Answered step by step

Verified Expert Solution

Question

1 Approved Answer

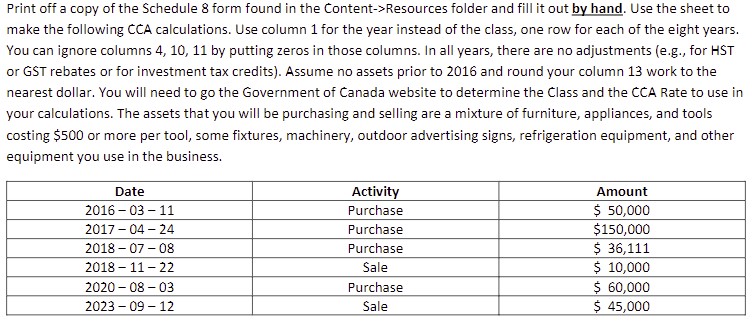

Print off a copy of the Schedule 8 form found in the Content->Resources folder and fill it out by hand. Use the sheet to

Print off a copy of the Schedule 8 form found in the Content->Resources folder and fill it out by hand. Use the sheet to make the following CCA calculations. Use column 1 for the year instead of the class, one row for each of the eight years. You can ignore columns 4, 10, 11 by putting zeros in those columns. In all years, there are no adjustments (e.g., for HST or GST rebates or for investment tax credits). Assume no assets prior to 2016 and round your column 13 work to the nearest dollar. You will need to go the Government of Canada website to determine the Class and the CCA Rate to use in your calculations. The assets that you will be purchasing and selling are a mixture of furniture, appliances, and tools costing $500 or more per tool, some fixtures, machinery, outdoor advertising signs, refrigeration equipment, and other equipment you use in the business. Date 2016-03-11 Amount Activity Purchase 2017-04-24 Purchase $ 50,000 $150,000 2018-07-08 Purchase $ 36,111 2018-11-22 Sale $ 10,000 2020-08-03 Purchase $ 60,000 2023-09-12 Sale $ 45,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To begin filling out the Schedule 8 form you need to first organize your purchases and sales into categories based on the Canadian governments classif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started