Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 2 - 5 3 ( Algo ) Real Options and Sensitivity Analysis [ LO 1 2 - 4 , 1 2 - 5

Problem Algo Real Options and Sensitivity Analysis LO

Refer to the XYZ Company example in the chapter and the results in Panels A and B of Exhibit On the basis of this information, management of the company has decided to delay the implementation of the project for year. Those managers are now interested in knowing how sensitive this decision is with respect to the assumptions they've made regarding the basic analysis. Therefore, they have asked you to prepare some supplementary analyses regarding Panel B of Exhibit

Required:

Holding everything else constant, what is the expected NPV of the decision if the probabilities for the three scenarios are as follows: high medium and low

Holding everything else constant, what is the expected NPV of the decision if the probabilities for the three scenarios are as follows: high medium and low

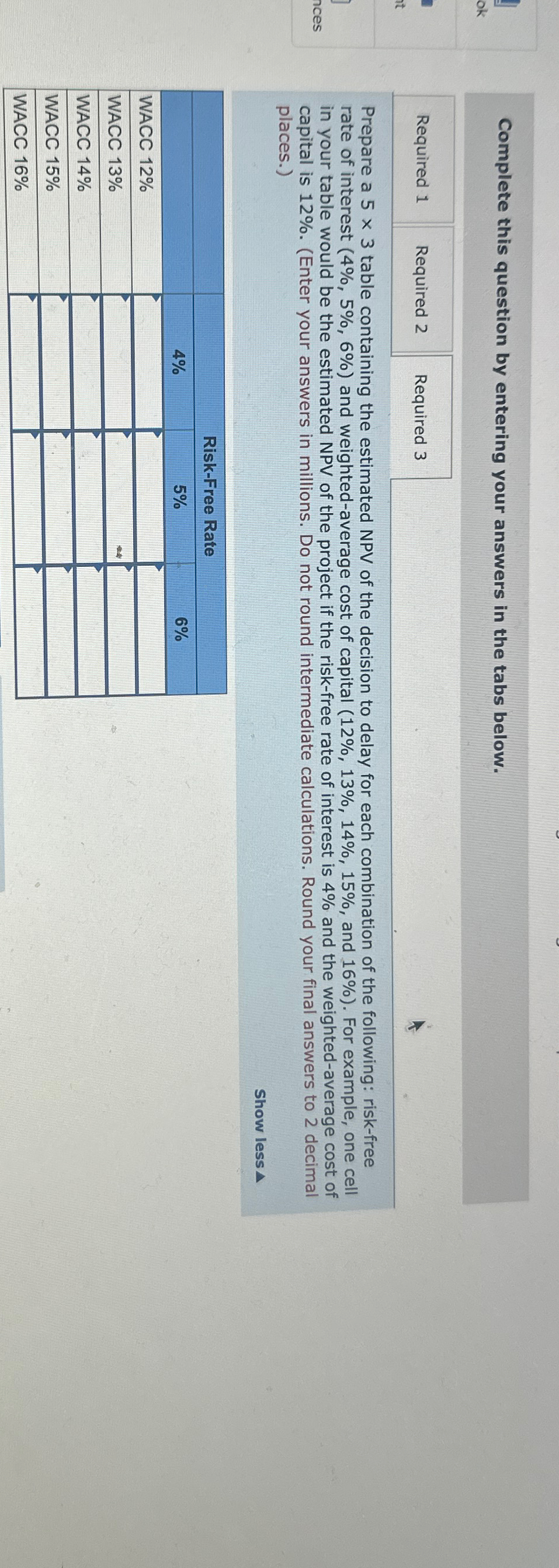

Prepare a table containing the estimated NPV of the decision to delay for each combination of the following: riskfree rate of interest and weightedaverage cost of capital and For example, one cell in your table would be the estimated NPV of the project if the riskfree rate of interest is and the weightedaverage cost of capital is

Complete this question by entering your answers in the tabs below.

Holding everything else constant, what is the expected NPV of the decision if the probabilities for the three scenarios are as follows: high medium and low Enter your answers in millions. Do not round intermediate calculations. Round your final answers to decimal places.

tableScenarioNPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started