I need the answers right please

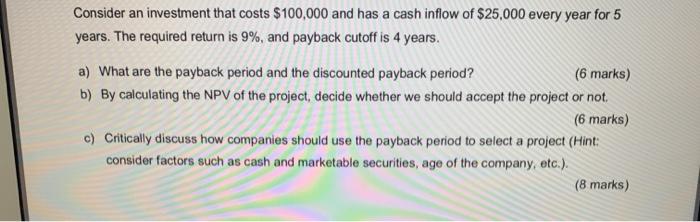

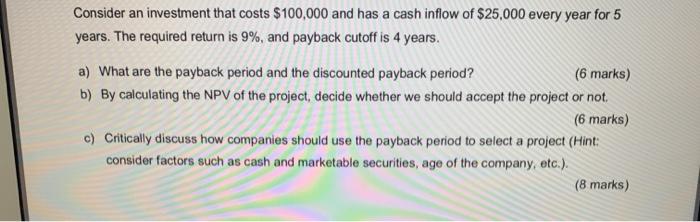

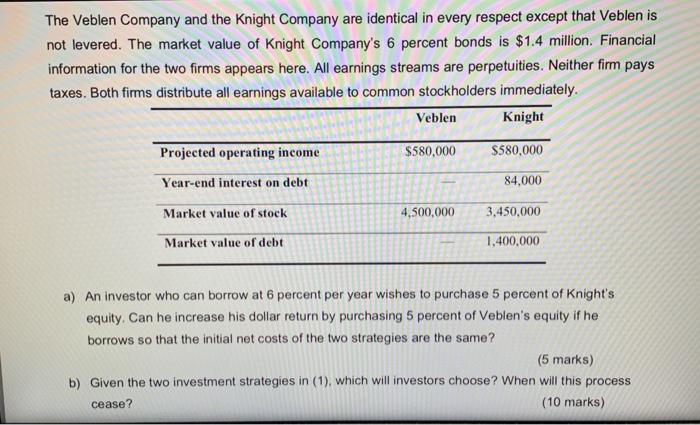

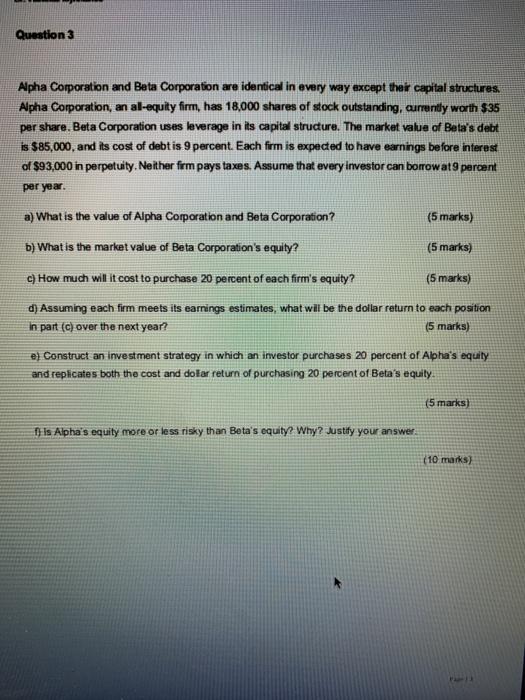

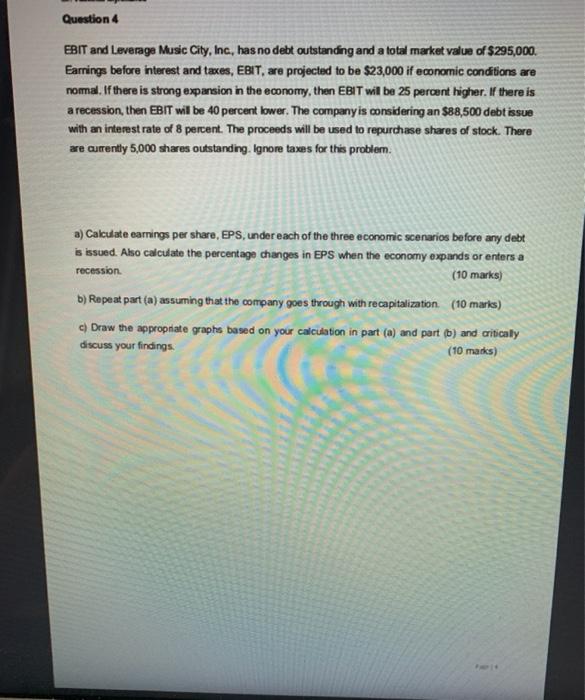

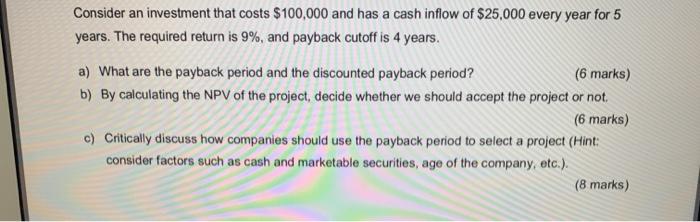

Consider an investment that costs $100,000 and has a cash inflow of $25,000 every year for 5 years. The required return is 9%, and payback cutoff is 4 years. a) What are the payback period and the discounted payback period? (6 marks) b) By calculating the NPV of the project, decide whether we should accept the project or not (6 marks) c) Critically discuss how companies should use the payback period to select a project (Hint: consider factors such as cash and marketable securities, age of the company, etc.). (8 marks) The Veblen Company and the Knight Company are identical in every respect except that Veblen is not levered. The market value of Knight Company's 6 percent bonds is $1.4 million. Financial information for the two firms appears here. All earnings streams are perpetuities. Neither firm pays taxes. Both firms distribute all earnings available to common stockholders immediately. Veblen Knight Projected operating income $580,000 $580,000 Year-end interest on debt 84.000 Market value of stock 4,500,000 3,450,000 Market value of debt 1,400,000 a) An investor who can borrow at 6 percent per year wishes to purchase 5 percent of Knight's equity. Can he increase his dollar return by purchasing 5 percent of Veblen's equity if he borrows so that the initial net costs of the two strategies are the same? (5 marks) b) Given the two investment strategies in (1), which will investors choose? When will this process cease? (10 marks) Question 3 Alpha Corporation and Beta Corporation are identical in every way except their capital structures. Alpha Corporation, an al-equity firm, has 18,000 shares of stock