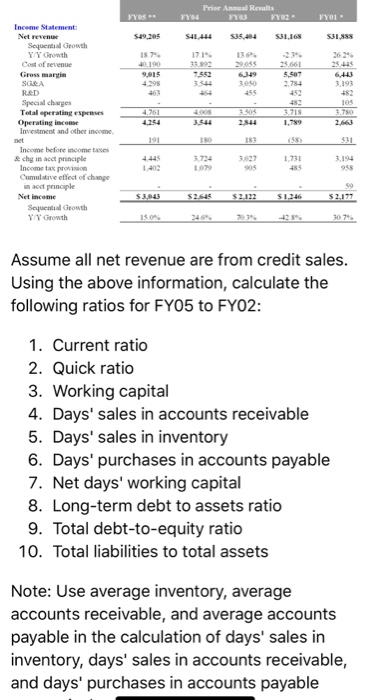

Prior Annual Results Inceme Statement Sequenmiad Geowth YY Growth 187% 171% 136% -23% 262% Cost of sevenue Cross margin 9915 5,507 2.784 452 44 39 3,193 682 los Special chaeges Tetal operating espenses Operating income Investment and other income 4254 Income before income tases 3,724 73 3,194 958 & chg in aect principle 1402 905 Income tax provisson Cumulative effect of change n acct principle Net income Sequentiad Geowth Y Growth Assume all net revenue are from credit sales Using the above information, calculate the following ratios for FY05 to FYO2 1. Current ratio 2. Quick ratio 3. Working capital 4. Days' sales in accounts receivable 5. Days' sales in inventory 6. Days' purchases in accounts payable 7. Net days' working capital 8. Long-term debt to assets ratio 9. Total debt-to-equity ratio 10. Total liabilities to total assets Note: Use average inventory, average accounts receivable, and average accounts payable in the calculation of days' sales in inventory, days' sales in accounts receivable, and days' purchases in accounts payable Prior Annual Results Inceme Statement Sequenmiad Geowth YY Growth 187% 171% 136% -23% 262% Cost of sevenue Cross margin 9915 5,507 2.784 452 44 39 3,193 682 los Special chaeges Tetal operating espenses Operating income Investment and other income 4254 Income before income tases 3,724 73 3,194 958 & chg in aect principle 1402 905 Income tax provisson Cumulative effect of change n acct principle Net income Sequentiad Geowth Y Growth Assume all net revenue are from credit sales Using the above information, calculate the following ratios for FY05 to FYO2 1. Current ratio 2. Quick ratio 3. Working capital 4. Days' sales in accounts receivable 5. Days' sales in inventory 6. Days' purchases in accounts payable 7. Net days' working capital 8. Long-term debt to assets ratio 9. Total debt-to-equity ratio 10. Total liabilities to total assets Note: Use average inventory, average accounts receivable, and average accounts payable in the calculation of days' sales in inventory, days' sales in accounts receivable, and days' purchases in accounts payable