Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 - 1 1 A Computing and interpreting return on assets A 2 Coca - Cola and PepsiCo both produce and market beverages that

Problem A

Computing and interpreting return on assets

A

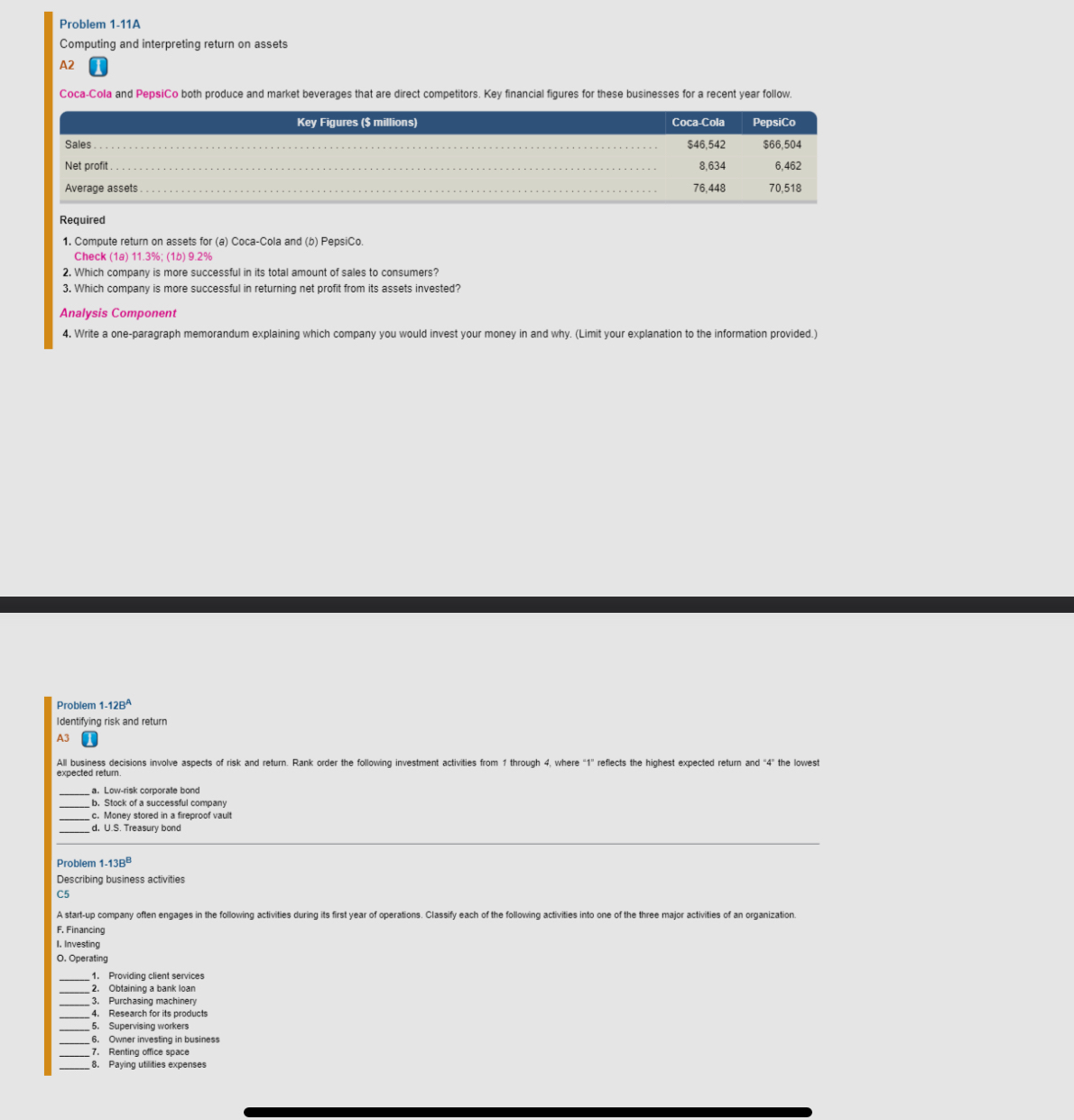

CocaCola and PepsiCo both produce and market beverages that are direct competitors. Key financial figures for these businesses for a recent year follow.

Required

Compute return on assets for a CocaCola and b PepsiCo.

Check a; b

Which company is more successful in its total amount of sales to consumers?

Which company is more successful in returning net profit from its assets invested?

Analysis Component

Write a oneparagraph memorandum explaining which company you would invest your money in and why. Limit your explanation to the information provided.

Problem BA

Identifying risk and return

All business decisions involve aspects of risk and return. Rank order the following investment activities from through where reflects the highest expected return and the lowest

expected retum.

a Lowrisk corporate bond

b Stock of a successtul company

c Money stored in a fireproof vaut

d US Treasury bond

Problem B

Describing business activities

C

A startup company often engages in the following activities during its first year of operations. Classify each of the following activities into one of the three major activities of an organization.

F Financing

I. Investing

o Operating

Providing client services

Obtaining a bank loan

Purchasing machinery

Research for its products

Supervising workers

Owner investing in business

Renting office space

Paying utitities expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started