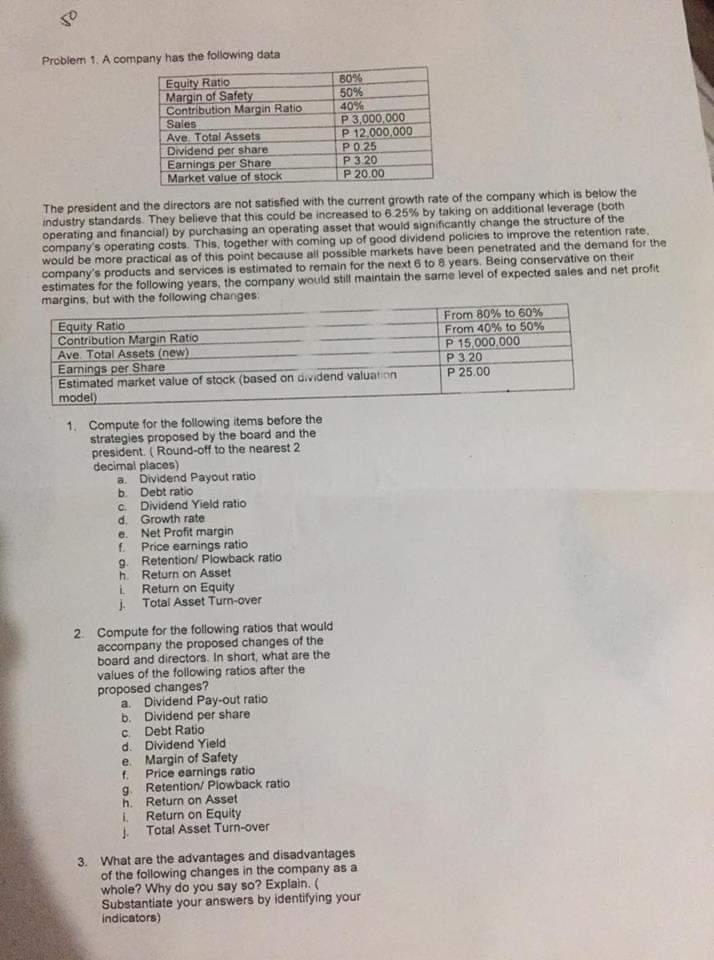

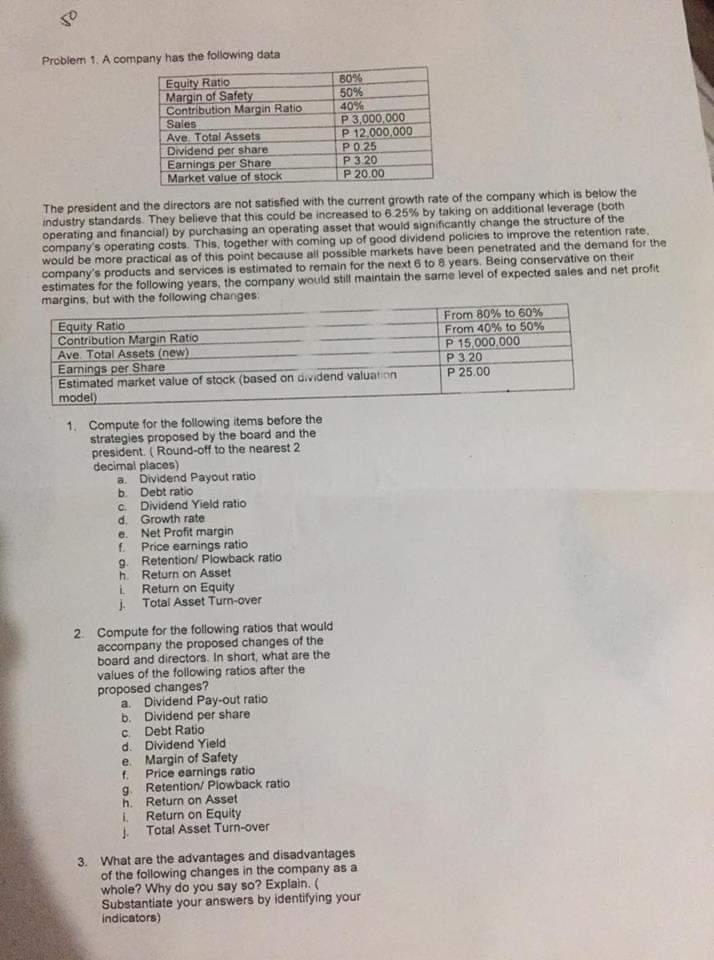

Problem 1. A company has the following data Equity Ratio Margin of Safe Contribution Margin Ratio Sales Ave Total Assets Dividend per share Earnings per Share Market value of stock 40% P 3,000 000 P 12.000,000 P 025 P 3.20 P 20.00 The president and the industry standards. They believe that this could be increased to 625% by taking on additional leverage (both operating and financial) by purchasing an operating asset that would significantly change the structure of the company's operating costs. This, together with coming up of good dividend policies to improve the retention rate, would be more practical as of this point because all possible markets have been penetrated and the demand for the company's products and services is estimated to remain for the next 6 to 8 years, Being conservative on their estimates for the following years, the company would still maintain the same level of expected sales and net proft directors are not satisfied with the current growth rate of the company which is below the margins, but with the following changes 1 From 80% to 60% Equity Ratio Contribution Margin Rati Ave Total Assets(new) Eanings per Share Estimated market value of stock (based on dividend valuation From 40% to 50% P 15,000 000 P 25.00 Compute for the following items before the strategies proposed by the board and the president. ( Round-off to the nearest 2 decimal places) 1. a. Dividend Payout ratio b. Debt ratio c. Dividend Yield ratio d. Growth rate e. Net Profit margin f. Price earnings ratio g. Retention/ Plowback ratio h. Return on Asset i. Return on Equity J Total Asset Turn-over 2. Compute for the following ratios that would accompany the proposed changes of the board and directors. In short, what are the values of the following ratios after the proposed changes? a. Dividend Pay-out ratio b. Dividend per share c. Debt Ratio d. Dividend Yield e. Margin of Safety f. Price earnings ratio g. Retention/ Plowback ratio h. Return on Asset i. Return on Equity J. Total Asset Turn-over What are the advantages and disadvantages of the following changes in the company as a whole? Why do you say so? Explain. ( Substantiate your answers by identifying your indicators) 3