Question

Prior to the merger, Firm Dune has RM1,140 in total earnings with 760 shares outstanding at a market price per share of RM40. Firm

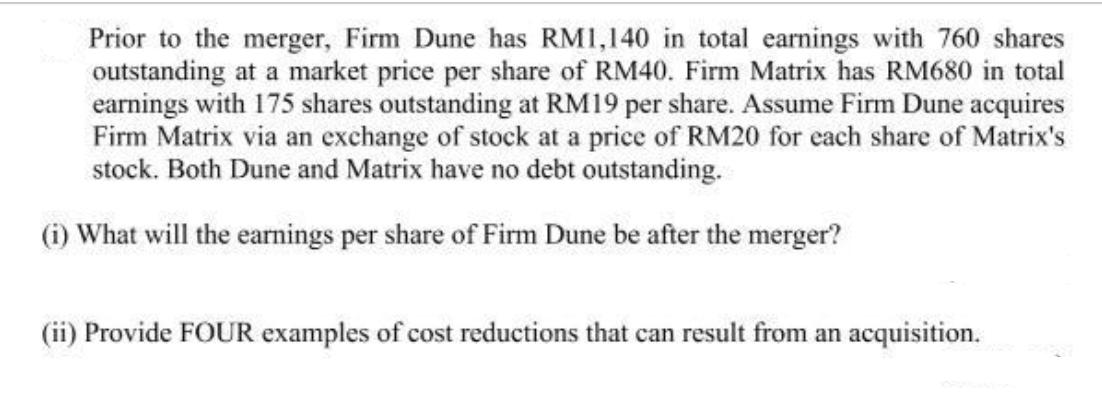

Prior to the merger, Firm Dune has RM1,140 in total earnings with 760 shares outstanding at a market price per share of RM40. Firm Matrix has RM680 in total earnings with 175 shares outstanding at RM19 per share. Assume Firm Dune acquires Firm Matrix via an exchange of stock at a price of RM20 for each share of Matrix's stock. Both Dune and Matrix have no debt outstanding. (i) What will the earnings per share of Firm Dune be after the merger? (ii) Provide FOUR examples of cost reductions that can result from an acquisition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Earnings per Share EPS after Merger To calculate the EPS after the merger we need to consider the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App