Answered step by step

Verified Expert Solution

Question

1 Approved Answer

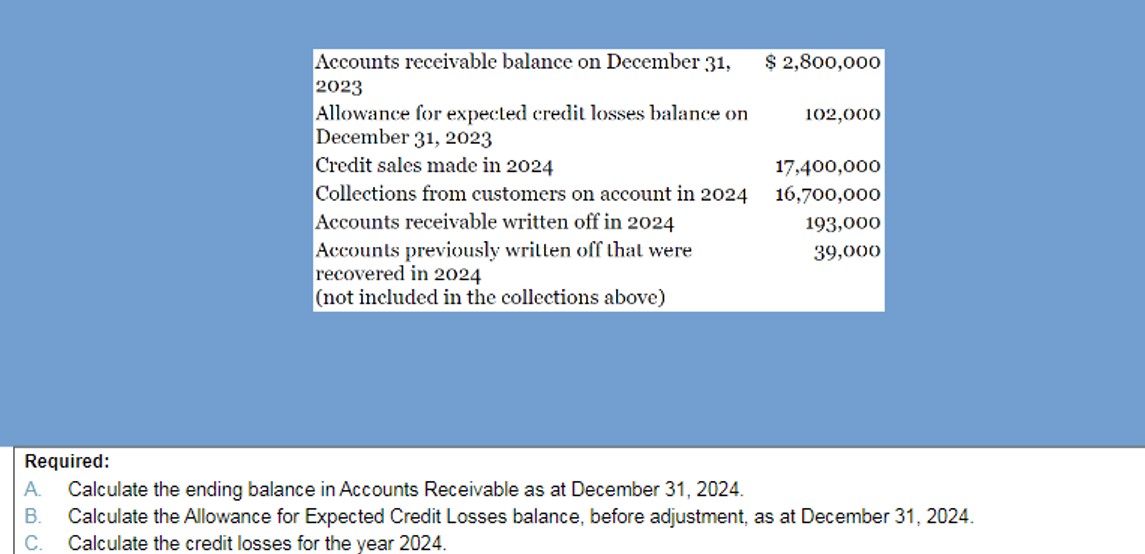

Accounts receivable balance on December 31, 2023 Allowance for expected credit losses balance on December 31, 2023 $ 2,800,000 102,000 Credit sales made in

Accounts receivable balance on December 31, 2023 Allowance for expected credit losses balance on December 31, 2023 $ 2,800,000 102,000 Credit sales made in 2024 17,400,000 Collections from customers on account in 2024 16,700,000 Accounts receivable written off in 2024 193,000 Accounts previously written off that were recovered in 2024 (not included in the collections above) 39,000 Required: A. Calculate the ending balance in Accounts Receivable as at December 31, 2024. B. Calculate the Allowance for Expected Credit Losses balance, before adjustment, as at December 31, 2024. Calculate the credit losses for the year 2024. C.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate the ending balance in Accounts Receivable as of December 31 2024 we need to consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started