Answered step by step

Verified Expert Solution

Question

1 Approved Answer

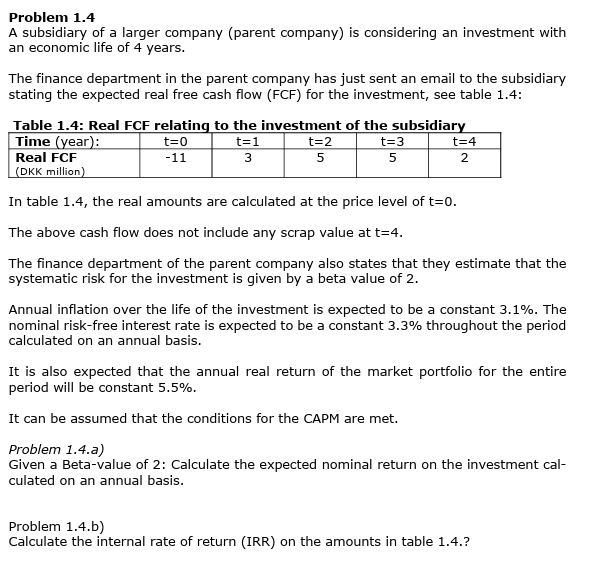

Problem 1 . 4 A subsidiary of a larger company ( parent company ) is considering an investment with an economic life of 4 years.

Problem

A subsidiary of a larger company parent company is considering an investment with

an economic life of years.

The finance department in the parent company has just sent an email to the subsidiary

stating the expected real free cash flow FCF for the investment, see table :

Table : Real FCF relating to the investment of the subsidiary

In table the real amounts are calculated at the price level of

The above cash flow does not include any scrap value at

The finance department of the parent company also states that they estimate that the

systematic risk for the investment is given by a beta value of

Annual inflation over the life of the investment is expected to be a constant The

nominal riskfree interest rate is expected to be a constant throughout the period

calculated on an annual basis.

It is also expected that the annual real return of the market portfolio for the entire

period will be constant

It can be assumed that the conditions for the CAPM are met.

Problem a

Given a Betavalue of : Calculate the expected nominal return on the investment cal

culated on an annual basis.

Problem b

Calculate the internal rate of return IRR on the amounts in table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started