Question

Problem 1 (14points):Assume the forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=7.5% and r(2)=8%. Keep at least 6 decimal digits

Problem 1 (14points):Assume the forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=7.5% and r(2)=8%. Keep at least 6 decimal digits while doing calculations and reporting the answer.

a) (3points) Find the 2-year spot rate.

b) (3points) Find the price of an 8% coupon bond maturing in 2 years. Keep at least 4 decimal digits while doing calculations and reporting the answer.

c) (3points) If you want to issue a two-year bond so that its current price is equal to its face value, what coupon rate should have? (This rate is known as par rate.)Keep at least 6 decimal digits while doing calculations and reporting the answer.

d) (5points) Assume that a 12% coupon bond maturing in 2 years sells for $108 while an 8% bond maturing in 2 years sells for a fair price (that you were expected to compute in part (b)). Assume also that there is a 2-year zero-coupon bond selling for a fair price (based on the given forward rates). How can you make an arbitrage by trading only these three bonds? State how many of each bond you want to buy or sell (assume you can freely short-sell any bond) and your net cash flow at each point in time. Note that to make arbitrage you must have non-negative profit at any point in time and strictly positive profit at least at one point in time.

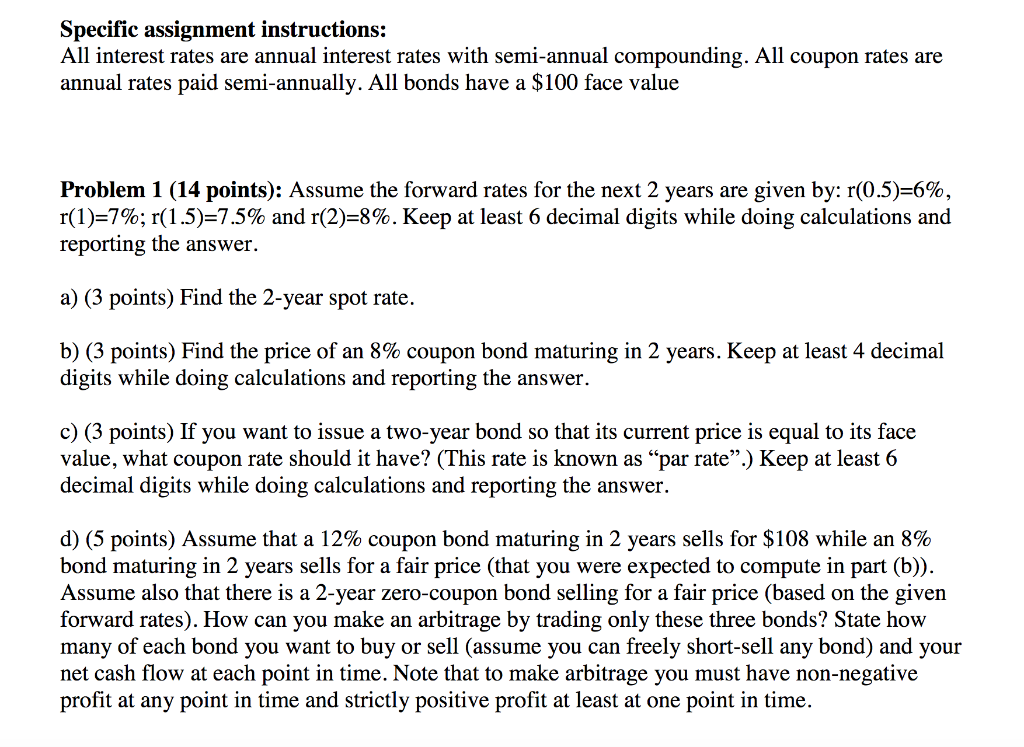

Specific assignment instructions: All interest rates are annual interest rates with semi-annual compounding. All coupon rates are annual rates paid semi-annually. All bonds have a $100 face value Problem 1 (14 points): Assume the forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=7.5% and r(2)=8%. Keep at least 6 decimal digits while doing calculations and reporting the answer. a) (3 points) Find the 2-year spot rate. b) (3 points) Find the price of an 8% coupon bond maturing in 2 years. Keep at least 4 decimal digits while doing calculations and reporting the answer. c) (3 points) If you want to issue a two-year bond so that its current price is equal to its face value, what coupon rate should it have? (This rate is known as par rate.) Keep at least 6 decimal digits while doing calculations and reporting the answer. d) (5 points) Assume that a 12% coupon bond maturing in 2 years sells for $108 while an 8% bond maturing in 2 years sells for a fair price (that you were expected to compute in part (b)). Assume also that there is a 2-year zero-coupon bond selling for a fair price (based on the given forward rates). How can you make an arbitrage by trading only these three bonds? State how many of each bond you want to buy or sell (assume you can freely short-sell any bond) and your net cash flow at each point in time. Note that to make arbitrage you must have non-negative profit at any point in time and strictly positive profit at least at one point in time. Specific assignment instructions: All interest rates are annual interest rates with semi-annual compounding. All coupon rates are annual rates paid semi-annually. All bonds have a $100 face value Problem 1 (14 points): Assume the forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=7.5% and r(2)=8%. Keep at least 6 decimal digits while doing calculations and reporting the answer. a) (3 points) Find the 2-year spot rate. b) (3 points) Find the price of an 8% coupon bond maturing in 2 years. Keep at least 4 decimal digits while doing calculations and reporting the answer. c) (3 points) If you want to issue a two-year bond so that its current price is equal to its face value, what coupon rate should it have? (This rate is known as par rate.) Keep at least 6 decimal digits while doing calculations and reporting the answer. d) (5 points) Assume that a 12% coupon bond maturing in 2 years sells for $108 while an 8% bond maturing in 2 years sells for a fair price (that you were expected to compute in part (b)). Assume also that there is a 2-year zero-coupon bond selling for a fair price (based on the given forward rates). How can you make an arbitrage by trading only these three bonds? State how many of each bond you want to buy or sell (assume you can freely short-sell any bond) and your net cash flow at each point in time. Note that to make arbitrage you must have non-negative profit at any point in time and strictly positive profit at least at one point in timeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started