Answered step by step

Verified Expert Solution

Question

1 Approved Answer

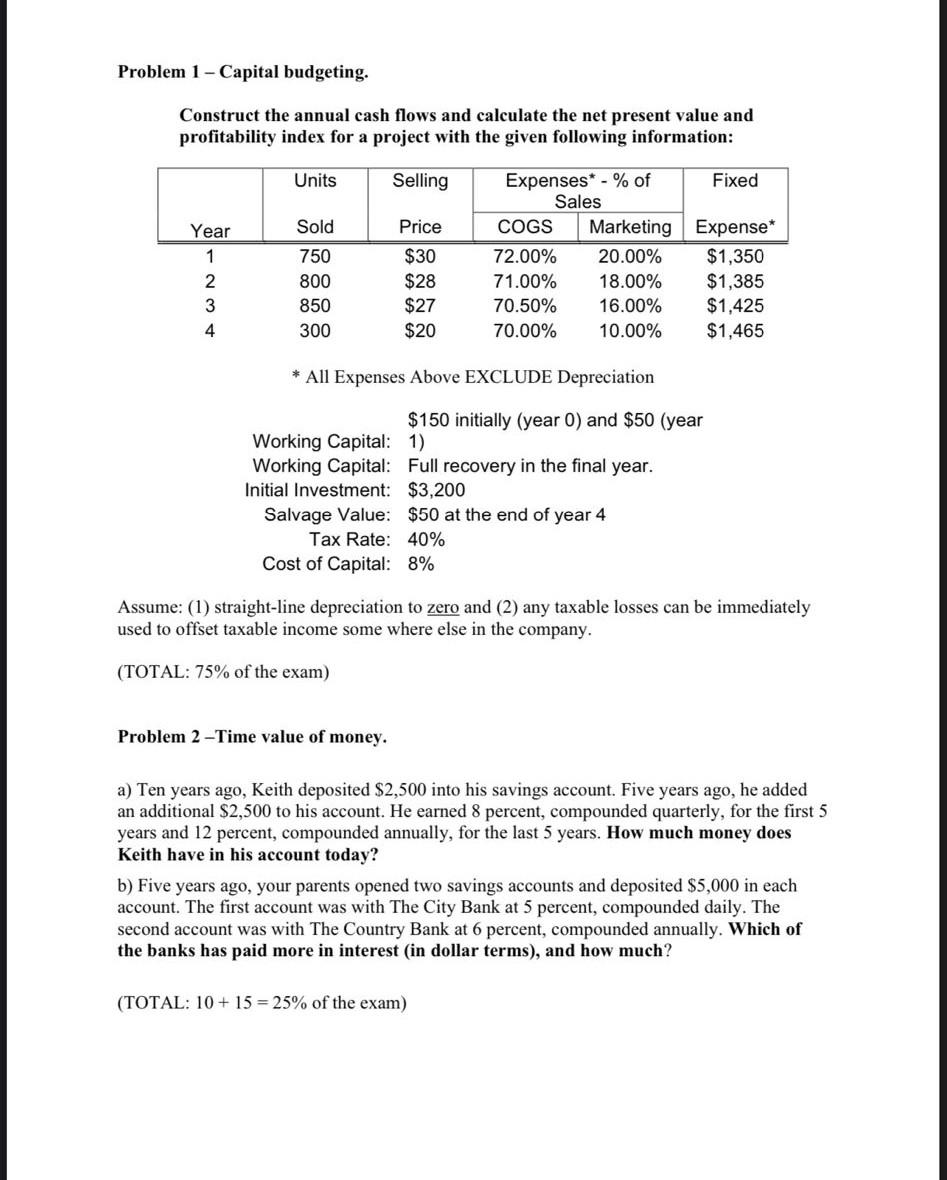

Problem 1 -Capital budgeting. Construct the annual cash flows and calculate the net present value and profitability index for a project with the given following

Problem 1 -Capital budgeting. Construct the annual cash flows and calculate the net present value and profitability index for a project with the given following information: * All Expenses Above EXCLUDE Depreciation WorkingCapital:WorkingCapital:InitialInvestment:SalvageValue:TaxRate:CostofCapital:$150initially(year0)and$50(year1)Fullrecoveryinthefinalyear.$3,200$50attheendofyear440%8% $150 initially (year 0 ) and $50 (year Working Capital: 1) Working Capital: Full recovery in the final year. Initial Investment: $3,200 Salvage Value: $50 at the end of year 4 Tax Rate: 40% Cost of Capital: 8% Assume: (1) straight-line depreciation to zero and (2) any taxable losses can be immediately used to offset taxable income some where else in the company. (TOTAL: 75% of the exam) Problem 2-Time value of money. a) Ten years ago, Keith deposited $2,500 into his savings account. Five years ago, he added an additional $2,500 to his account. He earned 8 percent, compounded quarterly, for the first 5 years and 12 percent, compounded annually, for the last 5 years. How much money does Keith have in his account today? b) Five years ago, your parents opened two savings accounts and deposited $5,000 in each account. The first account was with The City Bank at 5 percent, compounded daily. The second account was with The Country Bank at 6 percent, compounded annually. Which of the banks has paid more in interest (in dollar terms), and how much? (TOTAL: 10+15=25% of the exam)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started