Question

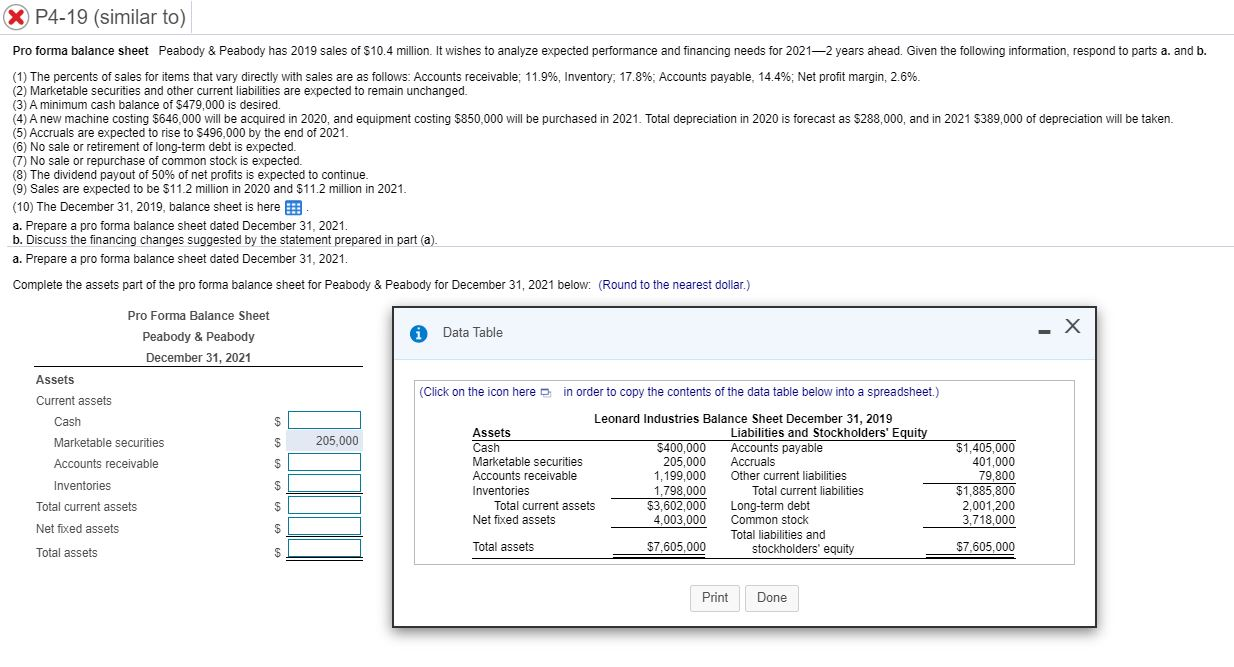

Pro forma balance sheet Peabody & Peabody has 20192019 sales of $ 10.4$10.4 million. It wishes to analyze expected performance and financing needs for 20212021long

Pro forma balance sheet Peabody & Peabody has

20192019

sales of

$ 10.4$10.4

million. It wishes to analyze expected performance and financing needs for

20212021long dash2

years ahead. Given the following information, respond to parts a. and b.

(1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable;

11.9 %11.9%,

Inventory;

17.8 %17.8%;

Accounts payable,

14.4 %14.4%;

Net profit margin,

2.6 %2.6%.

(2) Marketable securities and other current liabilities are expected to remain unchanged.

(3) A minimum cash balance of

$ 479 comma 000$479,000

is desired.

(4) A new machine costing

$ 646 comma 000$646,000

will be acquired in

20202020,

and equipment costing

$ 850 comma 000$850,000

will be purchased in

20212021.

Total depreciation in

20202020

is forecast as

$ 288 comma 000$288,000,

and in

20212021

$ 389 comma 000$389,000

of depreciation will be taken.

(5) Accruals are expected to rise to

$ 496 comma 000$496,000

by the end of

20212021.

(6) No sale or retirement of long-term debt is expected.

(7) No sale or repurchase of common stock is expected.

(8) The dividend payout of

50 %50%

of net profits is expected to continue.

(9) Sales are expected to be

$ 11.2$11.2

million in

20202020

and

$ 11.2$11.2

million in

20212021.

(10) The December 31,

20192019,

balance sheet is here

LOADING...

.

a. Prepare a pro forma balance sheet dated December 31,

20212021.

b. Discuss the financing changes suggested by the statement prepared in part

(a).

P4-19 (similar to) Pro forma balance sheet Peabody & Peabody has 2019 sales of $10.4 million. It wishes to analyze expected performance and financing needs for 20212 years ahead. Given the following information, respond to parts a. and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 11.9%, Inventory, 17.8%; Accounts payable, 14.4%; Net profit margin, 2.6% (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $479,000 is desired. (4) A new machine costing $646.000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $288,000, and in 2021 5389,000 of depreciation will be taken. (5) Accruals are expected to rise to $496,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of 50% of net profits is expected to continue. (9) Sales are expected to be $11.2 million in 2020 and $11.2 million in 2021. (10) The December 31, 2019, balance sheet is here a. Prepare a pro forma balance sheet dated December 31, 2021. b. Discuss the financing changes suggested by the statement prepared in part (a). a. Prepare a pro forma balance sheet dated December 31, 2021. Complete the assets part of the pro forma balance sheet for Peabody & Peabody for December 31, 2021 below. (Round to the nearest dollar.) Data Table x (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Pro Forma Balance Sheet Peabody & Peabody December 31, 2021 Assets Current assets Cash $ Marketable securities $ Accounts receivable $ Inventories 205,000 Leonard Industries Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Cash $400,000 Accounts payable Marketable securities 205,000 cruals Accounts receivable 1,199,000 Other current liabilities Inventories 1,798,000 Total current liabilities Total current assets $3,602,000 Long-term debt Net fixed assets 4,003,000 Common stock Total liabilities and Total assets $7,605,000 stockholders' equity $1,405,000 401,000 79,800 $1,885,800 2,001,200 3,718,000 Total current assets $ Net fixed assets $ $ Total assets $7,605,000 Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started