Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compounding and Discount Factor (Natural Resource Extraction) 1. 2. 3. 4. 5. Explain present value of benefit and future value cost. Assume you put

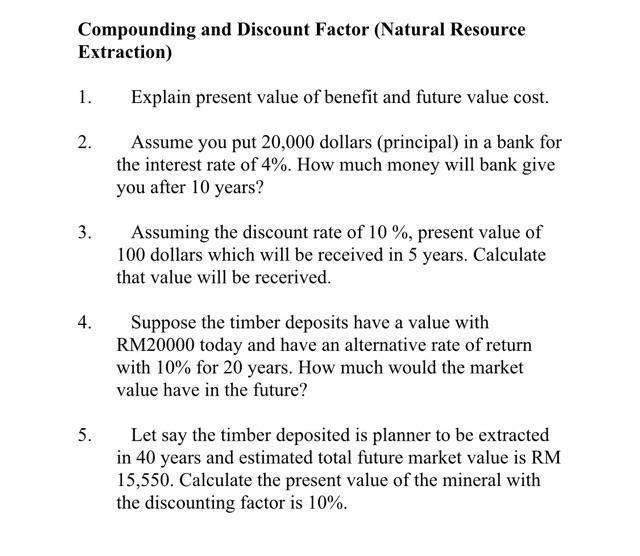

Compounding and Discount Factor (Natural Resource Extraction) 1. 2. 3. 4. 5. Explain present value of benefit and future value cost. Assume you put 20,000 dollars (principal) in a bank for the interest rate of 4%. How much money will bank give you after 10 years? Assuming the discount rate of 10 %, present value of 100 dollars which will be received in 5 years. Calculate that value will be recerived. Suppose the timber deposits have a value with RM20000 today and have an alternative rate of return with 10% for 20 years. How much would the market value have in the future? Let say the timber deposited is planner to be extracted in 40 years and estimated total future market value is RM 15,550. Calculate the present value of the mineral with the discounting factor is 10%.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Present value of benefits is the discounted value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started