Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LONG-TERM RATES : HUMPED;NORMAL;INVERTED;FLAT SHORT-INVERTED,NORMAL,FLAT, HUMPED short term interrest rates are less than the long term rates. Attempts Average: 13 2. More basic concepts: alternative

LONG-TERM RATES : HUMPED;NORMAL;INVERTED;FLAT

SHORT-INVERTED,NORMAL,FLAT, HUMPED

short term interrest rates are less than the long term rates.

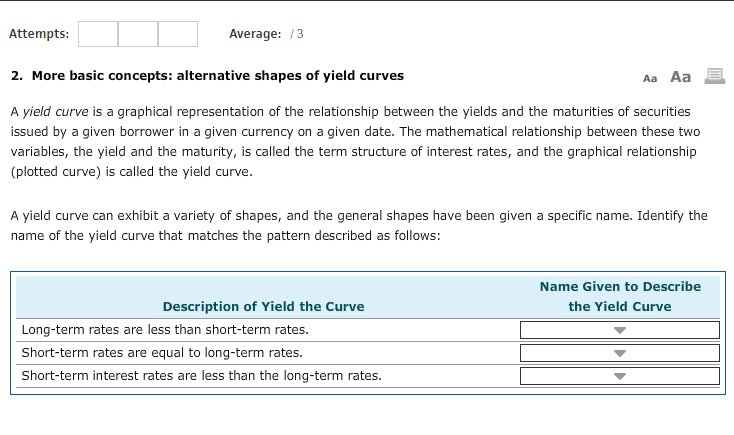

Attempts Average: 13 2. More basic concepts: alternative shapes of yield curves Aa Aa A yield curve is a graphical representation of the relationship between the yields and the maturities of securities issued by a given borrower in a given currency on a given date. The mathematical relationship between these two variables, the yield and the maturity, is called the term structure of interest rates, and the graphical relationship (plotted curve) is called the yield curve. A yield curve can exhibit a variety of shapes, and the general shapes have been given a specific name. Identify the name of the yield curve that matches the pattern described as follows: Name Given to Describe Description of Yield the Curve the Yield Curve Long-term rates are less than short-term rates. Short-term rates are equal to long-term rates. Short-term interest rates are less than the long-term rates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started