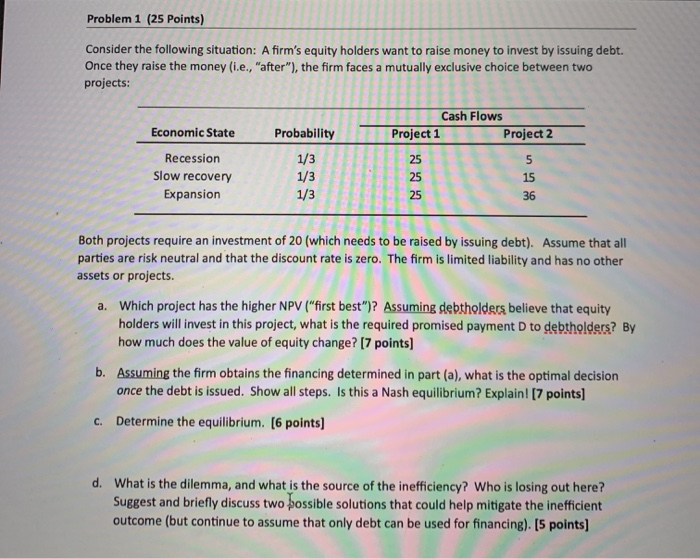

Problem 1 (25 Points) Consider the following situation: A firm's equity holders want to raise money to invest by issuing debt. Once they raise the money (ie, "after"), the firm faces a mutually exclusive choice between two projects: Cash Flows Project 1 Project 2 Probability Economic State Recession Slow recovery Expansion ww 1/3 Both projects require an investment of 20 (which needs to be raised by issuing debt). Assume that all parties are risk neutral and that the discount rate is zero. The firm is limited liability and has no other assets or projects. a. Which project has the higher NPV ("first best")? Assuming debtholders believe that equity holders will invest in this project, what is the required promised payment D to debtholders? By how much does the value of equity change? [7 points) b. Assuming the firm obtains the financing determined in part (a), what is the optimal decision once the debt is issued. Show all steps. Is this a Nash equilibrium? Explain! [7 points) c. Determine the equilibrium. (6 points) d. What is the dilemma, and what is the source of the inefficiency? Who is losing out here? Suggest and briefly discuss two possible solutions that could help mitigate the inefficient outcome (but continue to assume that only debt can be used for financing). [5 points) Problem 1 (25 Points) Consider the following situation: A firm's equity holders want to raise money to invest by issuing debt. Once they raise the money (ie, "after"), the firm faces a mutually exclusive choice between two projects: Cash Flows Project 1 Project 2 Probability Economic State Recession Slow recovery Expansion ww 1/3 Both projects require an investment of 20 (which needs to be raised by issuing debt). Assume that all parties are risk neutral and that the discount rate is zero. The firm is limited liability and has no other assets or projects. a. Which project has the higher NPV ("first best")? Assuming debtholders believe that equity holders will invest in this project, what is the required promised payment D to debtholders? By how much does the value of equity change? [7 points) b. Assuming the firm obtains the financing determined in part (a), what is the optimal decision once the debt is issued. Show all steps. Is this a Nash equilibrium? Explain! [7 points) c. Determine the equilibrium. (6 points) d. What is the dilemma, and what is the source of the inefficiency? Who is losing out here? Suggest and briefly discuss two possible solutions that could help mitigate the inefficient outcome (but continue to assume that only debt can be used for financing). [5 points)