outstanding, currently worth $35 per share. Beta Corporation uses leverage in its capital structure. The market value of Beta's debt is $85,000, and its cost of debt is 9 percent. Each firm is expected to have earnings before interest of $93,000 in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at9 percent per year. a) What is the value of Alpha Corporation and Beta Corporation ? (5 marks) b) What is the market value of Beta Corporation's equity? (5 marks) c) How much will it cost to purchase 20 percent of each firm's equity? (5 marks) d) Assuming each firm meets its earrings estimates, what will be the dollar return to each position In part (c) over the next year? (5 marks) e) Construct an investment strategy in which an investor purchases 20 percent of Alpha's equity and replicates both the cost and doar return of purchasing 20 percent of Betas equity. (5 marks) f} Is Alpha's equity more or less risky than Beta's equity? Why? Justify your answer. (10 marks) Question 4 EBIT and Leverage Music City, Inc, has no debt outstanding and a total market value of $295,000 Earnings before interest and taxes, EBIT, are projected to be $23,000 if economic conditions are nomal. If there is strong expansion in the economy, then EBIT will be 25 percent higher. If there is a recession, then EBIT will be 40 percent lower. The company is considering an $88,500 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 5,000 shares outstanding. Ignore taxes for this problem. a) Calculate earnings per share, EPS, under each of the three economic scenarios before any debt is issued. Also calculate the percentage changes in EPS when the economy expands or enters a recession (10 marks) b) Repeat part (a) assuming that the company goes through with recapitalization (10 marks) c) Draw the appropriate graphe based on your calculation in part (a) and part (0) and critically discuss your findings (10 marks)