 revealed a balance of RM9,000 only. You are required to prepare: a) Profit & Loss Statement for the year ended 30 April 2020 b) Statement of change in equity for the year ended 30 April 2020 c) Statement of financial position as at 30 April 2020

Please upload the answer sheets. Thanks

Question 1 PKB, owner of STAY TIOME STAY SAVE Enterprise provides Covid-19 awareness consultation for covid-19 patients in Malaysia. STAY HOME STAY SAVE Enterprise has a financial year ending 30 April 2020. The trial balance of STAY HOME STAY SAVE Enterprise as at 30 April 2020 is shown below: Additional Information: i. i Prepaid insurance above was paid for 12 months ending 31 December 2020. ii. Advertisement hill for April 2020 amounting to RMI, 800 was received but it was not recorded and not paid. . iii. 40% of unearned consultation fee have been carned during the year ended 30 April 2020 Interest of RM2,500 for the year ended 30 April 2020 is yet to be received. Stock of stationeries as at 30 April 2020 revealed a balance of RM9.000 only. IV. You are required to prepare: ) Profit & Loss Statement for the year ended 30 April 2020 b) Statement of change in equity for the year ended 30 April 2020 c) Statement of financial position as at 30 April 2020 STAY HOME STAY SAVE Enterprise Unadjusted Trial Balance as at 30 April 2020 Accounts Debit Credit (RM) (RM) Accommodation expense 21.000 70.000 Accounts receivable ta Advertising expense 16,500 Building 200,000 Cash at bank 20.000 Cash in hand 900 son Drawings 8,000 Entertainment expense 6,500 Land 280,000 Office equipment 40.000 Once Tom Prepaid insurance 48.000 nepam Tone Printing expense . 11.000 Repairs & maintenance expense 7.000 a Salaries expense 65,500 Stationeries expense Si 3.500 La Stock of stationeries 12.000 Telecommunication expense 32.000 Upkeep of land 9.000 Utilities expense 42.000 Vehicle 150,000 ent Accounts payable Accounts 60.900 Capital 130.000 Consultation fees an 670,000 Interest received 14.000 Loan (duc on 31 December 2020) Loan (duc on 31 December 2030) 85,000 Rental received Uncarned consultation fees 30,000 1,042,900 1,042,900 Please upload the answer sheets. Thanks 25.000 28,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started